Apple Wants to Tax Ethereum

Dear Bankless Nation,

The development of web3 tech couldn’t be more nascent.

But there are already some pretty sizable enemies getting in the way of apps and games that allow users to transact with each other and take ownership of digital assets.

Huge companies — ones that build products you love — are all fighting to keep crypto and NFTs off of your devices.

Valve is. Nintendo is. Apple is, too.

This week, we dig into Apple’s public skirmish with Coinbase and why a web3 future might not include the iPhone.

-Bankless Team

Web3 believers lay out a future for the internet where data is portable, incentives are transparent and consumer choice is more empowered than ever. It’s an idealistic endeavor that developers are still trying to unpack, but it’s also one that tech giants aren’t interested in letting them build towards.

Apple has proven to be one of the tech superpowers most determined to curtail efforts by technologists to rethink the economics of the web. They’ve continued to block the most basic functions of blockchain-based platforms, while applying their weighty 30% App Store tax on some base-level peer-to-peer transactions, ensuring that iPhone users get the worst experience in web3.

Coinbase announced this past Friday that it was disabling NFT transactions on its iOS app in compliance with a block Apple had placed on their last app release. Why? Apple demands 30% of gas fees on every NFT transaction be paid to them.

You might have noticed you can't send NFTs on Coinbase Wallet iOS anymore. This is because Apple blocked our last app release until we disabled the feature. 🧵

— Coinbase Wallet (@CoinbaseWallet) December 1, 2022

The announcement could appear like a sleight to Coinbase given that it’s impacting their native app and their app’s users, but by ordering Coinbase to tax user gas fees that are paid on-chain to block validators, Apple is taking an uncomfortable step in forcing developers away from decentralized blockchain infrastructure.

Apple has declared war on plenty of tech sectors over the years to ensure that their profit centers remain robust. Apple usually wins, and these battles generally fail to leave significant scars on end users. After all, it’s hard for iOS users to know what companies could’ve been created and what services they could’ve gotten access to if Apple wasn’t stripping 30% of app revenues from a generation of internet companies.

This war is a little different. Apple’s misguided rules aren’t attacking Coinbase so much as they are undermining blockchain ecosystems like Ethereum itself. Decentralized systems are being taxed by front ends to the front ends and leaving users fewer ways to access services they want to explore.

Sure, it’s frustrating for Coinbase, but it’s really an embarrassing affront to iPhone users who are fascinated by crypto — a niche that isn’t all that small.

A 30% tax on innovation

As tech stocks have imploded over the past year, Apple’s riches have proven more resilient thanks to their deepening chokehold of mobile marketshare and their power in influencing how other businesses are fundamentally able to monetize.

Apple owns the web of profits enabled by native apps, but in a way they also own the “open” mobile web itself by designing the limitations that prevent users from getting the most from mobile web browsers on iOS where their 30% fees fail to reach.

