American Perpetuals

View in Browser

Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

Yesterday marked a watershed moment for American crypto traders.

Coinbase launched the first CFTC-regulated perpetual futures or “perps” in the U.S. If you've been stuck using VPNs to access offshore exchanges or simply avoided perps altogether, this changes everything.

In case you didn’t know, perpetual futures are the backbone of crypto’s capital markets, accounting for over 90% of global derivatives volume. And now, they're finally legal and accessible for U.S. traders.

For those who may want to dip their toes in, let's break down what this means 👇

The wait is over - Perpetual futures have arrived in the U.S.

— Coinbase Futures (@cbFutures) July 21, 2025

→ No monthly expirations

→ Trade with up to 10x leverage

→ Fees as low as 0.02%

Now you can trade perpetual-style futures on Coinbase Financial Markets, a secure and CFTC-regulated platform. pic.twitter.com/627ZOPTTzG

What Are Perpetual Futures?

Think of perpetual futures (or "perps") as a method of betting on crypto price movement without actually buying crypto.

What do I mean? When you buy Bitcoin on spot, you're purchasing actual Bitcoin that sits in your wallet. You own it, transfer it, hold it. With perps, you're not buying Bitcoin at all — you're entering a contract that pays you (or costs you) based on Bitcoin's price movements.

Unlike traditional futures contracts that expire after a set time period (forcing you to roll positions and pay fees), perps have no expiration date. You can hold your position forever — as long as you can afford it. They're designed to track the spot price through a mechanism called funding rates.

Here's the key difference from spot trading – with perps, you can:

- Go long OR short — bet on prices rising (long) or falling (short)

- Use leverage — more exposure with less money

The Dangerous Magic of Leverage

Perpetuals turn on a function called leverage, which sizes up your positioning by a certain multiple. For example, if you open up a Bitcoin position for $1K on 10x leverage, you get $10K worth of Bitcoin exposure. If BTC moves up 5%, you make 50% as the move is multiplied by 10. But — and this is crucial — if it moves down 5%, you lose 50% of your money. Move down 10%? You're completely wiped out.

Think of it like driving a Ferrari instead of a Honda. Sure, you'll get there faster, but take a wrong turn and you're wrapped around a tree. When leverage is added to our notoriously volatile markets, fortunes are made and lost in minutes.

James Wynn from +80M at peak to 0

— Psyduck (@cryptopsychdoc) May 27, 2025

devastating to watch unfold in real time pic.twitter.com/aNy0GhKzpG

How Funding Rates Keep Everything in Check

Because perpetual futures don't have an expiration date and operate in their own markets, exchanges use the aforementioned mechanism of “funding rates” to keep the contract's price closely tied to the real-time spot price of the underlying crypto.

These rates are tiny payments swapped directly between traders — usually every hour, though some platforms do it every 8 hours. Here's the simple breakdown of why prices can deviate and how funding rates balance things out. It all starts with trader behavior.

As mentioned above, perps trade in their own market, separate from the spot market. If a ton of traders pile into long positions, that increased demand can drive the perp price higher than the actual spot price — creating a premium. Conversely, if everyone's shorting, the extra supply can push the perp price below spot, creating a discount.

- Bullish scenario (perp price > spot): With the perp trading at a premium due to heavy longing, long positions pay a small fee to short positions. This makes shorting more profitable and attractive, drawing in more sellers to increase supply and naturally pull the perp price back down to match the spot.

- Bearish scenario (perp price < spot): If the perp is at a discount from aggressive shorting, shorts pay longs. This boosts the appeal of going long, encouraging more buyers to add demand and push the perp price back up into alignment.

Coinbase vs. The Competition

Now that U.S. traders have options, let's compare the big three:

Coinbase's edge? Compliance and trust. While Hyperliquid offers lower fees for volume traders and Binance boasts a wide variety of assets, Coinbase's regulated pathway provides something priceless: peace of mind.

And, while a 10x leverage limit might feel restrictive compared to Binance's casino-like 125x, it’s safe to assume that if you need more than 10x leverage, you're not trading — you're gambling.

Overall, the timing of Coinbase’s launch comes at an ideal time. We're seeing a perfect storm of:

- Regulatory clarity: The GENIUS Act and STABLE Act are moving through Congress.

- Institutional demand: TradFi wants in, but needs compliant venues.

- Market maturity: After years of offshore dominance, the U.S. is ready to compete.

This isn't just about Coinbase adding a product. It's about breaking into and legitimizing an entire market segment that's historically been crypto's dirty little secret. Now, retail traders have institutional-grade trading infrastructure, complete with the compliance comfort of a public U.S. company.

