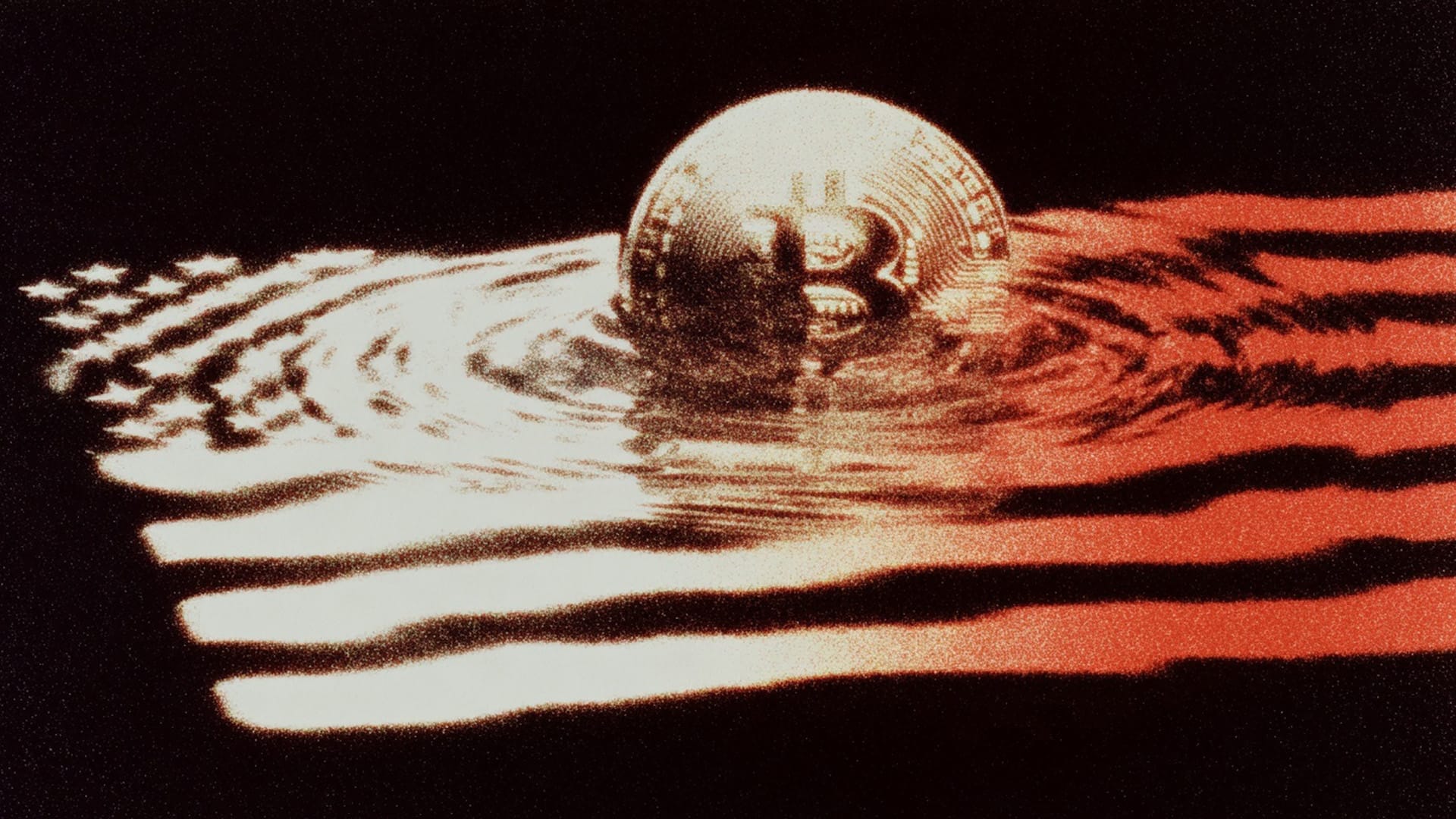

American Bitcoin Drops 20%, Following Debut Plunge

Bitcoin miner and treasury firm American Bitcoin (ABTC) saw its stock tumble 20% on Thursday. Shares were trading $6.41 on market close, well below their Nasdaq listing highs set yesterday.

What’s the Scoop?

- Rough Debut: Since ABTC peaked at $14.00 during its Nasdaq debut, shares have sharply reversed course.

- Trump Ties: American Bitcoin is majority held by mining firm Hut 8, with estimated 20% ownership by Donald Trump Jr. and Eric Trump. The firm holds over 2.4k BTC, valued around $269M, and has filed to raise up to $2.1B in an at-the-market equity offering to further expand its bitcoin treasury.

- Nasdaq Miners Slump: ABTC wasn't alone in its slide; shares of other miners – including Marathon Digital (MARA) and Riot Platforms (RIOT) – also dropped on Thursday, despite U.S. stock indexes posting gains.

Bankless Take:

While ABTC finds itself well off yesterday's high-water mark, the Trump family's net worth has no doubt surged this week thanks to the stock's completed Nasdaq listing. They also benefited from the liquification of World Liberty Financial (WLFI) tokens on Monday.

And we are off the the races 🏎️ @AmericanBTC @EricTrump @DonaldJTrumpJr @mikehomkh @MattPrusak pic.twitter.com/j49IT6ucjO

— Asher Genoot (@ashergenoot) September 3, 2025