Accept the Pain | Market Monday

Dear Bankless Nation,

Over the last two weeks crypto experienced one of its worst drawdowns ever.

From peak-to-trough, Bitcoin shed 50% of its market cap, from $60,000 to $30,000, in just 11 days. Inside that 11 day period, it dropped 34% ($15,500) in just 24 hours! 😭

Meanwhile ETH’s market movements were even more violent. ETH lost 60% of its value in just 11 days, from $4384 to $1734. 😱

The ferocity of these price movements were shocking to…pretty much everyone.

The main reason people in crypto were shocked by this massive price drawdown is that it occurred during a bull market. This was a “COVID-style crash” except without the black-swan event to trigger it.

Why did this happen?

The simplest answer to why this happened is: “Well, just look how fast things went up! Things go up, things go down ¯\_(ツ)_/¯”.

Even at its lowest amid the crash, ETH was back to its March 29th price, just 53 days earlier. At its current price (~$2,500), ETH has been set backwards 28 days. Meanwhile, Bitcoin’s downturn is a little more significant at ~110 days.

Also, when we are zoomed in on the charts, it’s easy to lose perspective. If we take a step back, and also view the charts at logarithmic scale, these price movements seem relatively par-for-the-course.

Bitcoin and Ethereum are not linearly growing ecosystems. They are asymmetric bets on world-changing technology. Logarithmically scaled charts help view the growth of these systems, and in log terms, these drops look… normal.

Two idioms come to mind:

Bull markets climb a wall of worry

Every significant green day in a bull market leaves investors with perpetual anxiety about how the next day could be an even more significant red day. Every slow, incremental increase in market valuations could be met with a single day that wipes everything out.

Stairs up, elevator down

Said in other words, when markets go up, they tend to go up slowly over longer period of time. Then, when it comes time for them to correct, it skips over the stairs and takes the elevator back down. Markets fight gravity on the way up, and succumb to it on the way down.

While this seems frightening, this is crypto. You don’t get asymmetric upside without the downside. And things don’t move slowly. $ETH ran from $700 to $4300 in ~150 days, and then lost $2650 off the top in just 2 weeks.

This is called whiplash, and it throws everyone around. It’s meant to challenge your conviction.

Accept the Pain

As an investor, you’re supposed to be a cold, calculating, unemotional human.

But you’re not because you’re human. You feel emotions. You toil hard for your money, and then you put it into BTC or ETH and watching it jump around all over the place.

In the legacy markets, where they get ~5-15% over 365 days, it’s easier to be unemotional. In crypto markets, you can get ~5-15% over the time you’ve read this article, so it’s naturally harder to keep your head cool.

I’m sure many of you were euphoric over the last few months. I bet a lot of you felt pain over the last week or so. This is normal. Pain is always on the horizon. If you enjoy feeling good during times of number-go-up, then you are committing to feeling pain during rapid price drawdowns.

You don’t only get good feelings. You also must accept pain. You must have your conviction tested and questioned. The market needs to shake out the weak hands.

If you can’t handle -60% drawdowns, then you don’t deserve +6,000% gains.

Ryan and I discussed the role of mindfulness and being zen in last weeks Weekly Rollup:

Where Does Pain Come From?

If you want to avoid pain from crypto-markets, it’s good to understand where pain comes from.

Pain comes from forced-selling from being over-extended.

If you feel significant amounts of market pain, it’s because:

- You put more in than what you could afford to lose

- You were on too much leverage

- You own too illiquid assets

The through-line between these three circumstances is that, during market dumps, you’re forced to sell.

Did you put June’s rent money into ETH in May? Well, June 1st is a week away, and now your money is worth 40% less. If you want to keep your place to live, you have to sell and eat the loss.

Were you on too much leverage, and were on the cusp of liquidation? Well if you want to keep the remainder of whatever position you have, you must sell some of your position to reduce your leverage.

If this is you, here is when you sold:

