8 Strategies to Balance Your Crypto Bets

Dear Bankless Nation,

The SEC offensive against crypto has undoubtedly left plenty of investors taking a hard look at the health and resilience of their portfolios.

Today, we offer up some strategies for making sure your crypto bets are diversified.

- Bankless team

8 Ways to Diversify Your Crypto Portfolio

Bankless Writer: Donovan Choy

Crypto is one of the few asset classes where retail investor can net life-changing returns within a very short period of time.

Unfortunately, it’s also the one asset class that is subject to so much regulatory FUD. The recent SEC crackdown on the industry showcases that. This lack of predictability means crypto investors should not consider themselves exempt from balancing their bets.

Here are eight classic Bankless strategies to diversify your crypto portfolio. You're getting the full list because you're a Bankless Citizen 🫡

♦ Follow along with Asymetrix Protocol ♦

#1 Liquid staking tokens 💧

It’s hard to go wrong with liquid staking tokens AKA liquid staking derivatives (LSDs). LSDs are a user-friendly way for crypto investors to participate in securing the underlying L1 blockchain and earn rewards without going through the technical process of setting up a node.

For years, many feared that staking ETH on the Beacon chain was risky as developers had not yet enabled ETH withdrawals. This changed with the Shapella network upgrade in April 2023 where withdrawals were successfully enabled.

Right now, you can stake ETH on liquid staking protocols like Rocket Pool for APY rewards of 6.86%, or Lido for 4.2%. Alternatively, you can invest in an ETF-like index token composed of a range of liquid staking tokens. Popular options include the Gitcoin Staked ETH Index (gtcETH) or the Diversified Staked Ethereum Index (dsETH).

