Aave: Road to Billions

Dear Bankless Nation,

We’re doing a new thing on Thursdays.

Rather than keeping our Thursday slots reserved for thought pieces, we’ll going to starting covering more token-specific content. If you like Tactic Tuesdays…you’re gonna love Token Thursdays!

Here’s the cool part. Rather than us choosing what we cover on Token Thursdays, the projects we cover will ultimately be decided by you, the bankless community.

Decided how?

Decided by member vote through Bankless NFTs cause we’re crypto geeks like that.

After a quick poll earlier this week with the new 2021 member badges, the Bankless community voted on Aave—barely winning out to Uniswap. Sybil resistant decentralized governance baby!

Ultimately, the goal on Thursday’s is to level up our knowledge of tokens, valuation metrics, what they do, and just have a solid grasp on the crypto capital assets in play so you’re positioned to win this market cycle.

Sound fun?

k, let’s start leveling up on tokens.

- RSA

Aave: Decentralized Money Markets

Yield has been one of the key drivers behind the growth of DeFi. Over the past two years, billions of dollars in capital has poured into the space as interest rates in traditional finance grind down to 0%, and even negative in some circumstances.

As a result, DeFi has been a new haven for savvy investors to earn high yields in a range of different ways, one of them being from emerging interest rate protocols.

Aave is one of these leading decentralized interest rate protocols in DeFi, currently holding nearly $5B on its balance sheet. The protocol allows anyone to deposit capital in return for interest as well as borrow in an overcollateralized or undercollateralized fashions (via flash loans or credit delegation).

After rebranding from EthLend in January 2020, the protocol has broken out to become the 14th most valuable crypto asset to date--boasting a $6.8B fully diluted valuation. This piece will dive into Aave’s native governance token, an update on key stats, and a breakdown on what’s hot these days.

Let’s get into it.

What does AAVE do?

The core value of AAVE is its use as collateral of last resort for the Aave protocol.

If Aave experiences a shortfall event—a period where the protocol incurs a deficit—AAVE is used to re-collateralize the system. The difference from other ‘collateral of last resort’ assets, like MKR in Maker, is that rather than forcing holders to deal with the dilution in the instance of a shortfall event, Aave allows holders to opt into slashing events by staking into the Safety Module (SM).

In return for staking AAVE as protocol insurance, stakers receive a portion of the ecosystem incentives including incentives from the ecosystem reserve as well as protocol fees. At the current rates, this results in roughly ~6% APY for AAVE stakers.

It’s important to recognize that shortfall events are subject to protocol governance, but we can imagine that qualifiable events would include protocol-level hacks and oracle failures. None of these have happened yet to Aave specifically, but worth highlighting as an inherent risk when holding and staking AAVE.

With the announcement of Aavenomics this past summer, Aave also detailed the launch of Aave V2—a new and improved money markets protocol. Some of the notable features includes gas optimization, credit delegation, fixed rate deposits, and the implementation of private markets for institutional investors.