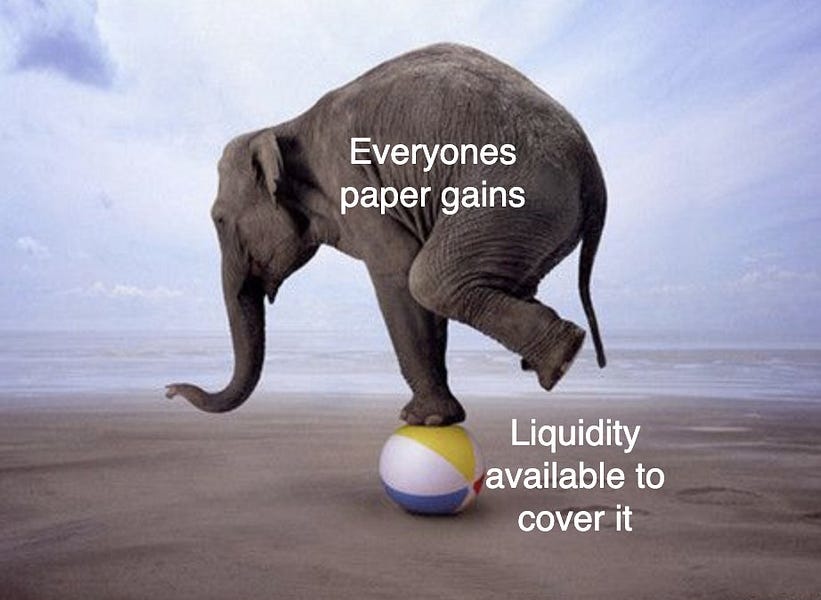

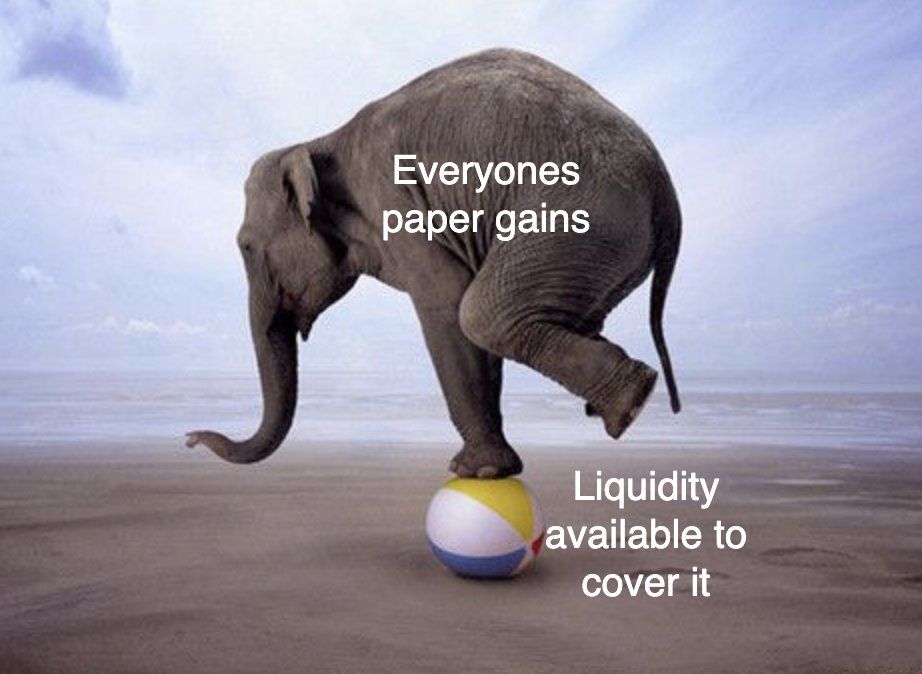

Crypto price movements are violent because there are relatively thin order books supporting everyone’s unrealized gains. Especially when it comes time for leverage liquidations, liquidity leaves markets, and forced-sellers sell into terrible offers that they must take.

For more commentary on this effect, Anthony Sassano over at the Daily Gwei wrote more on this subject today.

DeFi Crushed it, CEX’s failed

Something positive to end on…

DeFi absolutely crushed it during this unprecedented market volatility. The last time we had market movements like this was during the COVID crash in march, where a decent number of DeFi apps broken down in their functioning due to extreme congestion and volatility.

This time around, DeFi is ~80x bigger than what it was in March 2020 ($1b in DeFi, vs $80b at the recent peak). And from what we can see, every single DeFi app worked exactly as expected. If these applications can weather a 40% drawdown in 24 hours, they’re are clearly sufficiently resilient to grow even bigger (even if the investors using them aren’t 😜)

Meanwhile, here’s a list of centralized exchanges that crashed due to the volume of users that tried to log in to make trades:

- Coinbase

- Binance US

- Gemini

- Kraken

- Bitstamp

This is the power of a global computer running unstoppable code on an unstoppable network. Financial services of the future will not halt for anyone. Markets will clear no matter what. Unironically, this was bullish selling.

Looking forward to enjoying the 2nd half of this bull market with you all.

We may chop around but if you think crypto is done, I got news for you son…

We got 99 problems, but bear markets ain’t one.

- David

🎙️ NEW PODCAST EPISODE

Listen in Podcast App | iTunes | Spotify | YouTube | RSS Feed

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers 📊

- ETH sinks -23% to $2,540 from $3,295 last Monday

- BTC drops -13% to $37,500 from $43,000 last Monday

- TVL slumps -22% to $56.5B from $72.5B last Monday

- DPI tanks -27% to $385 from $529 last Monday

- DAI stability fee on ETH stays at 5.50%

Market opportunities 🤑

- Launch a token on Sushiswap’s Miso

- Deposit LINK into Compound (new asset!)