#2 Stablecoin diversification 🪙

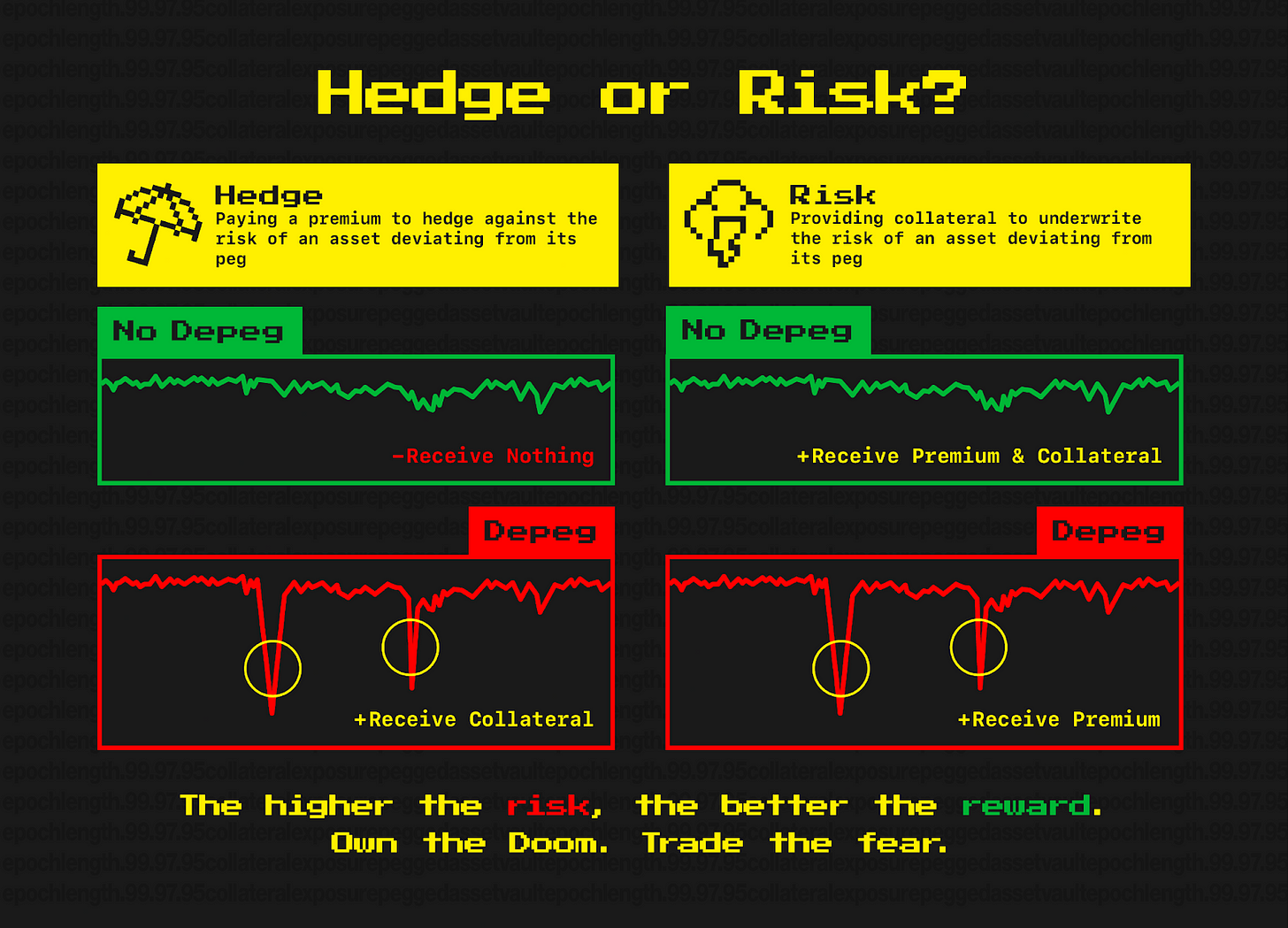

Most crypto investors keep a portion of their portfolio in stablecoins. It turns out that stablecoins may not always be so stable which means protecting against a depeg is another strategy to consider in the investor toolbox.

Holding different stablecoins between USDC, USDT and DAI is the first thing to consider. Alternatively, you can opt for a protocol like Y2K finance that lets you buy a kind of “insurance” against a potential depeg. Should an eventual stablecoin depeg occur, investors are paid a set sum of collateral from underwriters betting against a depeg.

See Bankless’ previous article on How to Protect Against Stablecoin Blowups with Y2K Finance.

#3 Diversify your wallet custody 🔑

“Not your keys, not your crypto” is an industry mantra that any crypto investor should pay heed to.

If you have to keep your crypto on a centralized custodian, use many centralized custodians. Should you own your crypto on an offline, cold wallet, it doesn’t hurt to diversify among more than one set of crypto wallets, especially after the Ledger wallet drama last month reminded us that even hardware cold wallets are never 100% safe.

Putting all of your eggs in one basket is always a recipe for disaster.

Alternatively, investors can opt for a multisig smart-contract wallet like Gnosis Safe. Safe distributes the ownership of the crypto wallet by splitting up the private key into different pieces, kind of like what Voldemort did with his soul. Without every private key signing off on a transaction, the funds in the multisig wallet cannot be moved.

See Bankless’ previous article on How to Evaluate the Safety of Your Crypto Wallet Custody.

#4 Hedge your exposure with DeFi options ⚖️

The volatility of crypto markets makes hedging your portfolio exposure a good strategy. Thanks to a variety of DeFi options protocols, you can do just that.

Options let investors speculate on the future direction of market prices. Investors can lock in a right (not obligation) to buy or sell an asset at a predetermined price. For example, if you believe the price of ETH will rise, you can purchase a “call” option that lets you buy ETH at current prices in the future. Vice versa, if you believe ETH prices will fall, you can purchase a “put” option to sell ETH at a future date.

In short, options is a hedging device that investors can use to reduce overall risk in their portfolio. You can experiment with on-chain options for BTC and ETH on protocols like Lyra Finance ($29M TVL), Hegic ($8.2M TVL) or Whiteheart ($2.6M TVL).