But remember: with great leverage comes great risk. Start small, use stop losses religiously, and never trade more than you can afford to lose. Because while perps can amplify your gains, they're equally efficient at amplifying your mistakes.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

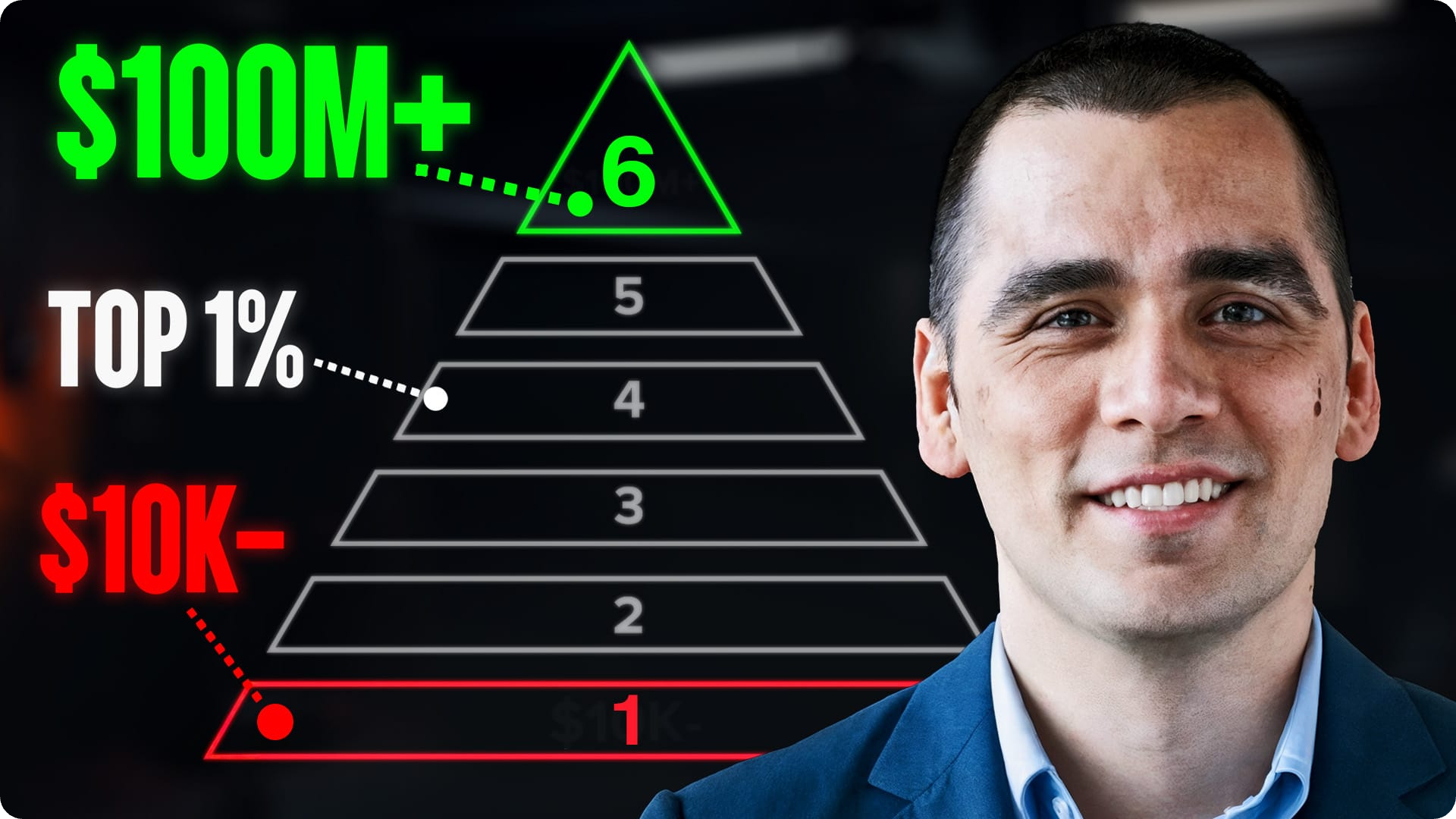

Everyone wants to climb the wealth ladder, but very few ask if they should. In this episode, Ryan sits down with Nick Maggiulli to explore the six stages of wealth, how your strategy should evolve at each level, and why reaching the top isn’t always the win it seems.

From early savings and side hustles to ownership leverage and lifestyle trade-offs, Nick guides us through practical, data-driven ways to build wealth, without losing sight of happiness along the way. If you’re somewhere between $10K and $10M, this episode is for you.

Listen to the full episode👇