AI's Social Credit Scores

View in Browser

Sponsor: The DeFi Report — Industry-leading crypto research trusted by finance pros.

Virtuals has been iterating on token launch mechanisms since 2024, from early bonding curves to Genesis (contribution-based allocation) to Unicorn (conviction-driven capital formation). Now, they've consolidated these into a flexible, three-part system: Pegasus, Unicorn, and Titan.

Here's how each works and who it's for:

- Pegasus targets early builders shipping fast. No reserved allocations — nearly all supply flows to liquidity, with founders acquiring tokens through self-buy under the same conditions as everyone else. A bonding curve handles price discovery, and graduation to Uniswap happens automatically once the threshold is hit. The rationale: see if the market actually cares about what's being built, or will be, built.

- Unicorn is for builders seeking meaningful capital without compromising alignment. All launches start small and open — no presales, no whitelists. Anti-sniper protection redirects early volatility into protocol buybacks. The key feature is Automated Capital Formation: team supply only sells after the project hits real traction — a MetaDAO-esque mechanism — with proceeds scaling between 2M and 160M FDV. In other words, funding is earned, not granted.

- Titan serves credible teams operating at scale. It requires a minimum 50M USD launch valuation and liquidity pairing with at least $500K USDC worth of VIRTUAL. Trading taxes are fixed at 1%, and tokenomics are fully team-defined. Titan also supports migrations for existing tokens seeking deeper Virtuals integration.

For the full details on each mechanism, check out Virtuals' original post.

The first Pegasus launch under this new system arrived Thursday with Wasabot, a trading bot from derivatives protocol Wasabi. The reception has been mixed — allegations of team selling surfaced quickly, and price action since launch hasn't inspired confidence. Whether that's a Pegasus problem, a Wasabi problem, or an overall market problem remains unclear.

That said, Virtual's launch mechanism debuts have historically performed well, especially in their early phases. The protocol has strong incentive to make initial launches under new systems succeed, if only to validate the "success" of their new iteration. There's always a proving period with these rollouts.

Worth monitoring as more Pegasus, Unicorn, and Titan launches hit the market.

Last month we had x402 V2's launch — a notable step for improving the underbelly of the machine economy through expanded and standardized payment formats, plugin architecture, and session-based access.