Aave: The Fundamentals

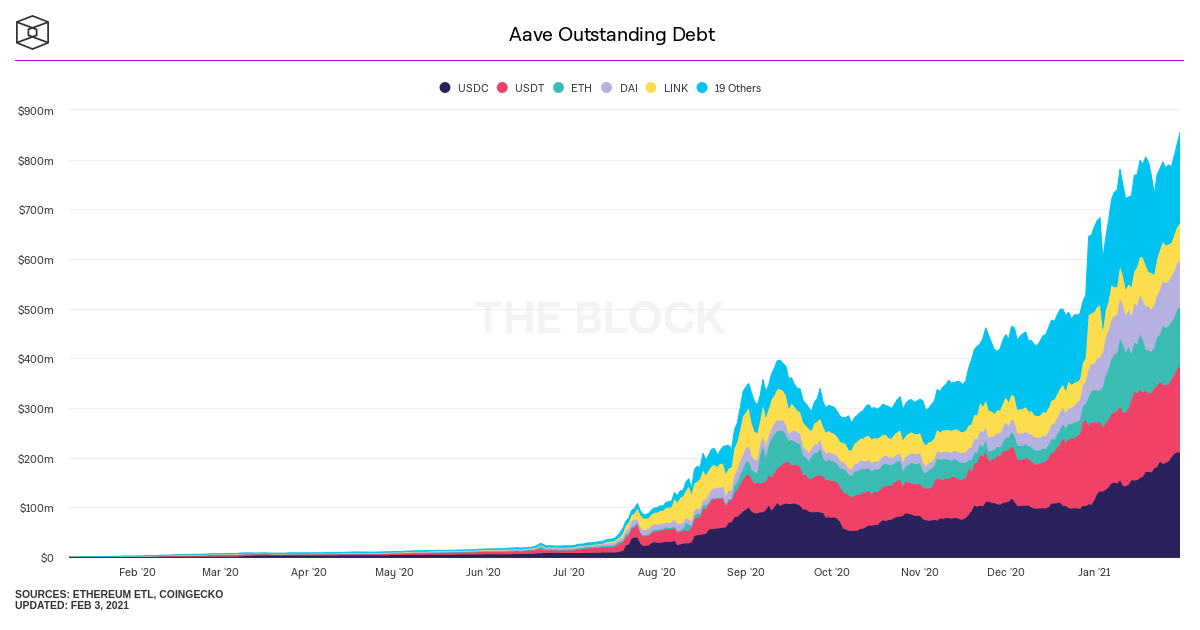

There’s no doubt that Aave has seen a surge in demand in DeFi. In the past year, the protocol has seen its outstanding debt rise to over $800M, according to The Block.

Like volume with DEXs, outstanding debt is one of the key fundamental metrics with interest rate protocols as it shows the demand for borrowing—a requirement in order to provide competitive rates for depositors. The more people that are borrowing from the protocol, the higher the demand for capital, and in turn, the better interest rates for suppliers, which means more liquidity. Simply put, the demand to borrow capital from the protocol is what drives its growth.

With that said, stablecoins are naturally one of the higher-demanded assets given the nature of the over-collateralized lending. Major crypto dollars like DAI, USDT, USDC and others currently make up nearly 70% of all borrowing demand on the protocol.

Why? Because investors use Aave (and any overcollateralized lending protocol) as a liquidity pool for leverage.

The prime example on how people use interest rate protocols with overcollateralized lending is this: deposit ETH to receive borrowing power, use that borrowing power to borrow dollars, sell dollars into ETH, and then hold ETH. You then have a leveraged position in ETH. Therefore, if the value of ETH skyrockets, borrowers can pay back the dollar-denominated debt plus interest and, ideally, keep the remaining capital left.

There are obviously other reasons one could borrow from Aave, like using your ETH to borrow money for a downpayment on a house, but generally speaking, leverage is one of the key drivers.