See Bankless’ previous Ultimate Guide to DeFi Options.

#5 Buy BTC and ETH 👑

If there’s something ostensibly missing in both the recent SEC lawsuits against Coinbase and Binance, it’s the majors: BTC and ETH.

Why have BTC and ETH been excluded? Well, trying to understand the SEC’s motivations is anybody’s guess. While Gensler has been non-committal on the topic of ETH's security status in recent months, he has appeared more willing to signal that Bitcoin is likely not a security.

Then again, perhaps the reason is that regulators actually know something about decentralization, and understand that both the Bitcoin and Ethereum networks have thousands of validators securing the blockchain, unlike many of the alt-L1 chains that sprouted up in the past bull cycle.

In any case, Bitcoin and Ethereum have attained the hardened reputations of market-tested, decentralized cryptocurrencies. They are likely the lowest risk cryptocurrency bets one can take. For these reasons alone, keeping a stash of them unstaked in a cold wallet should probably be part of every crypto investor’s portfolio.

#6 Diversify with NFTs 🖼️

NFT markets have not always historically moved in tandem with the broader crypto market, making it a potential alternative to diversifying your crypto portfolio.

Despite a depressed bear market, developers in the NFT sector have continued to build out financial infrastructure around NFTs, the subsector known as NFT-Fi (NFT Finance), which lets investors leverage their NFTs as collateral for taking a loan. Protocols like NFTFi, Arcade, and more recently Blur, let you unlock dead capital on your NFTs which can then be put to other more productive purposes.

There are also NFT options protocols like NiftyOption which lets investors hedge their exposure to their volatile overpriced JPEGs.

The basic idea of how it works is this: NFT holders worrying of an impending bear market can create an option and offer an incentive to bullish speculators willing to take a countertrade. The options creator locks their NFTs in an escrow contract, and a countertrader will also lock in a set amount of collateral. The options creator can then choose to exercise the option and take the collateral anytime in the next several months if the NFT’s price tanks. If it doesn’t, the creator doesn’t exercise the option at all, and the countertrader earns the incentive.

The web3 ecosystem is an expansive world, full of endless opportunities for those curious enough to explore them! Head over to MetaMask Portfolio to get started, where you can view your assets in one place and discover other features such as Buy, Swap, Bridge, and Stake.

#7 Diversify with stocks 💱

Diversifying your portfolio between different crypto assets is important, and there is no reason why you should not be looking at other markets to get exposure to your crypto bullishness.

While there are only a few bespoke Crypto ETFs and crypto-aligned publicly traded entities stateside, they exist! Some of these entities like Coinbase are especially vulnerable to regulatory whims but offer a way to back your crypto bullishness on public markets.

Your vision of the future that crypto enables may also touch publicly traded tech stocks that aren't strictly involved in crypto today but would benefit from it's ascension. Take some time to study the market, and direct some of your investments into the stock market.

#8 Tame your animal spirits 🐂

Investing is as much an exercise in psychology as it is an understanding of finance.

The ability to tame your emotions is the difference between an investor that knows when to cut their losses, versus one who blindly HODLs a dubious token, praying that it may one day bounce back.

Being a master in investing psychology is all the more important in crypto investing, where massive price swings can occur in the blink of an eye in a market that operates 24/7. Stomaching the anxiety, regret, and disappointment while seeing number go down on a shitcoin you shamelessly shilled last Christmas to your friends and family takes a kind of restrained temperament, and not everyone is cut out for it.

If you’re investing in crypto, you’re taking reasonably calculated risks. Do not enter without an exit plan, and when you have an exit plan, stick to it religiously.

See Bankless’ previous 10 Psychology Hacks for Investing.

Action Steps:

- 📂 Start diversifying your portfolio!

- 🤓 Get educated on the current regulatory climate and fight back!