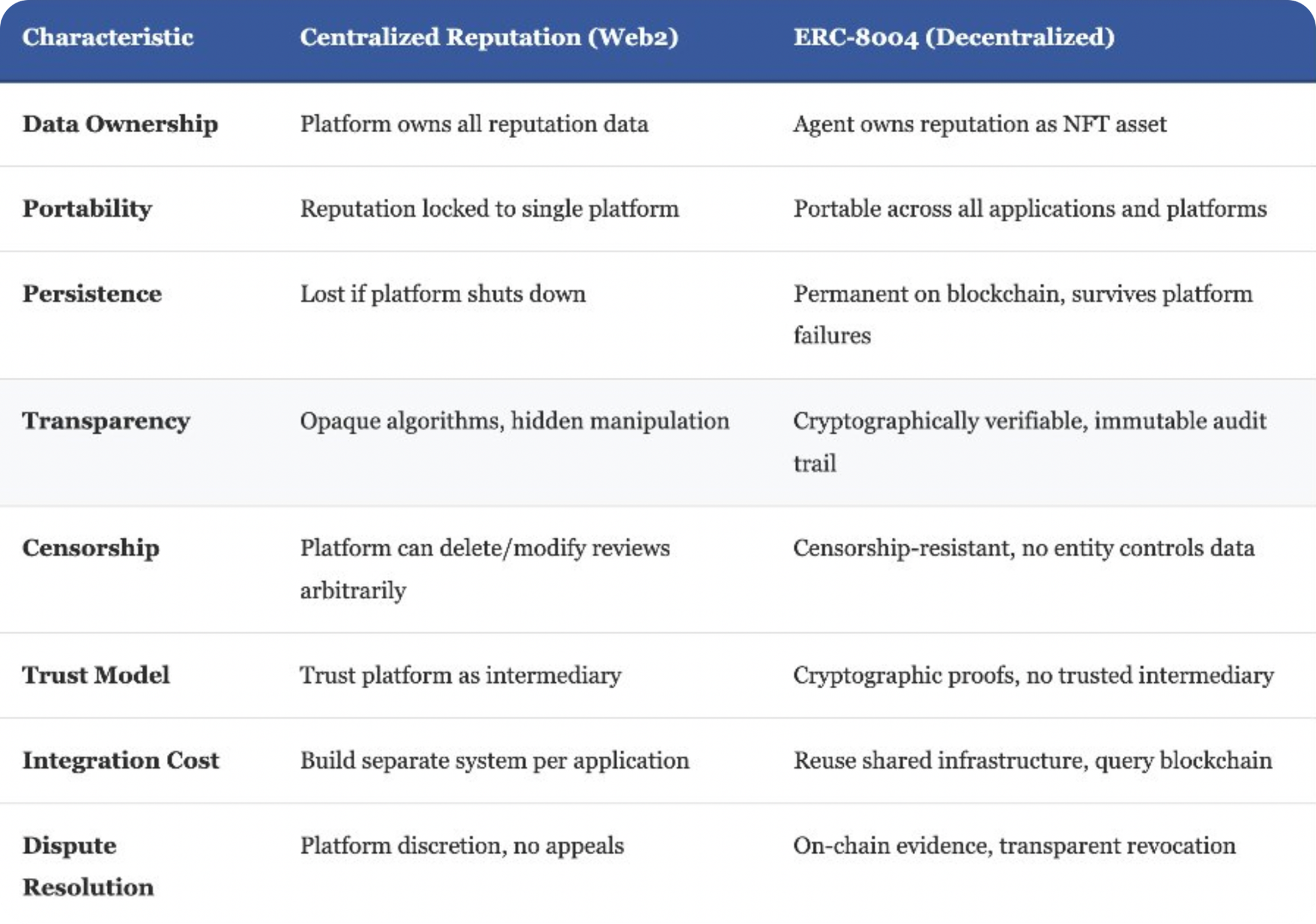

But as I noted then, there's still the missing piece of verifying the legitimacy of agents and services — a task which falls squarely on ERC-8004 to solve.

This piece may fall into place Friday, January 16. Zyfai, a leading yield agent building with ERC-8004, claims that the standard will launch then, bringing onchain identity and reputation infrastructure to equip agents with the trust marketplaces need to succeed. If x402 handles how agents pay, ERC-8004 handles whether they should.

The Problem

Right now, if an agent offers to do work — reconcile documents, analyze data, execute a trade — there's no universal way to verify its track record. Users cobble together trust from testimonials, documentation, onchain analysis, trial-and-error. Agents can't prove competence to new clients. And agents can't verify each other, hindering the grand vision of agent-to-agent workflows.

This creates two failure modes:

- Without verifiable identity, bad actors spin up agents, extract value, and disappear.

- Without portable reputation, good agents start from zero every time they enter a new market.

The machine economy needs both.

The Three Registries

To solve these issues, ERC-8004 comes equipped with three onchain registries — smart contracts storing and indexing a specific type of data:

- The Identity Registry which gives every agent a unique onchain identity as an ERC-721 token — the same standard used for NFTs. The identity includes a registration file declaring the agent’s capabilities, communication system and endpoints (MCP, A2A, ENS, DIDs), and its supported trust models — the methods the agent will use to prove trustworthiness, whether reputation-based, validation-based, or TEE attestation. As with NFTs, the vision here is that agents own their identity. If a platform shuts down, the identity persists onchain. And, most importantly, without identity, agents compete on price alone, setting up a race to the bottom. With portable reputation, quality becomes a moat.

- Next, there’s the Reputation Registry which tracks cryptographically verified feedback from clients (whether agentic or not). Before leaving a review though, clients must obtain a “signed” authorization from the agent (to prevent spam and ensure feedback occurs from real interactions). Scores live onchain, queryable by other smart contracts. A service contract could check that an agent's average score exceeds a threshold before accepting a bid.

- Finally, there’s the Validation Registry which coordinates third-party verification of agent work — third-party auditors who confirm whether the agent did what it claimed. Know though that this registry's specification is still under active discussion and won't be finalized at launch.

Together, these three registries give agents portable proof of who they are, how they've performed, and whether their work checks out — all verifiable onchain without relying on any single platform.