Total Value Locked

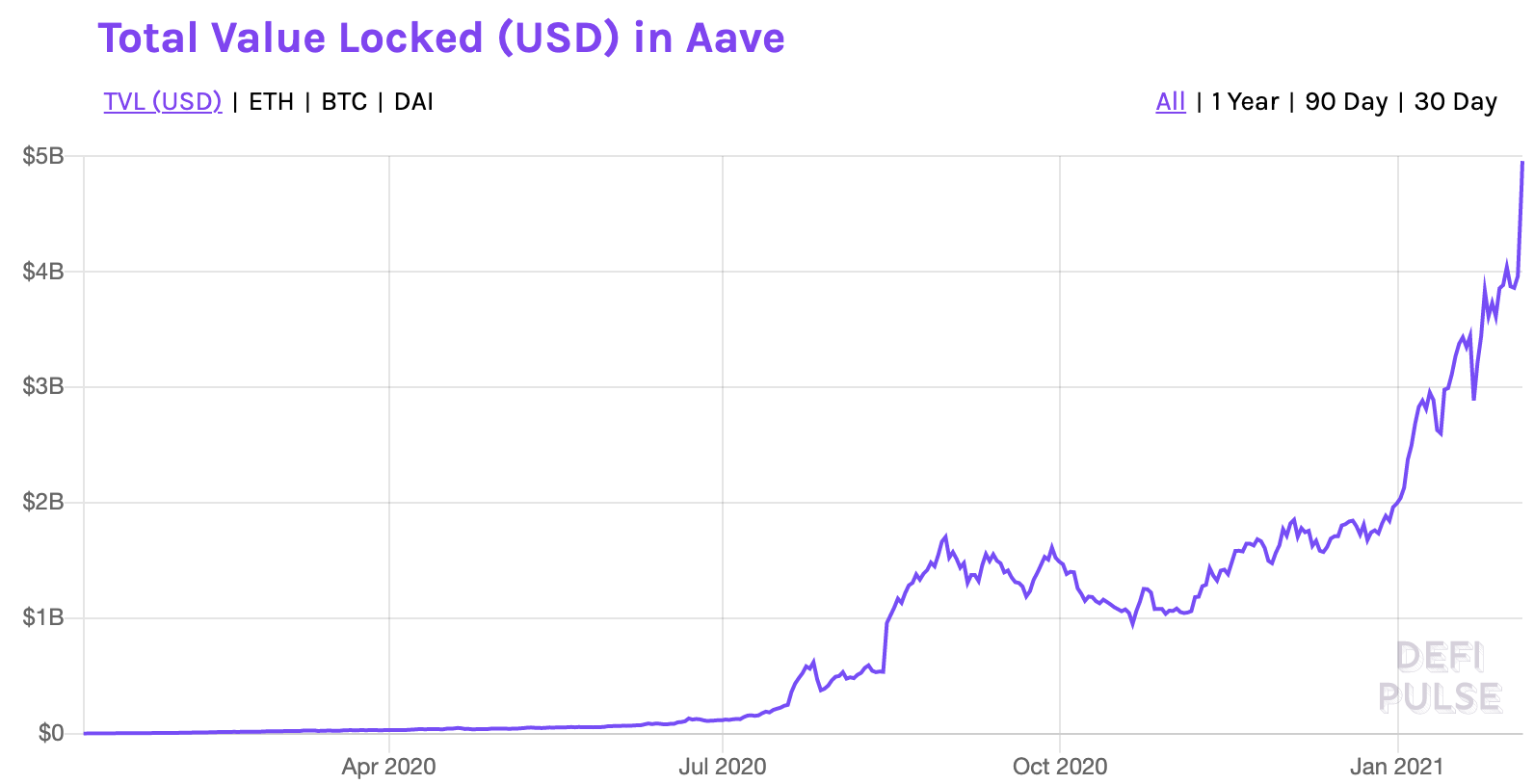

Total value locked for Aave has been one of the more notable statistics since its launch just over a year ago. The protocol has become a liquidity behemoth only falling to second place in DeFi value locked rankings to MakerDAO, the decentralized bank behind crypto-native stablecoin DAI.

In the bankless program, we like to view total value locked as the protocol’s balance sheet. It’s the amount of assets held by the software. And according to DeFi Pulse, Aave is rapidly approaching $5B on its balance sheet, including 0.35% of all ETH in circulation.

While the $5B milestone is noteworthy, the real achievement has been the level of growth. Aave launched literally a year ago, with maybe a few million dollars in capital. Fast forward to this past summer and Aave’s value held swelled to $1.1B. Now, it’s over $5B. This means that the protocol was effectively able to bootstrap itself from 0 to $1B in less than a year as well as 5x’ing its balance sheet by billions of dollars in a few months after it reached unicorn status. Insane. Not even the Fed could keep up, even in this “money printer go brrrr” environment that we now live in.

Equally as impressive to the growth rate, all of this value is completely organic. Unlike its main competitor, Compound, there’s zero incentive from the protocol to deposit capital. However, the Aavenomics upgrade did outline an allocation for future liquidity incentives. We’ll touch on that more below.

