A Fresh Start for Tokenomics in 2026

We’re all already well aware of the sad state of tokens in crypto.

Fundamentally, most tokens do not represent the same kind of investor upside exposure to projects as what you would find in the traditional stock market.

Tokens are a brand new form factor for investment, and we’ve learned that form factor has not been favorable to investors versus what they can find elsewhere.

As Threadguy put it: There’s a good coins problem.

There are two bits of data that I’d like to share today with you that are giving me some optimism for the state of tokens in 2026 and beyond:

- MegaETH’s KPI program

- Cap’s stabledrop

Making Token Supply Conditional

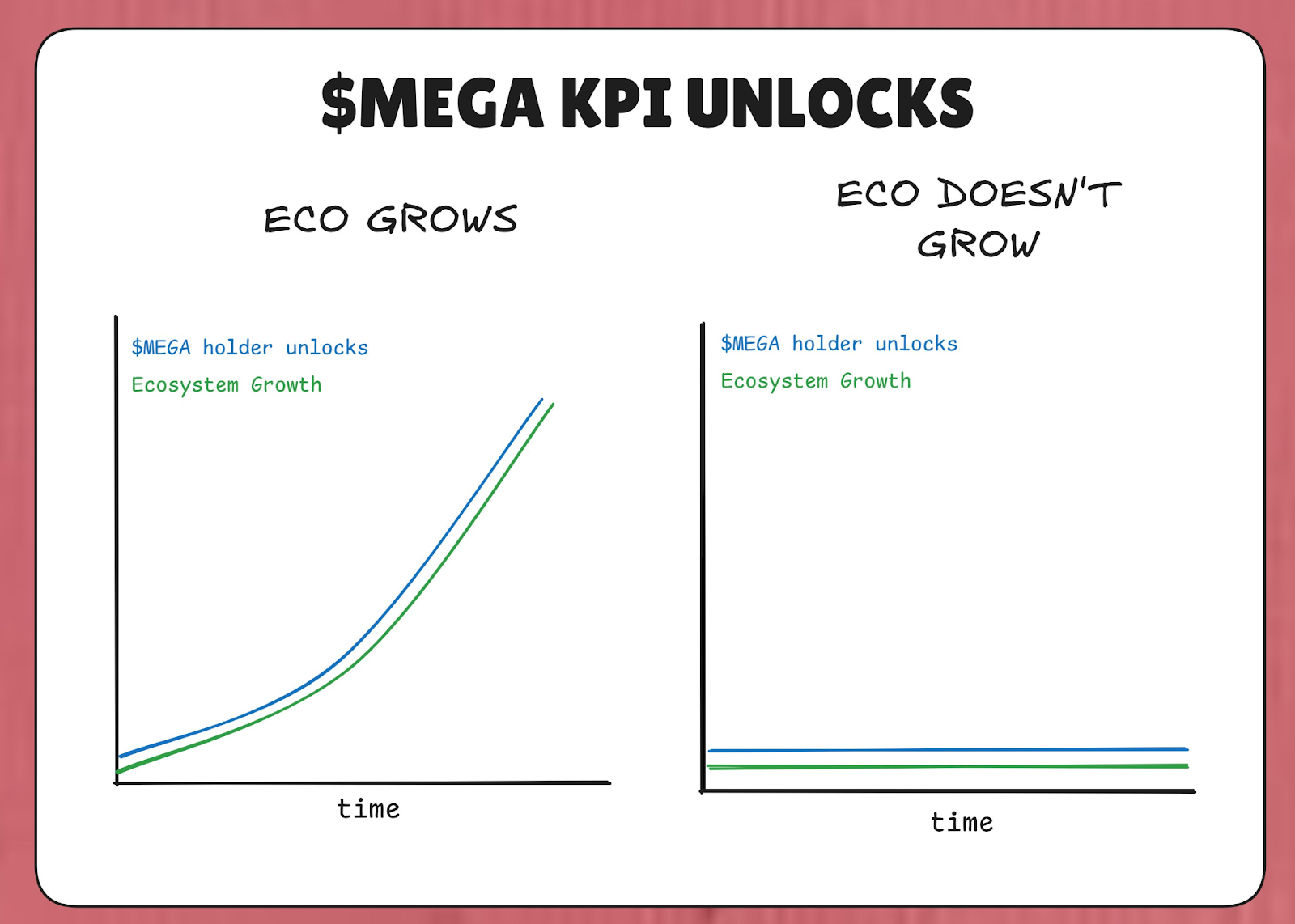

MegaETH has put 53% of the total supply of MEGA tokens locked behind a “KPI Program.” The thought is: if MegaETH doesn’t hit their KPIs [Key Performance Indicators], those tokens don’t get unlocked.