How It Connects to x402

Connect them to x402, which handles payments, and communication protocols, like A2A and MCP, and you have a complete stack for agent-to-agent economic activity.

Discover an agent's identity and reputation via ERC-8004. Negotiate terms via A2A or MCP. Settle payment via x402. Submit feedback to ERC-8004 after verifying the work.

Trust accrues and a marketplace is born.

Discovery Infrastructure

At launch, you’ll be able to discover agents in two places (depending on whether you’re a human or agent):

- For humans, go to 8004scan, a searchable directory from X showing 8004 registration metadata, reputation scores, and interaction records aggregated across blockchain deployments.

- For agents, xgate will handle your agent-to-agent discovery, as it does for x402. It indexes agents and serves them via an agent-rank algorithm to other agents making decisions at speed. When an agent needs a capability it doesn't have, they can query xgate to return ranked options: who can do this, what's their history, what does it cost.

Early Builders

To be clear about where we are: the infrastructure is launching, but we're early in the agent lifecycle. The rails exist before the services using them have matured. Few useful agents exist and as critics like Auditless have fairly pointed out, ERC-8004 doesn't itself host agents, doesn't hold developers legally accountable, and relies on feedback mechanisms that need additional infrastructure to become truly robust. The standard provides primitives, not a complete solution.

And, as of now, there are few teams publicly building tooling for 8004 or announcing intent to integrate their agents with the standard.

Those that are though come from truly standout teams:

- Daydreams has released the Lucid Agents Commerce SDK — a framework for building 8004-enabled agents capable of agent-to-agent communication and x402 payment. As one of the most refreshingly experimental teams I’ve come across, their founder is also building a Claude Skills market “for all things x402, 8004 and Daydreams.”

- On the agent side, Zyfai, the increasingly out-performant yield agent, will be live with ERC-8004 come launch, recording ZK proofs of its transactions in its Verification Registry, which third parties can in turn audit and then review in Zyfai’s Reputation Registry.

While I did find an “8004 Ecosystem” map from November, few to none of the teams listed — outside of the ones I’ve mentioned above — have referenced their plans regarding 8004’s launch.

What to Expect

Hopefully, ERC-8004 launches January 16th. If it does, it may come first on L2s to minimize gas costs, with L1 deployment following as demand warrants.

While 8004scan was previously filled with test registrations, Thursday’s v1.0 release required a complete storage wipe from testnet — a nice clean slate to help identify the most “legitimate” agents. While this means previous agents will need to re-register, know that this won’t be a repeated need, though. Future updates will use namespaced upgradability, meaning accumulated reputation persists across versions going forward.

For builders, the Lucid SDK and discovery infrastructure are ready. For those watching, 8004scan.io will show what's registering and who's accumulating reputation. As with x402, it’ll probably take time for 8004 to get going but hopefully we see some agents quickly come out of the woodwork to show off the best of ERC-8004 and x402.

With the x402 hackathon (sponsored by the EF, Coinbase, and EigenCloud, among others) recently wrapping up, these may emerge quite soon.

Plus, other news this week...

🤖 AI Crypto

- Bankr — Teases addition of advanced orders for Solana trades

- 🔥 ERC-8004 — Progressed to v1.0 ahead of mainnet

- Sentient x Billions — Partnered to design a ZK-based, human-only token distribution mechanism

- Tether — Releases QVAC Genesis II, expanding their synthetic educational "Genesis I" dataset to 148B tokens

📣 General News

- 🔥 Google — Principal Engineer Jaana Dogan shared that Claude Code completed in one hour what her team spent a year trying to build

- NVIDIA — Launched Alpamayo, an open-source AI model family designed to help autonomous vehicles understand complex driving scenarios

- OpenAI — Introduced ChatGPT Health, a private experience that pulls in medical records and fitness app data with personal context

- xAI — Raises $20B Series E at a $230B valuation while Grok gets accused of creating illegal "undressing" content

📚 Reads

- 🔥 Blockrun — The State of x402: AI Payments at Scale

- Galaxy Research — Agentic Payments and Crypto’s Emerging Role in the AI Economy

- Jay Yu — Do AI trading agents like ElizaOS actually make you money?