Revenue (V1 only)

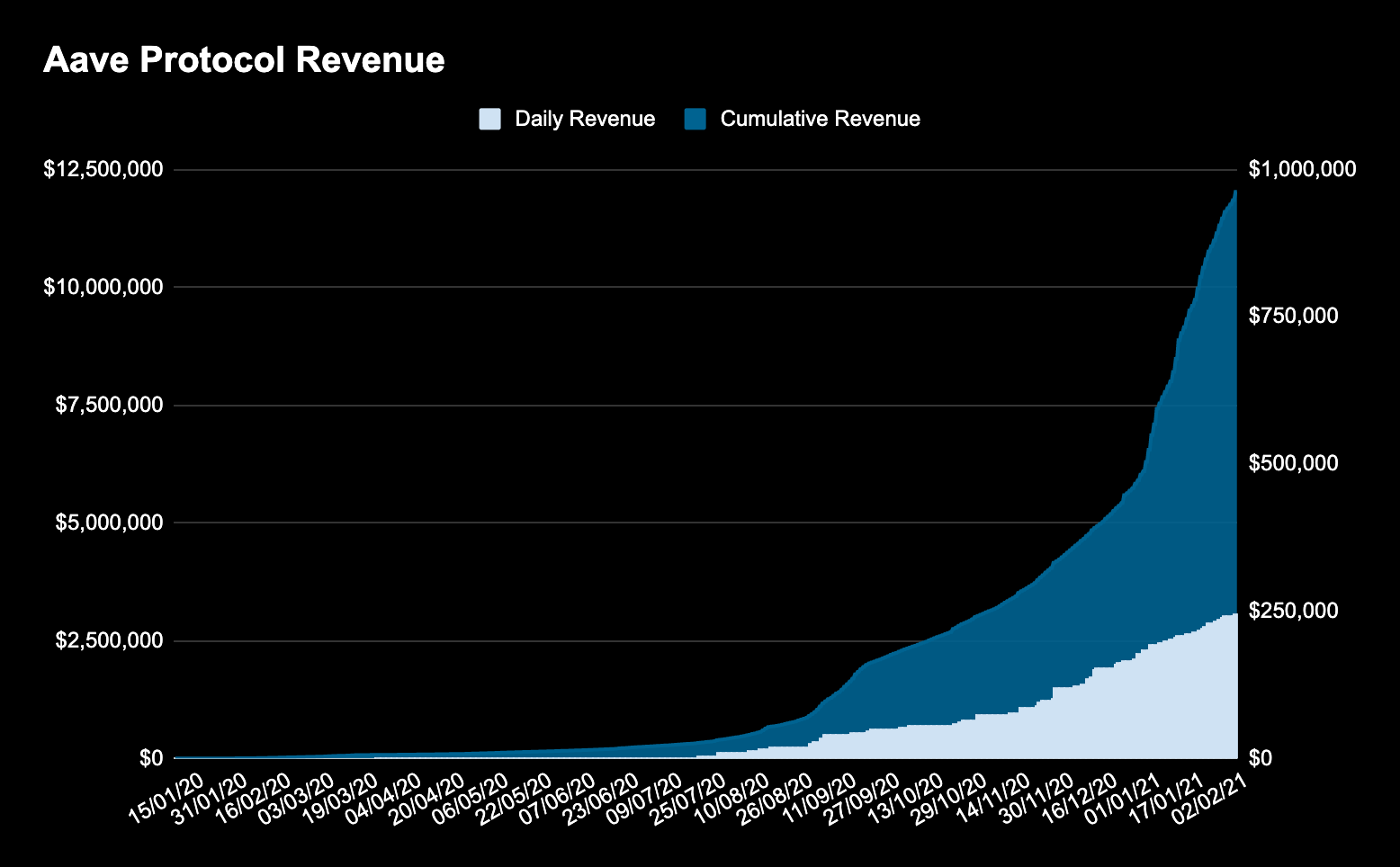

In DeFi, revenue refers to the total fees paid by the end users. In the case of interest rate and money market protocols, revenue derives from the interest borrowers pay on their outstanding debt. In other words, it is the amount of money people are willing to pay to borrow capital from Aave.

According to Token Terminal, the amount of interest generated per day in V1 has soared to nearly $12.5M with the rate rising to ~$250,000 per day.

On an annualized basis, Aave V1 is projected to earn $91M in revenue for the protocol’s suppliers. It’s important to recognize that Aave also has flash loans, where the protocol generates some fees from usage, however, this data is not included in the graphic below. Therefore, the graphic below is an underestimate on the amount of interest Aave generates on a daily basis.