So, in the bearish case, where the ecosystem isn’t growing, at least more tokens aren't also coming in and diluting holders. MEGA tokens only come into the market if the MegaETH ecosystem is actually achieving growth (as defined by the KPIs).

The KPIs for this program are grouped into 4 scoreboards:

- Ecosystem Growth (TVL, USDM supply)

- MegaETH Decentralization (Progression on L2Beat Stages)

- MegaETH Performance (IBRL)

- Ethereum Decentralization

So, in theory, as MegaETH hits its KPI goals, the value of MegaETH should be increasing commensurately, dampening the negative price impact of the MEGA dilution onto the market.

This strategy feels a lot like Tesla’s “only-get-paid-if-you-deliver” compensation philosophy for Elon Musk. In 2018, Tesla granted Musk an equity compensation package split into tranches that vested only if Tesla hit both escalating market-cap targets and revenue targets. Elon Musk only received $TSLA if Tesla was increasing revenues and increasing in market cap.

MegaETH is trying to port some of that same logic into their tokenomics. “More supply” is not a given – it’s something the protocol has to earn by putting real points on a meaningful scoreboard.

Unlike Musk's Tesla benchmarks, I don’t see anything in Namik’s KPI targets about having the market cap of MEGA be a KPI target – maybe for legal reasons. But as a public sale MEGA investor, that KPI is certainly interesting to me. 👀

Who Receives New Supply Matters

The other interesting factor in this KPI program is which investors are getting MEGA when KPIs are hit. According to Namik’s tweet, the people who get the MEGA unlocks are those who stake MEGA to a locking contract.

Those who lock more MEGA for longer, get access to 53% of MEGA tokens that come into the market.

When KPIs are achieved, all rewards are distributed to holders who have elected to lock their MEGA. Our design follows a conviction scaling model, where those who lock for greater periods of time receive a higher portion of the rewards.

— namik // mega-chef Σ: (@NamikMuduroglu) January 29, 2026

The foundation will internalize unvested &…

The logic behind this is simple: Put the MEGA dilution into the hands of those who have already proven to be MEGA holders and are interested in holding even more MEGA – the people who are the least inclined to be MEGA sellers.

