A Beginner's Guide to DeFi on Morpho

With more than $6 billion worth of deposits and deployments on 19 chains, Morpho is among the largest and most far-flung DeFi lending protocols.

It's an interesting time to zoom in on the project, as the team just unveiled Morpho V2. This updated system will complement the V1 protocol and offer fixed-rate, fixed-term onchain loans via intents.

That said, the new central components—Markets V2 and Vaults V2—are undergoing their final auditing phases now, but you don't have to wait for these rollouts to try Morpho as their V1 counterparts are live and powerful in their own right.

As things stand, then, the basics here are as follows:

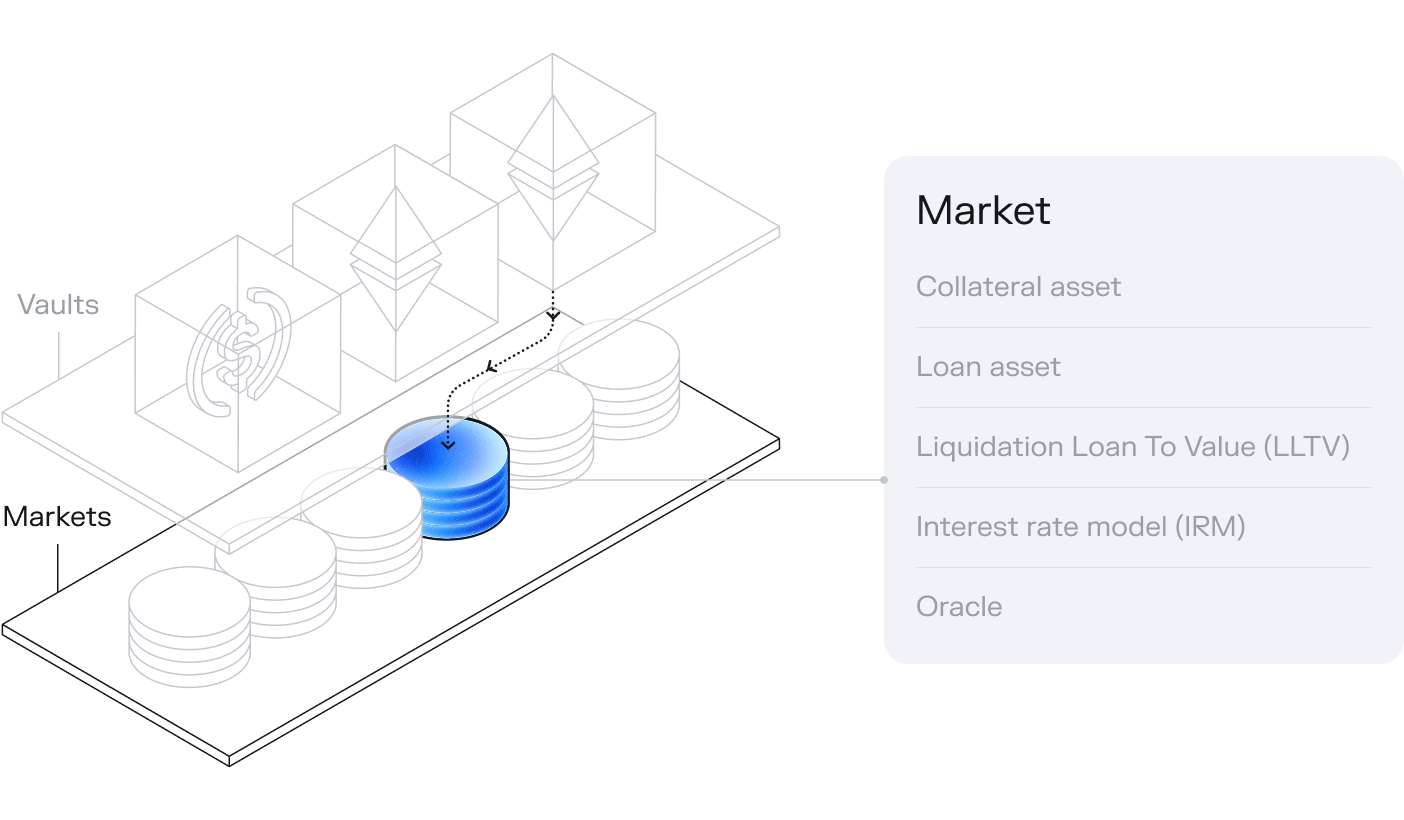

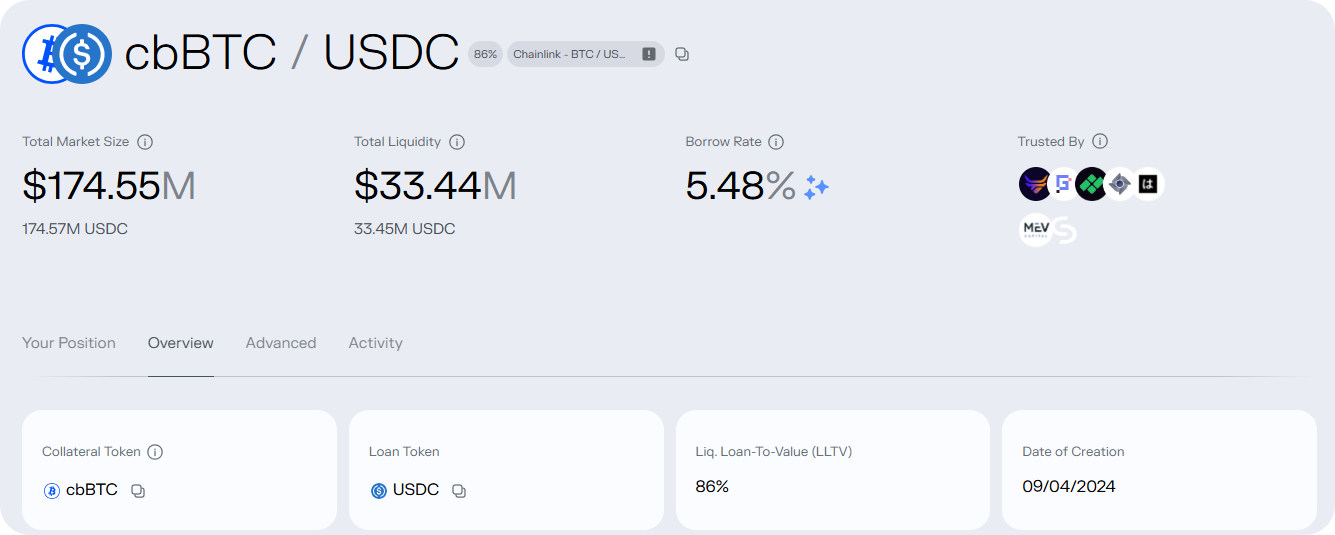

- Markets — These are isolated, one-collateral asset/one-loan asset pools (e.g. wstETH/USDC) that you can spin up permissionlessly. Parameters never change, so lenders and borrowers get predictability and self-contained risk.

- Vaults — These are ERC-4626 vaults that auto-deploy your deposits across vetted Markets, handling allocation and risk in the background so you can earn optimized yields with just a couple of clicks.

- MORPHO — This is the governance token of Morpho that holders can use to vote on improvements to the protocol.

If you want to dive deeper into the nuts and bolts, be sure to read up on how the project approaches curators, oracles, liquidations, interest rates, and fragmented liquidity.

As far as actually using the Morpho platform, you'll find the main frontend at app.morpho.org. Here you'll see four main tabs like so:

Explore lets you review Morpho's current deposit and loan stats, while Migrate lets you simply move existing DeFi borrow positions into the protocol, e.g. from Aave V3.

Accordingly, the real meat and potatoes for users are the Earn and Borrow hubs.

Using Morpho Earn

Earn is the main yield hub on the Morpho platform. To get started here, you could follow these steps:

- Get ready — Connect your wallet on Morpho, flip to your desired chain, and then click on the "Earn" tab.