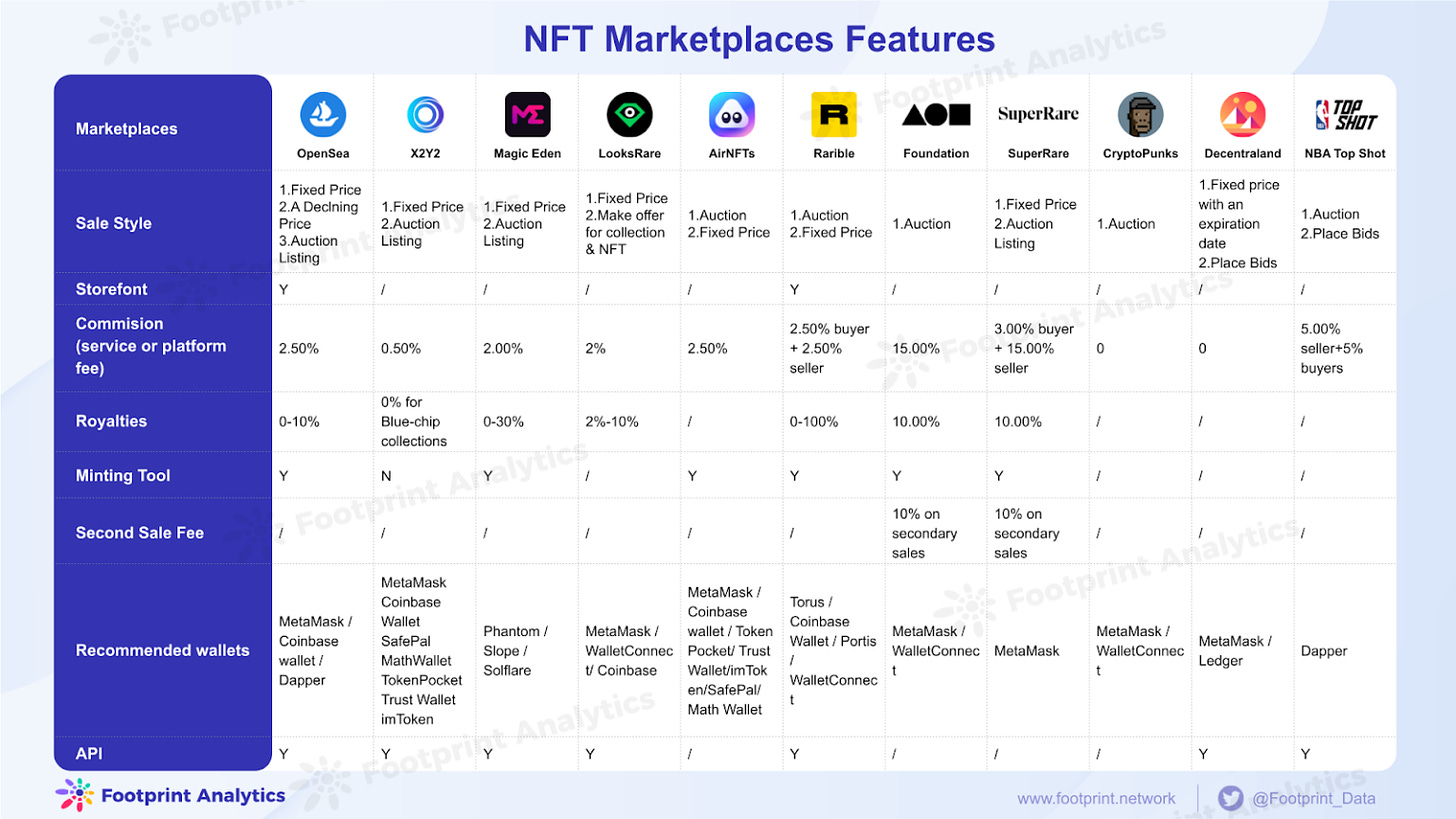

Yeah, platforms cost money, and web3 platforms also charge transaction fees. OpenSea, Magic Eden, LooksRare all take a 2-2.5% fees on sales through their platform, though users can get around these fees by transacting directly and simply paying the gas fees required to send assets.

Through its 30% commission, Apple has dictated the rules of how the internet has been monetized, and which developers succeed.

Apple’s actions dampens overall investments in web3. Every dollar that Apple extracts from web3 startups is one less buck for developers to push their own fledgling ideas forward.

NFT marketplaces can try to sidestep Apple’s 30% standard by stripping down the native experience for iPhone users, leaving them to move to more open hardware platforms when they actually want to transact. This is what major NFT marketplaces like OpenSea and Rarible already do. It’s also what traditional businesses like Amazon try to do by nudging users from Apple hardware onto its website to pay for virtual content like TV episodes or songs.

While these workarounds work okay for 2D marketplaces, gamers won’t jump to a website every time they need to make an in-game transaction. When Netflix rolled out games, they had no choice but to accept Apple’s 30% standard. And the same will be true for web3 gaming entities like Decentraland, The Sandbox, or any company that wants to offer in-app NFT purchases.

We’re singling out Apple, but the reality is that plenty of other hardware and OS platforms follow the company’s lead. Its biggest competitor Google levies the same tax on Android.