- Stake SNX and get ready for some airdrops (cutoff may have already happened tho)

- Analyze DeFi tokens with Token Terminal’s new dashboard

- Trade SOL on Coinbase Pro

- Order pizza and proceeds go to fund Bitcoin development (Congrats Pomp)

- Manage your yield risk with Barnbridge SMART yield

- Swap tokens on Balancer V2 and get BAL back on your gas fees

- Bid on the Ultra Sound Money Man NFT 🦇 🔊

Yield Farming 🌾

- ALPHA LEAK: Earn 50% APY in SUSHI plus 25% in trading fees by providing liquidity to the BTC2x-FLI-WBTC SLP Pair. Get paid to 1.5x long BTC!

- 3AC deposited another 100K ETH into Lido stETH/ETH Curve Pool

- Alpha Homora pumping out solid yields for tons of assets (sUSD at 52% APY!)

- Yearn fork AutoFarm goes live on Polygon

What’s new 📰

- The Fed considers issuing a Central Bank Digital Currency (they have no choice)

- US Treasury calls for stricter crypto compliance from IRS (oof)

- Flux Protocol raises $10.3M to build DeFi infrastructure on Near

- MCDEX raises $7M investment

- CoinDesk introduces $DESK token for event rewards

- Introducing Fish Vote to make Uniswap governance more accessible

- CommonWealth raises $3.2M for community token hub

- PoolTogether diversifies community treasury with new investor capital

- SecretSwap V2 is live

- DeversiFi raises $5M to build Layer 2 DEX

What’s hot 🔥

- Ray Dalio now owns Bitcoin (well well well)

- UK Parliament mentions the flippening (Bankless in parliament too??)

- Cathie Wood from Ark Invest is bullish on Ethereum (smart)

- Curve crosses $1B in 24 hour volume

- Uniswap supporting $40M volume on $1.2M in liquidity (capital efficiency is crazy)

- Perpetual Protocol hits $10B in total volume (tactic next week)

- Sushiswap flippened Bitcoin in transaction fees (woah)

- 1inch processed over $5B in volume in two weeks

- There’s over $1B in value stored in Argent Wallets

- MicroStrategy purchases another $10M in BTC (just another week)

- How Ethereum compares to Bitcoin in energy consumption

Money reads 📚

- Own the internet (case for ETH from outside crypto) - Packy McCormick

- Why you can’t just increase the blocksize by 10x - Vitalik Buterin

- Fear is the mind killer - Arthur Hayes (my response)

- Pushing the Frontier with Paradigm - Hasu & Uncommon Core

- Interview with Vitalik on the market crash - Matt Egan

- Liquidity Mining on Uniswap V3 - Dan Robinson

- Everything is a meme - Three Body Capital

Governance ⚖️

- Aave proposal to add dQUICk to its money markets

- Balancer proposal for partnership mining

- Bankless DAO proposal to incorporate PieDAO referrals

- Compound passes exec vote to add LINK markets

- Empty Set Dollar proposal to work with DeFi Pulse on DeFi integrations

- Index Coop discussion to revisit liquidity mining strategy

- Kain Warwick on Synthetix’s Governance

- MakerDAO poll to add Sushiswap USDC-ETH LP tokens as collateral

- Yearn vote to swap out multisig signers

WHAT I’M DOING

Check out a few cool things I’m capturing right now in crypto

- Ryan: Watched Ray Dalio say he’d rather own Bitcoin than a Bond this morning! Wait till he discovers non-soverign internet bonds.

- David: Speaking about Ultra Sound Money at Consensus 2021—tune in! Starts at 5:30pm PST.

- Lucas: Shared some thoughts on Seasons for the Bankless DAO! The purpose of seasons is to give the community a clear roadmap to focus their energy and resources too.

WHAT YOU’RE DOING

What’s the coolest thing you did in crypto last week?

- @TrainerWriting paid her daughter’s tuition off of Ethereum

- @ChainLinkGod recorded a new podcast

- @Fairlyoptimist had his eyes opened from the Mark Yusko ep (listen here)

- @0xWangarian got rekt

See the rest here!

Extra Credit Learning

- (Beginner) DeFi beyond the hype

- (Beginner) Addressing common criticisms on Ethereum

- (Beginner) A Guide on DAOs

- (Intermediate) What everyone gets wrong about 51% attacks

- (Intermediate) Nic Carter on China’s Mining Ban

- (Intermediate) How to launch a community token

- (Intermediate) Mapping the Metaverse

- (Advanced) How to save 50% on gas costs with Solidity

Some recent tweets…

Thanks Polygon for taking the hits for us…here’s how to use it.

Actions

- Execute any good market opportunities you saw

- Listen to Crypto’s Existential Threat | MEV Panel