8 High-Potential Opportunities on Starknet

Dear Bankless Nation,

Plenty of people are still kicking themselves for missing out on the $ARB airdrop, but if you missed it, focus your energy on capturing the next opportunities like those available on Starknet.

In today's newsletter, our analyst team pulls out the 8 most-promising projects on the Starknet network.

- Bankless team

Bankless Writer: Donovan Choy

Starknet is one of the most-hyped tokenless opportunities in crypto right now.

It is one of the “Big Four” Layer-2 rollup chains in the Ethereum ecosystem. StarkWare industries is valued at an impressive $8 billion. As of today, Starknet is still in its Alpha phase; TVL sits at $11.6 million with over 17,000 ETH bridged on-chain. These numbers are a fraction of its major L2 competitors yet developer fervor points to Starknet as a promising network opportunity.

Unlike Arbitrum and Optimism, Starknet’s unique competitive advantage lies in its zero-knowledge STARK technology which promises to scale blockchains well beyond the capabilities of its optimistic rollup counterparts. For a fuller guide to Starknet, see The Bankless Guide to Starknet.

Today, we spotlight eight promising Starknet projects. The first two are available for all, but our Bankless premium subscribers have access to everything.

1. zkLend

- Website | Twitter | Whitepaper

- Sector: Lending/Borrowing

- TVL: $864K

What is it? Every chain needs a money market protocol and Starknet’s leading choice today is zkLend. zkLend does not try to reinvent the money market design that Aave and Compound pioneered. Its unique proposition is a bet on Starknet’s success, by being the first to provide an isolated pool trading market for the many to-be-airdropped Starknet-native tokens such as the L2’s own STRK token.

zkLend’s primary product is Artemis, a permissionless DeFi protocol. They are also angling for TradFi’s entry into DeFi with its to-be-released KYC service Apollo, built for market makers, VCs and hedge funds with compliance needs.

How to interact? zkLend is open to use today. Connect your Argent X or Braavos wallet and begin providing liquidity on the protocol. Borrowing and lending assets or locking in liquidity for an extended period will likely increase your chances of acquiring its future ZEND token.

2. Realms Eternum

- Website | Twitter | Whitepaper

- Sector: GameFi

- Status: Under development

What is it? Perhaps the most prominent game in the Starknet ecosystem is Eternum, a strategy RPG game that is being built on top of the Loot intellectual property by Dom Hoffman. The project is led by the core developer team and community at Bibliotheca DAO.

Eternum is designed to be fully-onchain, which means the entirety of the game's assets, rules and state exist on the Starknet chain, not a centralized server or backend.

Eternum’s strategic advantage lies in its design environment, namely Starknet’s zero-knowledge-friendly modules. The team once tested its beta on Arbitrum but migrated to Starknet in favor of its ZK virtual machines that compress computation and generate proofs faster and more efficiently than the EVM, easing the higher transaction burden that games require. Starknet’s native account abstraction also introduces programmable smart contract logic into user crypto wallets, greatly improving the UX of the now rather un-user-friendly Web3 gaming experience.

How to interact? A production version of Eternum is not yet available. However, since the game’s lore is based on Dom Hoffman’s Loot NFT collection, fans can already purchase various in-game items in the form of ERC-721 tokens on open marketplaces like Opensea and Looksrare, as well as map assets (called Realms) released by the dev team. Staking these assets in Bibliotheca DAO’s contracts can also earn LORDS token emissions, the utility token of the Realmsverse.

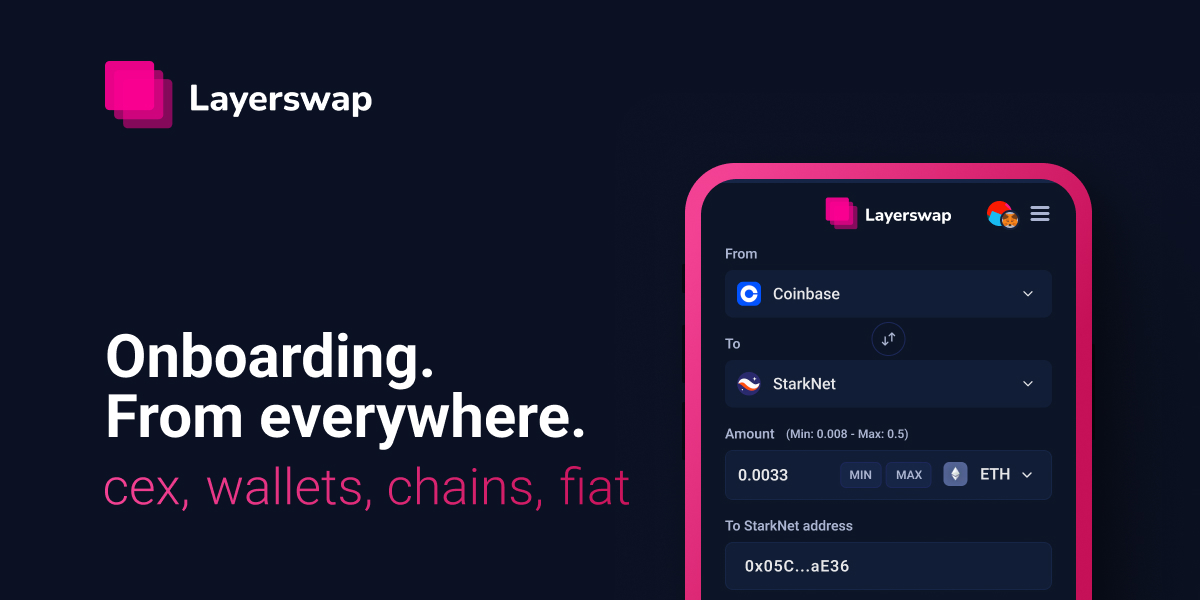

3. Layerswap

- Website | Twitter | Whitepaper

- Sector: Bridging

- Status: Mainnet

...

