Let’s face it: DeFi UX is broken.

Steep learning curves, long waiting times, and too many failed transactions make interacting with applications in DeFi a frustrating experience. But what if there was a design shift that could simplify this process?

Enter intents, an intuitive way for users to interact with applications where any outcome is achievable with just one click.

Sound too good to be true? Let’s find out more 👇

🙋♀️ What are Intents?

If you want to exchange USDC on Arbitrum for DAI on Optimism, currently, the UX looks something like this:

- Visit a bridge site and connect your wallet.

- Enter swap details and submit the transaction.

- Give token approval, pay the gas fees, and confirm the transaction.

- Wait 10 minutes for the bridge to do its magic.

- Switch chains to complete the transaction.

- You receive DAI on Optimism 🎉

It’s fair to say that this is by no means the ideal UX.

Let’s see what it would look like with intents:

- Visit a bridge site and connect your wallet.

- Enter the swap details and sign a message.

- You receive DAI on Optimism 🎉

The purpose of intents is to remove the complexity for the users. An intent refers to the desired outcome a user wants to achieve by interacting with an application.

In an intent-based paradigm, users only need to express their desired outcome without worrying about the process of achieving it.

But what does the process look like from intent creation to achieving the outcome? And who’s doing all the work?

There are a few key participants in an intent-based flow that makes this possible:

- User – The user submits their intent by signing a message that contains information about their desired outcome and the conditions within which they would like it to be achieved.

- Application – The front-end interface where the user expresses their intent.

- Solvers – The actors responsible for executing the transactions onchain on behalf of the users to achieve the desired outcome.

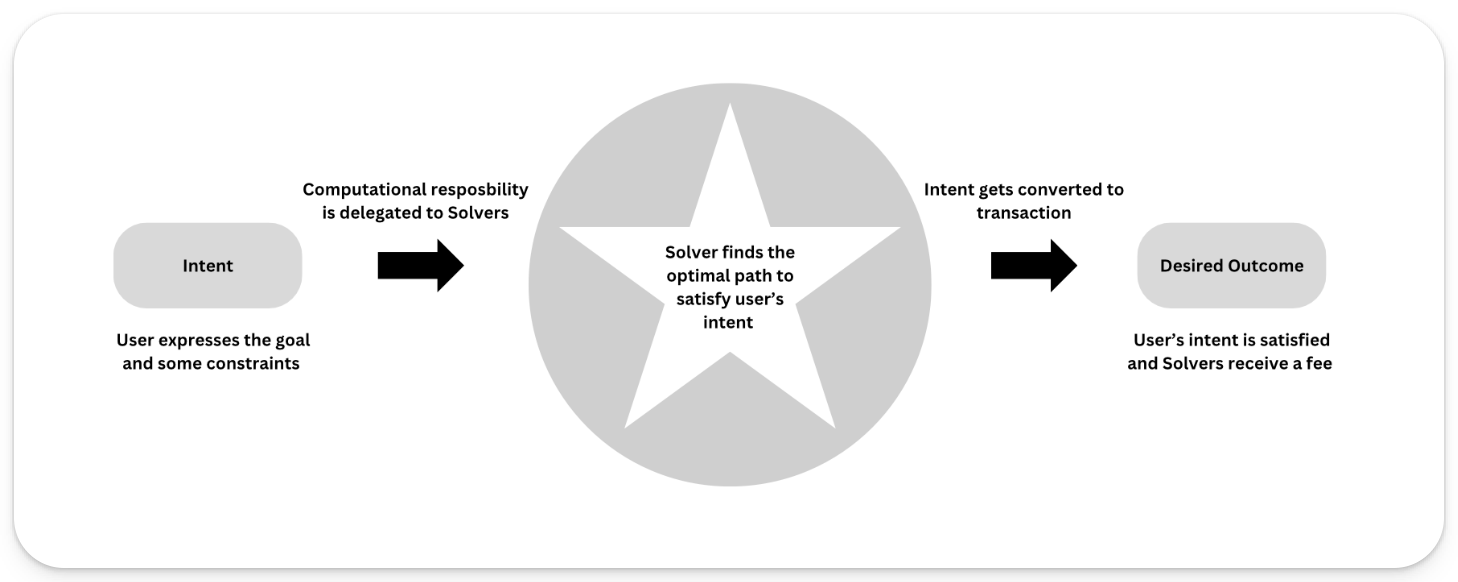

🔄 Lifecycle of an Intent

Here’s a simple depiction of the lifecycle of an intent, from intent creation to achieving the desired outcome.

What could this mean for DeFi UX? Let's explore the key themes of UX in an intent-centric world:

1. Complex DeFi tasks will become easier

Users will only need one step to achieve their desired outcome. The major benefit of this will be reduced errors.

Example: a user wants to earn a yield on USDC. They express their intent to the application. Behind the scenes, the Solvers take over and handle all the steps, such as choosing the blockchain, paying gas fees, and executing transactions.

2. More flexibility for users

Intents give users more flexibility and control over their onchain activities. Users can set conditions for trades, ensuring actions only occur under specific circumstances.

Example: a user can say, "Sell my asset if the price hits this much within the next 1 hour." When the price hits, the trade happens automatically.

3. Better execution of every action

Intent execution is outsourced to Solvers who optimize every action for the best price. This helps reduce issues like slippage and provides better protection against MEV.

🤖 What's next?

With intents, we could be looking at the solution that makes DeFi usable for the average user.

Upcoming projects, such as Flashbot’s SUAVE, Anoma, and Essential, that are building intent-centric architectures, hold promise for developing DeFi applications with superior UX and could perhaps be the catalyst for mainstream adoption.