Anatomy of the DCG Dumpster Fire

Dear Bankless Nation,

The market is doing a little pumping, but — we’re not gonna lie — there’s still a lot to feel uneasy about right now.

This week, we strap in and unpack all of the drama surrounding DCG, Genesis, Grayscale and Gemini’s customers. It’s not a pretty situation.

- Bankless team

It’s been a big week for Barry.

On January 2, Gemini co-founder Cameron Winklevoss released an open letter on his Twitter, addressed to Digital Currency Group (DCG) CEO Barry Silbert, pleading for Silbert to publicly commit to reaching an agreement with Gemini creditors by January 8 regarding the repayment of Genesis Global Capital debts.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/kouAviTho4

— Cameron Winklevoss (@cameron) January 2, 2023

Exercising a heart-wrenching appeal to ethos, Winklevoss provides a glimpse of the pain suffered by Gemini retail depositors, from the “father who lent his son’s bar mitzvah money” to the “single Mom who lent her son’s education money,” all becoming collateral to DCG’s “greedy share buybacks, illiquid venture investments, and kamikaze Grayscale NAV that ballooned the fee-generating AUM of [the Grayscale] trusts.”

Gemini, Genesis’s largest creditor, is owed $900M.

All well and fair, Cameron, but, may I point out the obvious hypocrisy?

while i agree with the sentiment that Genesis royally fucked up here,

— DCinvestor.eth ⌐◨-◨ (@iamDCinvestor) January 2, 2023

SO DID YOU GUYS

you selected Genesis, you promised users a return from Earn deposits, and apparently you didn't do your due diligence

where is YOUR OWN acceptance of responsibility to Earn users here???

Thou shalt not shield the Gemini fee scrape!

At least the Winklevii are trying to be better, DC!

While I am in no way implying that the Winklevii should bear the financial burden for Genesis's blunders or that Earn depositors weren’t made aware of risks they bore, it does sound a little like the pot is calling the kettle black…

But maybe that is besides the point, because today, we’re diving into the state of the DCG balance sheet and examining the ever growing number of obstacles between DCG and its pursuit to preserve equity.

💰 The Debt

After Luna came crashing back to orbit and 3AC went to hades, Genesis was left with a MAJOR hole in its balance sheet. To preserve the solvency of its lending desk, DCG assumed 3AC’s liability and Genesis’s role as creditor.

Through ~accounting magic~ Genesis was able to bridge over the insolvency, without having liquidity.

The battleship-sized salvo 3AC fired into the Genesis balance sheet forced DCG to extend a $1.1B promissory note with a ten year maturity to its subsidiary in addition to an existing intercompany loan made at “arm's length” for $575M due in May. Oh, and there was also that outstanding $350M credit facility with Eldridge.

This is apparently the letter sent out by Barry. https://t.co/pgS14U5mbg pic.twitter.com/73ePBqTzNY

— DIRTY BUBBLE MEDIA: THE WALLED GARDEN (@MikeBurgersburg) November 22, 2022

In total, DCG has over $2B in outstanding liabilities.

💰 The Assets

As I’m sure the astute Bankless reader may have deduced, it may be a bit of a challenge for DCG to find that kind of guap in the bear market.

Grayscale, GBTC, and ETHE holdings are by far the most liquid assets on DCG’s books. Value can be extracted from these positions in two ways. Unfortunately for DCG, neither of these options yield adequate cash.

So we there are two key options here

— Tommy Shaughnessy (@Shaughnessy119) January 5, 2023

1/ Sell Grayscale and sell GBTC/ETHE holdings =$600M + $471M =1.071B

2/ Unwind Grayscale (can't sell if unwind) and get assets back at Par or $900M

Let's call either option a wash as its ~$1B+ less than the 2.025B needed.

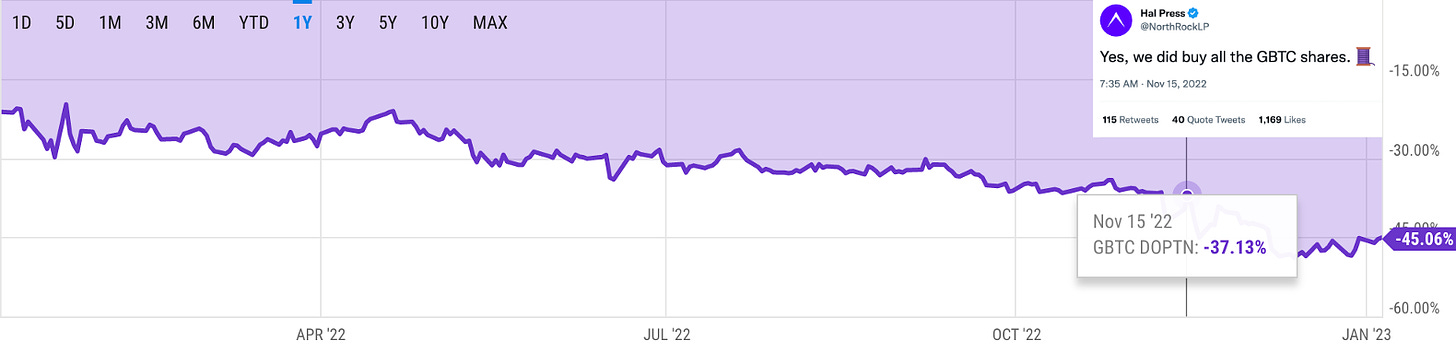

Choosing the higher-payout option one FURTHER increases the GBTC discount, currently sitting at a 45.1%.