Price to Sales Ratio

The last key metric we’ll look at is the Price to Sales (P/S) ratio for Aave. If you’re a regular reader, you’re probably familiar with this metric already. If you’re learning, the P/S is the market cap of the protocol divided by the amount of revenue it generates. In traditional finance, the P/S ratio serves as a basic metric for measuring how the market values the asset relative to amount of revenue it generates and its expectation of future growth.

With interest rate protocols, like Aave and Compound, the price to sales ratio literally translates to the market is willing to pay $X for every $1 in interest generated today.

But when Aave first launched, the protocol had an astronomical P/S ratio given the little usage and moderate valuation. However, as DeFi progressed through the year, Aave clawed back to more reasonable valuations. More importantly, even though the protocol was one of the best performing assets in DeFi for the past year, surging 14,000% in 1 year, the P/S ratio has never been lower as I write this.

Last month, Aave’s average P/S ratio was ~54 compared to its average 30 day P/S ratio of 155 when it first reached Unicorn status back in August. Meaning in August, Aave buyers were paying $155 for every $1 in interest generated, whereas buyers today are paying $54 for that same dollar of interest.

The key takeaway here? People are using Aave more than ever. Despite the insane growth in market cap, the protocol is keeping up on a fundamental level.

Actually, strictly by this measurement, Aave’s cheaper today at a $6B than it was at $1B. Pretty wild if you ask me.