The Alignment Tradeoffs

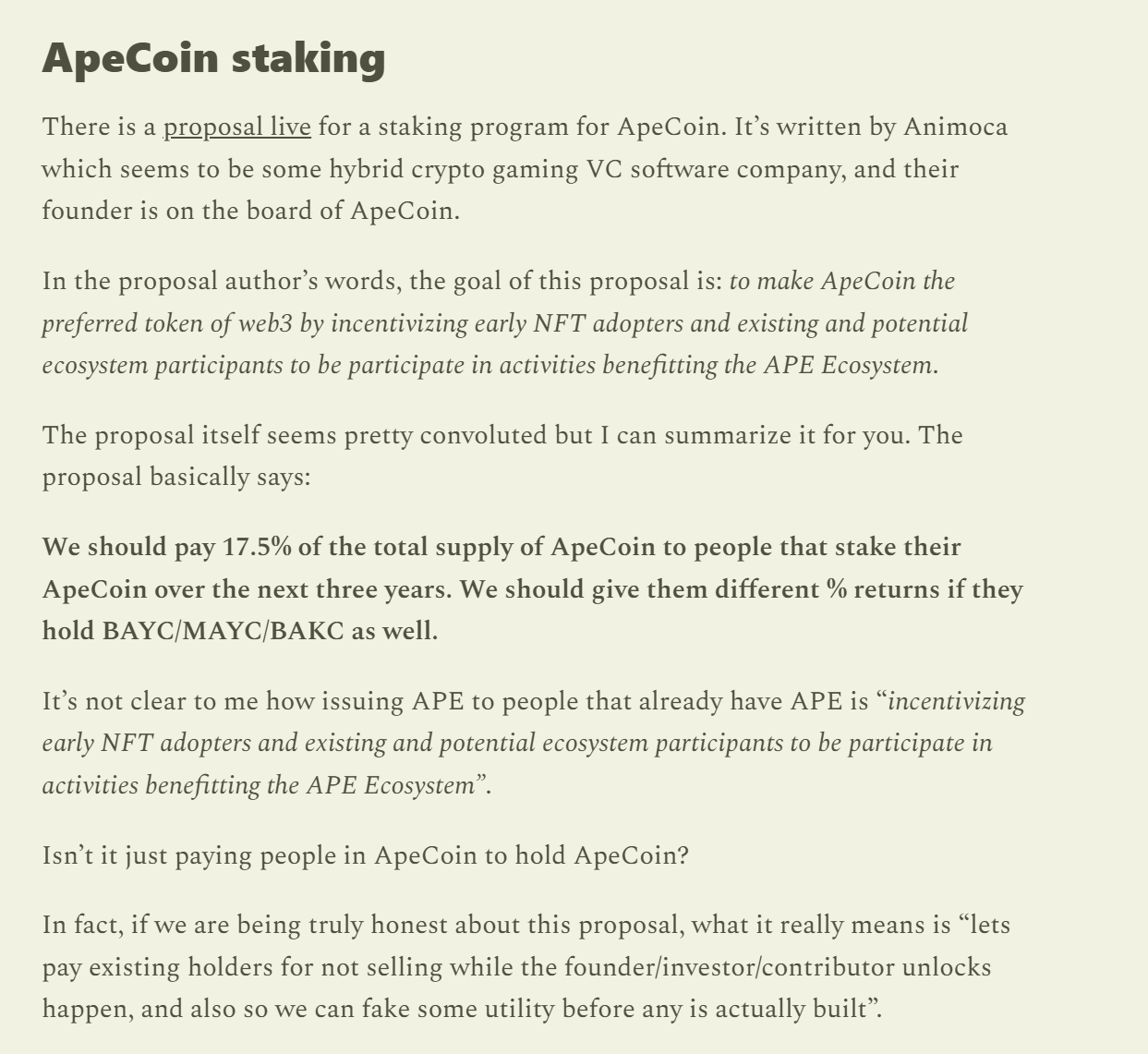

It’s worth highlighting the risks that this also presents. We’ve already seen historical examples of similar structures go terribly wrong. See this excerpt from a Cobie article: “ApeCoin & the death of staking”

If you’re a token pessimist, a crypto-nihilist, or just bearish, this alignment issue is the concern you have.

Alternatively, from the same article: “Staking mechanisms should be designed to support the goals of the ecosystem”

Gating token dilution behind the KPIs that are actually supposed to be reflected in the increasing value of the MegaETH ecosystem is a far better mechanism than any vanilla staking mechanism that we saw during the 2020-2022 era of yield farming. In that era, tokens were being issued no matter what – regardless of any fundamental progress from the team or growth in the ecosystem.

So, the net-net is that MEGA dilution is:

- Commensurately constrained by the growth of the MegaETH ecosystem

- Diluted into the hands of people who are the least inclined to sell MEGA

This is no guarantee that MEGA simply goes up in value as a result – the market will do whatever the market wants. But, it is a valid and honest attempt at fixing the core underlying malaise that seemingly impacts the whole token industrial complex of crypto.

Separating Rewards From Governance Tokens

Instead of a traditional airdrop, stablecoin protocol Cap is introducing a "stabledrop." Rather than airdropping their native governance token CAP, they're distributing their native stablecoin cUSD to users who farmed Cap points.

This approach rewards point farmers with real value, and thus fulfills their social contract. Users who deposited USDC into Cap's supply side accepted both smart contract risk and opportunity cost, and the stabledrop compensates them accordingly.

For those who want CAP itself, Cap is doing a token sale via a Uniswap CCA. Anyone seeking CAP tokens must become a real investor and invest real capital.

Filtering for Committed Holders

The stabledrop-plus-token-sale combination filters for committed holders. A traditional CAP airdrop would have gone to speculative farmers likely to sell immediately. By requiring capital investment through the token sale, Cap ensures CAP goes to participants willing to accept full downside risk for upside potential – a group far more likely to hold long-term.

The theory is that this structure gives CAP a higher probability of success by creating a concentrated holder base aligned with the protocol's long-term vision, as opposed to a less-precise airdrop mechanism that puts hands in those exclusively focused on short-term profits.

The stabledrop is a new paradigm for rewarding early users without diluting early believers

— DeFi Dave (@DeFiDave22) January 20, 2026

I explained our rationale behind this yesterday on @Bankless https://t.co/BHyGfDhDIS pic.twitter.com/a2tDO7tBCp

Token Design Is Growing Up

Protocols are getting smarter and more precise about their token distribution mechanisms. No more shotgun-style, spray-and-pray token emissions – MegaETH and Cap are choosing to be highly discriminating in who gets their hands on their tokens.

“Optimizing for distribution” is no longer a thing – perhaps a toxic hangover leftover from the Gensler era. Instead, these two teams are optimizing for concentration, in order to provide a stronger fundamental base of holders.

I hope as more apps come online in 2026, they can watch and learn from some of these strategies, and even improve upon them, so the “good coins problem” is no longer a problem, and we are just left with “good coins.”