Still in that GBTC trade, Hal?

This leaves around $1B more left to be found in the metaphorical couch cushion that is DCG’s venture capital book.

The future is looking grim for DCG, anon.

Realistically, a potential buyer would need to be PAID for the deal to even begin to make an iota of sense.

15/ As an investor, I can’t see how a VC would assign any positive equity value to DCG.

— Ram Ahluwalia, crypto CFA (@ramahluwalia) January 6, 2023

How much would you have to be paid to buy DCG?

You are on the hook for $2 Bn in claims and other clawbacks? You have $1.1 Bn loan callable instantly if Genesis goes.

And $575 MM due May

But somehow, it’s gotten even worse for a company that raised at a $10B equity valuation a little over 14 months ago!

💰 The Issues

Digital Currency Group already has very few options remaining to resolve the claims of Genesis creditors and make it out alive, but that doesn’t mean Mission Impossible can’t get a little more so!

Monopoly Money Has Left the Chat

As you probably could have guessed in 2022, business did not get better for Digital Currency Group in the New Year.

After a catastrophic year in crypto, it is somewhat comforting to hear that the bags of the wealthiest in the space are down in value along with the rest of ours.

If, however, one of your subsidiaries happens to be a crypto wealth management platform, you likely do not share in this sadistic pleasure.

Wealth management, like many financial professions, is a fee-based industry, meaning that the larger your AUM, the more money you make.

Translation: money comes easy in the bull, but is hard to find in the bear.

DCG clearly learned this lesson, tossing its WM division, HQ, to the curb along with 60 employees in the firm’s most recent round of cuts.

Scoop: Genesis parent company Digital Currency Group just shut down its $3.5 billion wealth management division as the crypto contagion continues. https://t.co/lI7TdnWdsg

— Kate Clark (@KateClarkTweets) January 5, 2023

Gone is another salable asset and income stream.

Hello sunk costs!

In a mad bid to trim expenses, any individuals or groups that have turned unprofitable with changing market conditions will be sent to the chopping block by DCG.

While this has a net positive impact on DCG’s cash flow, it is indicative of the extreme economic distress the firm is experiencing.

Callable Liabilities

The linchpin.

The (highly unlikely) best chance the once glorious DCG empire has to slog out of the crypto collapse of 2022 as an alive shell of its former self.

The reason Hal Press stands to lose $10k in BTC.

Bet accepted. 10k in $BTC. When you lose you have to donate those funds to a Gemini Earn creditor of my choosing.

— Andrew (@AP_Abacus) January 6, 2023

Ironically, DCG just may have shot itself in the foot here, as it would have dictated the terms of these intercompany notes!

A callable loan enables the holder of the note to demand its repayment.

In the present moment, DCG is indifferent to the callable note structures, as it controls the actions of the holder, Genesis.

Under bankruptcy proceedings, however, this would no longer be the case and creditors of the estate would likely petition the court to recall the obligation.

While it is unknown at the moment if the ten year promissory note is indeed callable, DCG’s hesitance to throw Genesis into bankruptcy may suggest that it is.

16/ If Genesis goes Ch 11, then the $1.1 Bn Promissory Note is instantly callable

— Ram Ahluwalia, crypto CFA (@ramahluwalia) January 6, 2023

The Promissory Note is like a noose wrapped tight around the neck of DCG.

If Genesis goes over the cliff, it drags DCG with it. pic.twitter.com/kpc5E2Orl8

Sorry Hal!

🚨 The Feds?

And you were thinking that Papa Gensler and Daddy Garland wouldn’t encircle the rotting corpse of a key crypto conglomerate like the regulatory vultures they are?

Late last Friday, they too crept out of the shadows.

UPDATE: DOJ and SEC have opened active investigations probing DCG over inter company loans and money transfers.

— Andrew (@AP_Abacus) January 7, 2023

**confirmed via Bloomberg late this evening

Bloomberg states investigators are “scrutinizing transfers between [DCG] and [Genesis]” in addition to “what investors were told about those transactions.”

The transactions in question are likely:

- $575M loan to DCG due May 2023; and/or

- $1.1B DCG promissory note due 2032.

While the feds may be interested in the transaction(s) for numerous reasons, one thing remains clear: it just got a hell of a lot grimmer for Barry.

Once the kimono is open, there are things than cannot be unseen. The DOJ has a 93% conviction rate. https://t.co/g59aI9DX2B

— Kyle Davies (@KyleLDavies) January 7, 2023

Better watch out Kyle, you’re probably next!