What is it? Layerswap is the first crypto bridging solution that lets users transfer from centralized exchanges like Coinbase and Binance to L1 and L2 blockchains. At present, the protocol supports transfers between 17 major centralized exchanges and 13 blockchains.

Layerswap lets centralized exchanges and the average crypto newbie onboard into Web3 easily. In the opposite direction, it also allows Web3 projects to deposit funds onto a centralized exchange. Both circumvent the days-long process that it usually takes to make deposits into a CEX.

How to interact? Airdrop farmers will want to use Layerswap to bridge into the Starknet L2 ecosystem. This will improve chances of an airdrop with Layerswap and Starknet’s eventual token drops.

4. Briq

- Website | Twitter | Whitepaper

- Sector: GameFi

- Status: Alpha phase

What is it? Briq is a gamified NFT construction builder that aims to make the foundational building blocks of the Metaverse accessible to everyone. Think of it as a Minecraft, except its intellectual property is open-source and on the blockchain.

On Briq, users can build their own “meta-NFTs” sets in the form of Lego-like blocks, then transfer it to someone else, who can disassemble it into smaller NFT blocks in the form of ERC-1155 tokens and modify them to their own liking. This is in contrast to the non-interoperable NFTs of today that cannot be broken down since they exist as monolithic ERC-721 tokens.

How to interact? Simply head over to Briq’s website, connect your Argent wallet and begin building.

5. JediSwap

- Website | Twitter | Whitepaper

- Sector: DEX

- TVL: $5M+

What is it? Led by the Mesh community, JediSwap is the leading automated market maker (AMM) decentralized exchange (DEX) on Starknet today. Its V2 version in Q3 2023 is set to introduce Uniswap’s signature concentrated liquidity features to enable lower slippage and efficient capital provision for traders.

How to interact? Make a swap, or provide liquidity! At present, there are zero gas fees and a swap fee of 0.3%. Voluntary contributors to JediSwap’s “guilds” are also rewarded with NFTs that will likely improve chances of a future JEDI airdrop. Historically, users of JediSwap could also earn NFTs that were launched in partnership with Argent X, Starknet’s leading wallet. Keep your eyes peeled for updates on Argent’s Twitter.

6. Hashstack

- Website | Twitter | Whitepaper

- Sector: Lending/Borrowing

- Status: Testnet

What is it? Hashstack is a money market protocol on Starknet focusing on undercollateralized loans. Retail users can borrow up to 328% of their collateral, above the market average of most DeFi money markets. The catch? It is not a permissionless protocol, and users have to be allowlisted for now.

By being able to borrow far more than the initial collateral, experienced traders can take on more risk in a variety of trading techniques such as maximizing the depth of a short, or paying off a separate loan on a different protocol.

How to interact? Airdrop farmers will want to supply liquidity and borrow from one of the supported assets on Hashstack. Also check out a list of miscellaneous contributor activities that will likely improve the chances of qualifying for an airdrop.

7. AVNU

- Website | Twitter | Whitepaper

- Sector: DEX aggregator

- Status: Testnet

What is it? AVNU is the 1inch-equivalent of a DEX aggregator on Starknet. At present, there are a variety of active DEXes on Starknet: JediSwap, 10KSwap, MySwap and SithSwap. Rather than fishing for the best trades within a single DEX, AVNU merges fragmented liquidity across different AMM liquidity sources and enables trading with better execution and less slippage.

How to interact? AVNU is still currently not live on mainnet, but you can use it on testnet now. Get started by making a trade across one of its aggregated DEXs. As the leading DEX aggregator on Starknet, usage of the protocol will highly likely be tied to future airdrops with the STRK token.

8. Influence

- Website | Twitter | Whitepaper

- Sector: GameFi

- Status: Under development

What is it? Influence is another prominent game building on Starknet. Taking inspiration from Eve Online, the game is a space-themed strategy MMO that, like Eternum, is also designed to be fully on-chain. The game’s assets and tokens include its in-game currency SWAY and “asteroids” which are the land players can own and play on. Players can manufacture, mine and refine raw materials from asteroids that then can be used to build ships and buildings in-game.

Like many games on Starknet, Influence’s choice of chain points to its belief in the technological superiority of zk-STARKs to deliver the necessary transaction throughput that is needed for transaction-heavy applications like a strategy game.

How to interact? Influence is still under development with a launch slated for the end of summer 2023. Players wanting to get started now can access its beta version with limited playability. Influence’s dev team is planning to launch events and quests where players can qualify to earn the game’s token SWAY.

Action steps

- 🚁 Interact with the above protocols and earn a potential airdrop

- 🏴 Check out The Bankless Guide to Starknet