Price Performance

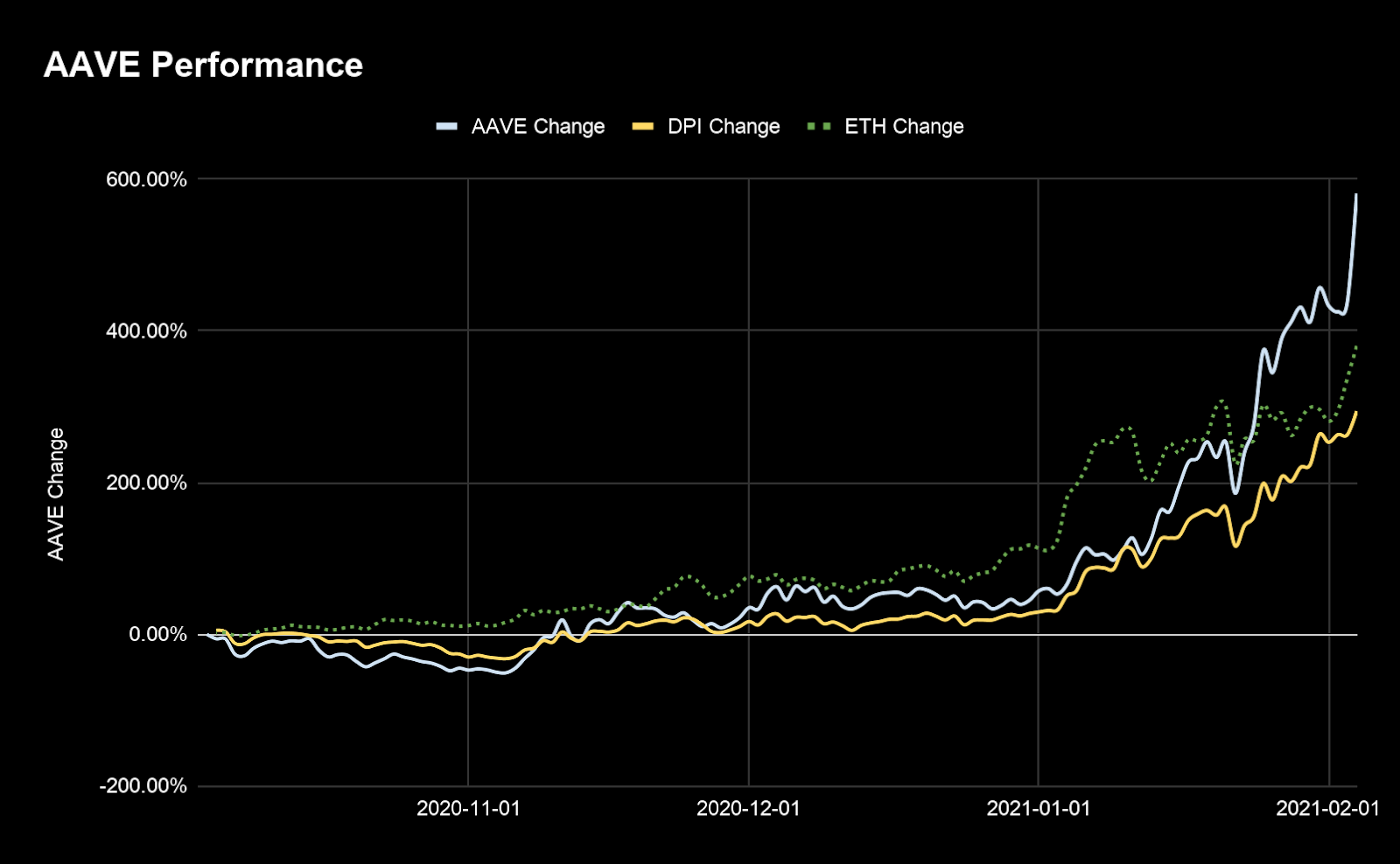

Lastly, let’s see how AAVE has performed against ETH and the DPI, one of the leading DeFi indices in crypto. One of the main principles with crypto investing is to measure your portfolio performance against major crypto assets. This is because, generally, a crypto investor’s goal is to increase your portfolio value in terms of ETH or BTC, while also ensuring that you’re outperforming the rest of the DeFi market.

Fortunately, AAVE is one of the fastest horses in DeFi. It has not only outperformed DPI but also ETH. Here’s the current tally since October 2020:

- AAVE: +581%

- ETH: +380%

- DPI: +294%

🔥 What’s hot with Aave

There’s no denying the fact that Aave has had an outstanding year. The launch of Aavenomics and Aave V2 served as a catalyst for new growth on both the protocol level and token level. But what’s next?

Here’s a few things worth keeping an eye on and notable events:

- Ecosystem incentives. Aavenomics introduced the concept of ecosystem incentives, specifically liquidity incentives for the protocol’s suppliers. But this has yet to be turned on. We can imagine that once Aave starts subsidizing deposits with the AAVE token, the incentive to earn one of DeFi’s best performing tokens could drive a massive inflow of liquidity into the protocol. That said, this seems to be a slow moving discussion so there’s nothing overly concrete as of yet.

- Credit delegation. Credit Delegation is a new feature in Aave V2 where depositors can delegate their borrowing power to other users, likely for a higher rate. Credit delegation may be one of the most interesting developments from my perspective as it’s a feature that enables entire businesses to be built on top of. Someone could effectively build a new BlockFi—a $500M crypto business—built on Aave money markets using credit delegation. Credit delegation could also open the door for Aave credit cards. It’s still very early for Aave CD but it’s a feature definitely worth keeping an eye out for in the coming months.

- Token Architecture V2. Delphi Digital recently proposed a new token architecture to accompany V2 on top of the Aavenomics upgrade. It enables borrowers and suppliers to pay a “one-click” insurance which would in turn stream fees from the interest generated to Aave Safety Module Stakers. The proposal also features a more complex design intended for the long term. You can read more about it here. Nothing has been finalized yet, but interesting discussion nonetheless.

- Listed on Bitwise 10. Aave recently replaced Cosmos in the Bitwise 10. This is a major milestone for Aave as it joins it’s fellow DeFi protocol Uniswap and other major large cap crypto assets like BTC, ETH, and LINK into this index. It’s a sign that the crypto industry is maturing as DeFi tokens with tangible usage start to creep into the most valuable crypto assets by market cap. That said, Tezos, EOS, Bitcoin Cash and others still populate the Bitwise index, leaving an open target for other major DeFi protocols rising up the ranks.

- Grayscale AAVE Trust. Grayscale recently filed for multiple new trusts, including AAVE. If launched, this would provide a major catalyst as AAVE would be directly available in traditional markets. Moreover, a successful launch of a Grayscale trust will result in a fair amount of buying pressure for AAVE as indicated by its current holdings with other major assets like BTC (>4% of supply) and ETH (holds >2% of supply).

Action steps

- Dig into Aave V2 and the Aavenomics upgrade

- Drop a comment on how you’d like to see Token Thursday improve!

- Listen to our Aave to Billions podcast episode with Stani Kulechov