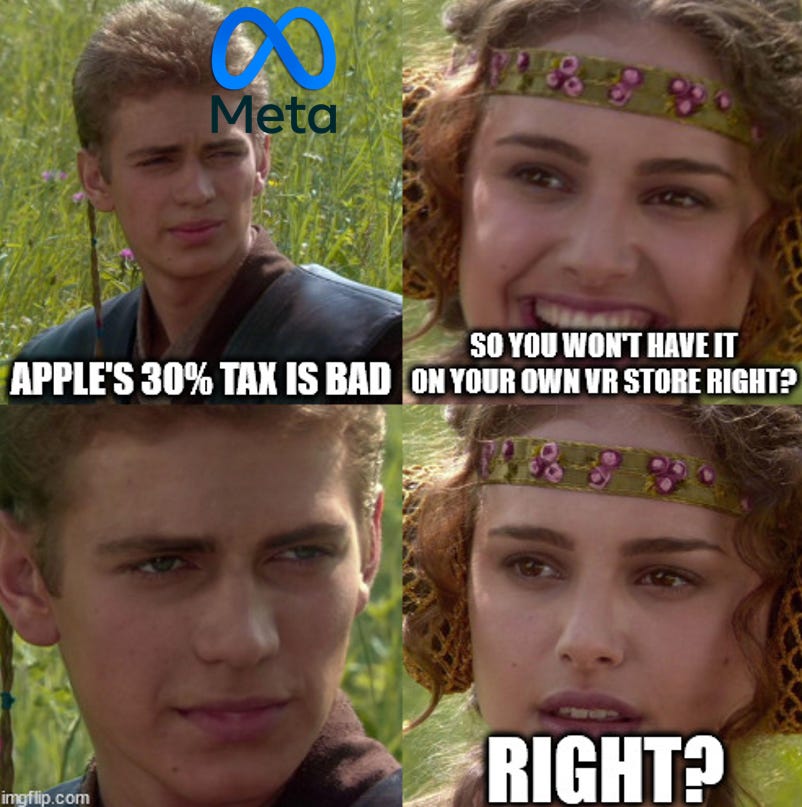

Meanwhile competitors like Meta who have complained for years about Apple’s taxes have copied their designs of walled garden hardware; Meta adhered to the same standard when it launched its own “Quest Store” despite publicly positioning itself as a committed investor to the metaverse and its builders.

The 30% standard may be here to stay. It’s an industry standard that goes back to the 1980s. It was inherited from the video gaming industry and traverses across more than the tech world. As Matthew Ball puts it in his book The Metaverse:

In 1983, the arcade manufacturer Namco approached Nintendo about publishing versions of its titles, such as Pac-Man, on its Nintendo Entertainment System (NES). At the time, the NES was not intended to be a platform. Instead, it played only titles made by Nintendo. Eventually, Namco agreed to pay Nintendo a 10% licensing fee on all of its titles that appeared for NES (Nintendo would have right of approval over every individual title), plus another 20% for Nintendo to manufacture Namco’s game cartridges. This 30% fee ultimately became an industry standard, replicated by the likes of Atari, Sega, and PlayStation.

Today, the 30% standard still stands across major gaming marketplaces like Nintendo’s store, Sony’s PlayStation Store, Microsoft's Xbox Store, and Valve's Steam.

These systems aren’t great for developers, but they really suck for users who are forced to pay upfront for their hardware and then pay for it over and over again as they are taxed on apps and services and the experience and services inside those apps and services. It’s not cool.

Crypto developers realistically have limited options to compete. The only real way to break free from the clutches of Apple and Google’s walled gardens is to maximize their sell on the open web where mobile giants can’t touch.

There’s also… the other option… to build a crypto phone.

Solana’s “Saga” smartphone that is slated for a 2023 release presents that sliver of hope. Anatoly Yakovenko has committed to leaving apps on its smartphone free of in-app purchase commissions, a stark contrast to the status quo.

Did you pre-order a @solanamobile yet? https://t.co/H5NGyzqH5c

— toly 🇺🇸 (@aeyakovenko) December 1, 2022

It’s certainly an uphill battle; tech giants aren’t taking it easy on crypto, even in a bear market.

We’ll remember.