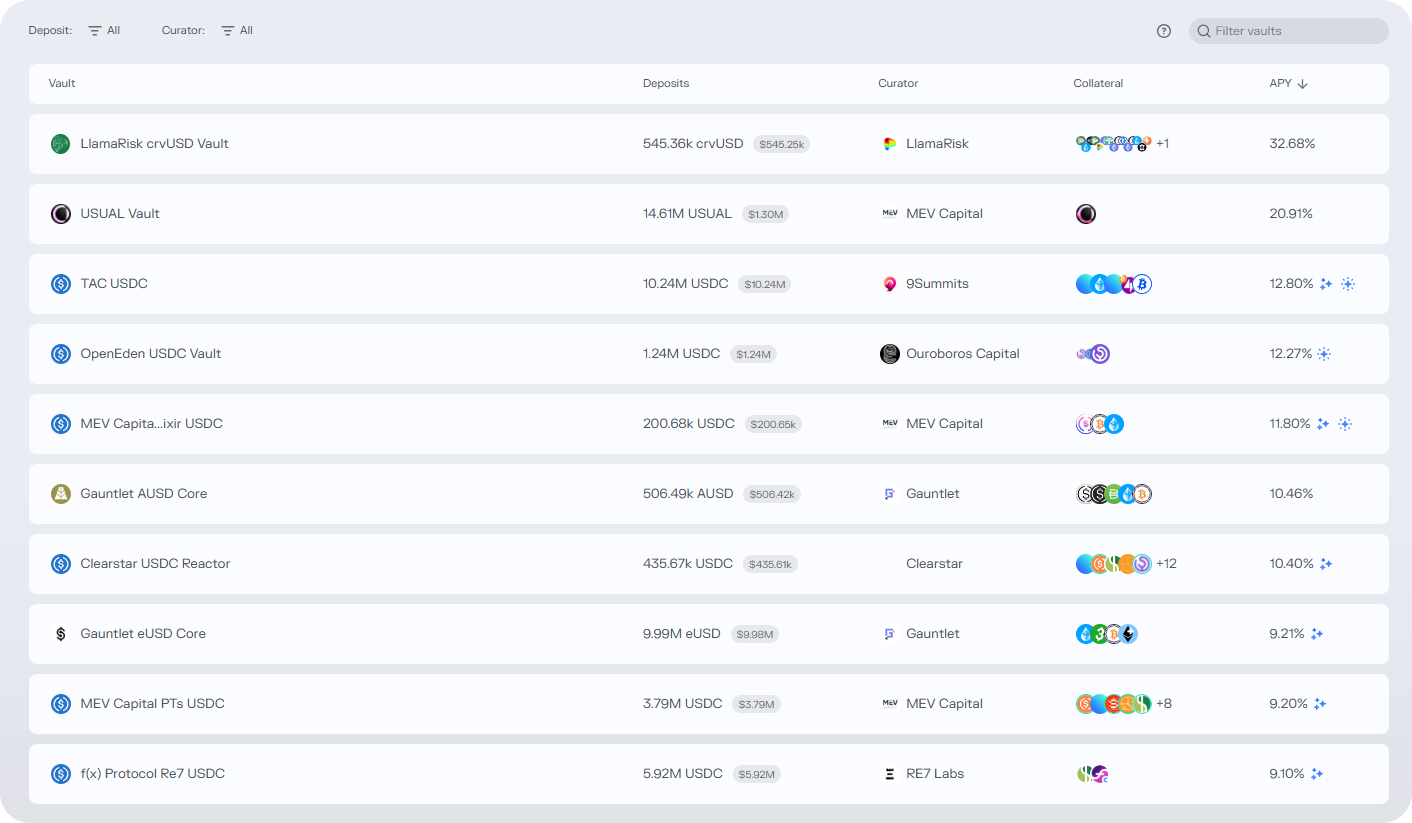

- Select a Morpho Vault — Review the available Vault offerings for your desired APY and collateral options, then make a deposit. Every Vault is curated by a different curator and has a different risk profile, so review all the provided details before jumping in.

- Earn yield — Each Morpho Vault can allocate deposits to Morpho Markets allowlisted by its curator. In turn, Vaults earn yield from the underlying lending activity, i.e. borrowers making interest payments. You'll earn accordingly as long as you're deposited into a Vault, and you can withdraw your funds whenever you want.

Using Morpho Borrow

On the flip side, Borrow is the avenue you can use for borrowing stable assets like USDC, DAI, and WETH on Morpho.

As mentioned earlier, first connect your wallet on the platform, select your preferred chain, and then click the "Borrow" tab. Then you could:

- Create your loan — Choose the lending pool you want to deposit to, then use the interface to input the amount of collateral you want to supply and your desired borrow sum. After you complete the deposit, you'll be charged an ongoing variable interest rate until you close your position.

- Manage your position — Keep an eye on the loan-to-value (LTV) percentage of your position so you can avoid its specified liquidation point, e.g. when the LTV crosses over 86% for some Vaults (though others allow even higher LTVs). Your aim will be to pay down your position so it stays under this point at all times.

- Close out when ready — Pay back the sum you borrowed and the accrued interest, and once that's covered you can withdraw your underlying collateral from the pool page.

And that's all it takes to get started with Morpho!

If you haven't tried the platform before, now's a good time to get your feet wet so you can familiarize yourself with the basics ahead of the upcoming V2 rollouts. These will be must-try DeFi resources once they're live, so get ready.