Aerodrome's Killer Year

Aerodrome is undeniably special.

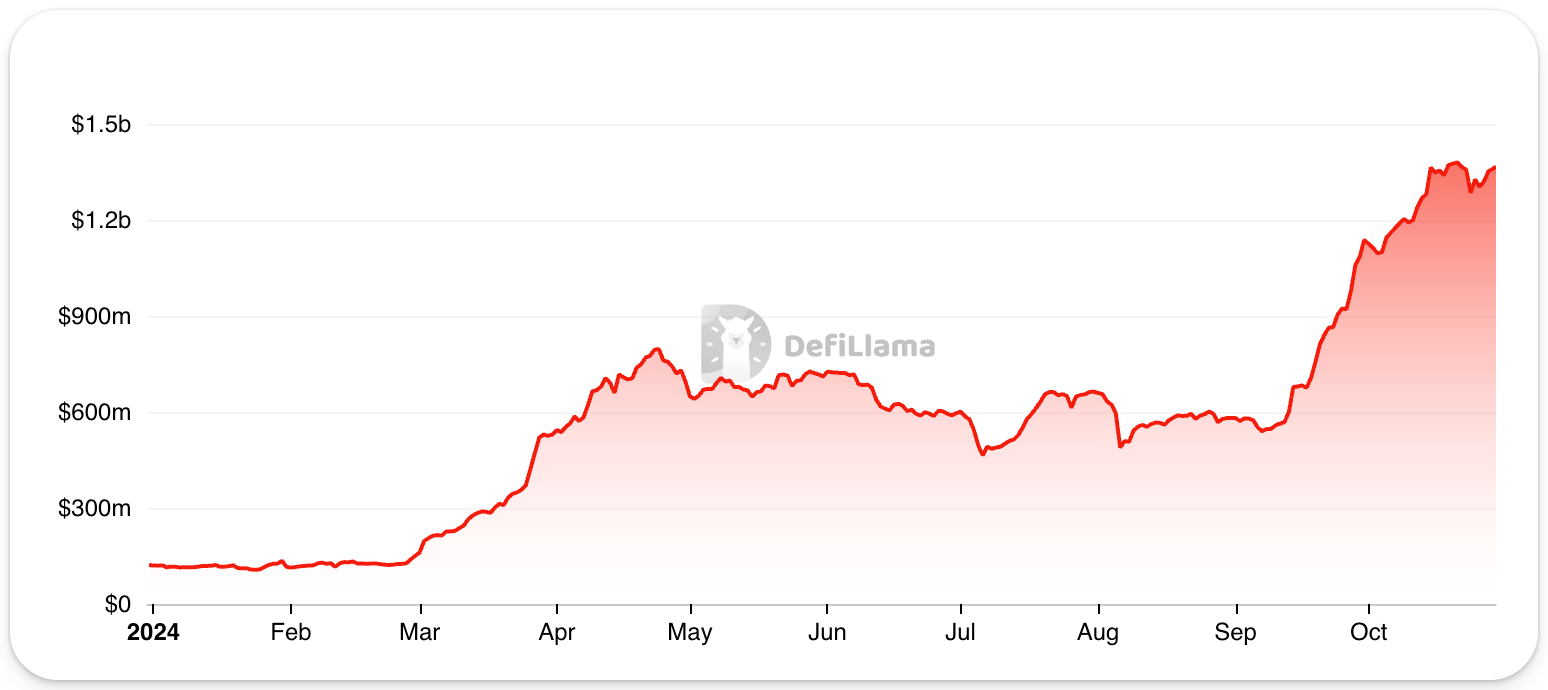

From day one, this “MetaDEX” has ranked as one of the most popular applications on the Base L2. The Protocol currently custodies $1.3B in TVL (50% of all Base smart contract deposits), and its AERO token has been a top-performing DeFi asset this fall – up 125% since the start of September.

While Aerodrome’s TVL had been holding steady around $5ooM before parabolically exploding in early September, this lack of growth became a major hindrance for AERO price, and the token was trading 80% below all-time highs before rebounding in the September bull sprint.

Today, we’re discussing Aerodrome’s mechanics to better understand the risks and opportunities associated with this high-flying exchange ✈️

🔧 Aerodrome’s Mechanics

Like many other decentralized exchanges, or DEXs, Aerodrome utilizes an automated market maker (AMM) to offer instantaneous low-slippage swaps and one-click liquidity provisioning earn opportunities on hundreds of cryptocurrencies.

As a “MetaDEXs,” Aerodrome is differentiated through its tokenomics, which layer the unique aspects of Curve and Convex liquidity mechanics onto passive market making technology pioneered by Uniswap. In practice, this yields an AMM exchange on Base with veTokenomics that empowers token holders with votes to direct emissions toward liquidity pools.

Part 2: The Token

— Aerodrome (@AerodromeFi) September 5, 2024

Thoughtful token design has advanced the MetaDEX beyond previous DEX models.https://t.co/aEyCzWQDGU

Unlike Curve, which rewards its veCRV holders with only 50% of swap fee revenues, Aerodrome directs 100% of application swap fees back to veAERO participants, who receive greater voting power and higher rewards rates by locking more tokens for longer. While Aerodrome liquidity providers do not receive any proceeds from token swaps, they are compensated with inflationary AERO emissions that can be held, sold, or vote-escrowed.

Via Aerodrome’s incentives market, users can lock crypto tokens as rewards for veAERO voters that direct emissions towards a designated pool, producing a functional Aerodrome liquidity bribery market and an additional source of income for veAERO participants.

Epoch 60 (or the week ending on October 23, 2024) was Aerodrome’s sixth-most profitable week by total rewards on record and second-best by volumes, with veAERO lockers netting $5.85M in fees and incentives against $3.63B in volume.

Aerodrome Cruising Above $3B Volume 🛫

— Aerodrome (@AerodromeFi) October 24, 2024

The second-highest ever volume was achieved during epoch 60, hitting $3.63 billion.

veAERO voters shared a total of $5.848m in Total Rewards (fees + incentives). 👨🏽✈️ pic.twitter.com/7k8gVZrWp9

🧐 Investment Considerations

Aerodrome tokenomics encourage long-term oriented holders to lock their tokens in hopes of offsetting AERO’s lofty inflation rates, which amounted to 37% annualized at the time of analysis.

With 50% of the AERO supply currently locked for an average duration of 3.86 years, the token can more easily pump on thinner buying pressure, as limited availability in for-sale tokens creates a supply/demand mismatch.

Upticks in Aerodrome’s market capitalization are extremely desirable, as increases to the value of emissions boost aggregate liquidity provider yields, attracting new deposits that better the Protocol’s fundamental bull case while increasing investor willingness to pay for AERO!

Sadly, while veTokenomics can successfully pump token prices and deposits, they also inspire inherent reflexivity. As clearly demonstrated by AERO’s aggressive 80% drawdown despite stable TVL off the April all-time highs, high rates of token inflation are difficult for markets to absorb when investor demand diminishes.