7 Mental Health Tips for This Bear Market

Dear Bankless Nation,

Bear markets can be a bummer.

Unless you’re a crypto mega whale hoovering up capitulation plankton, chances are number go down for a while.

And even if you’re a grizzled crypto vet who’s seen it all before, challenging times are in store.

If it’s your first cycle, you’re gonna learn a lot about yourself during this period.

We’re here to help make sure they’re good things.

Bankless Editor Jem Khawaja is a bonafide bear market stoic.

He claims to have never sold a single ETH. 😱

Here are some things he learned the hard way…

— Bankless

7 Mental Health Tips for This Bear Market

This article is for those who intend to HODL out the crypto winter.

No amount of worrying, stressing, panicking, moping, or anxiety is going to make a single iota of difference to the price of crypto.

The good news is that you can turn all that inefficient inwards energy into positive outwards build energy that may actually impact the future of the world.

It all starts with maintaining your mental health. Here are a few easy ways to making that happen, even when the market looks like a bad day in Mordor.

#1: Stop looking at the charts every five minutes.

This is absolutely first and foremost the most important thing you can do to keep your head screwed on straight over a long bear market: stop compulsively checking the charts.

Just as it’s easy to get obsessed with checking charts when the market is going parabolic — I’m rich, mom! — for a quick hit of dopamine, it’s easy to get obsessed doomchecking your holdings as they slowly (and sometimes quickly) dwindle: “I’ve f*cked everything up!”

That’s like giving yourself a zap of bad news on a frequent and consistent basis over the course of months. Are you a research rat in a pavlovian depression study?

No, anon. You deserve more than that. You’re a human being.

Either turn notifications off, or change them so you’re only updated when big swings occur.

#2: Zoom out.

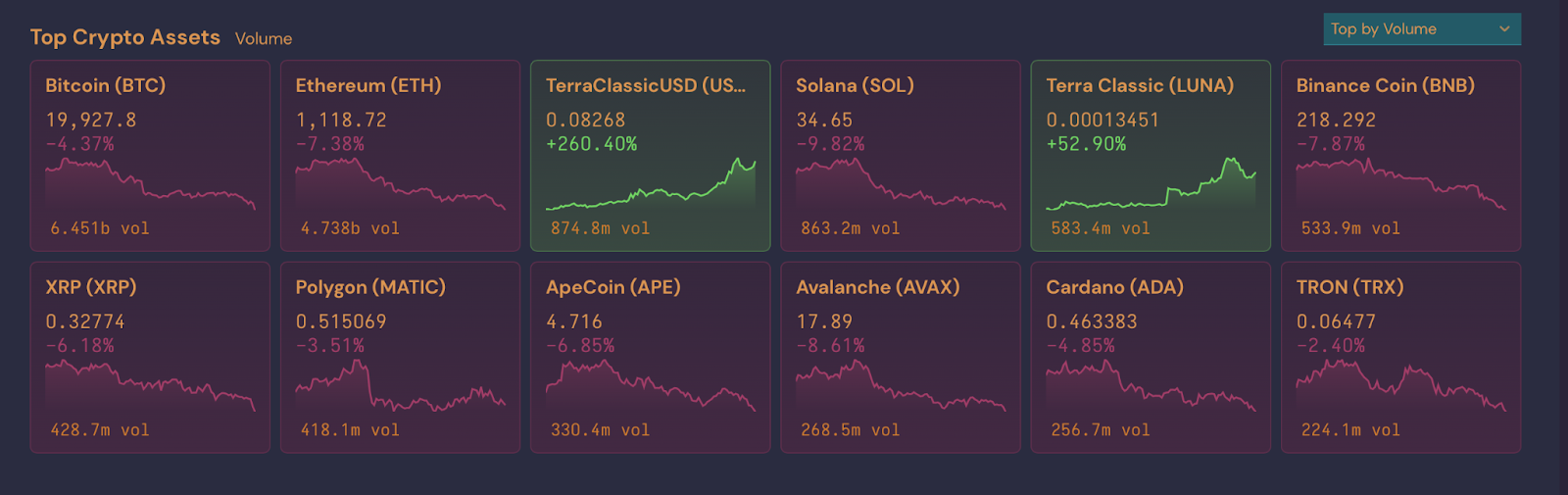

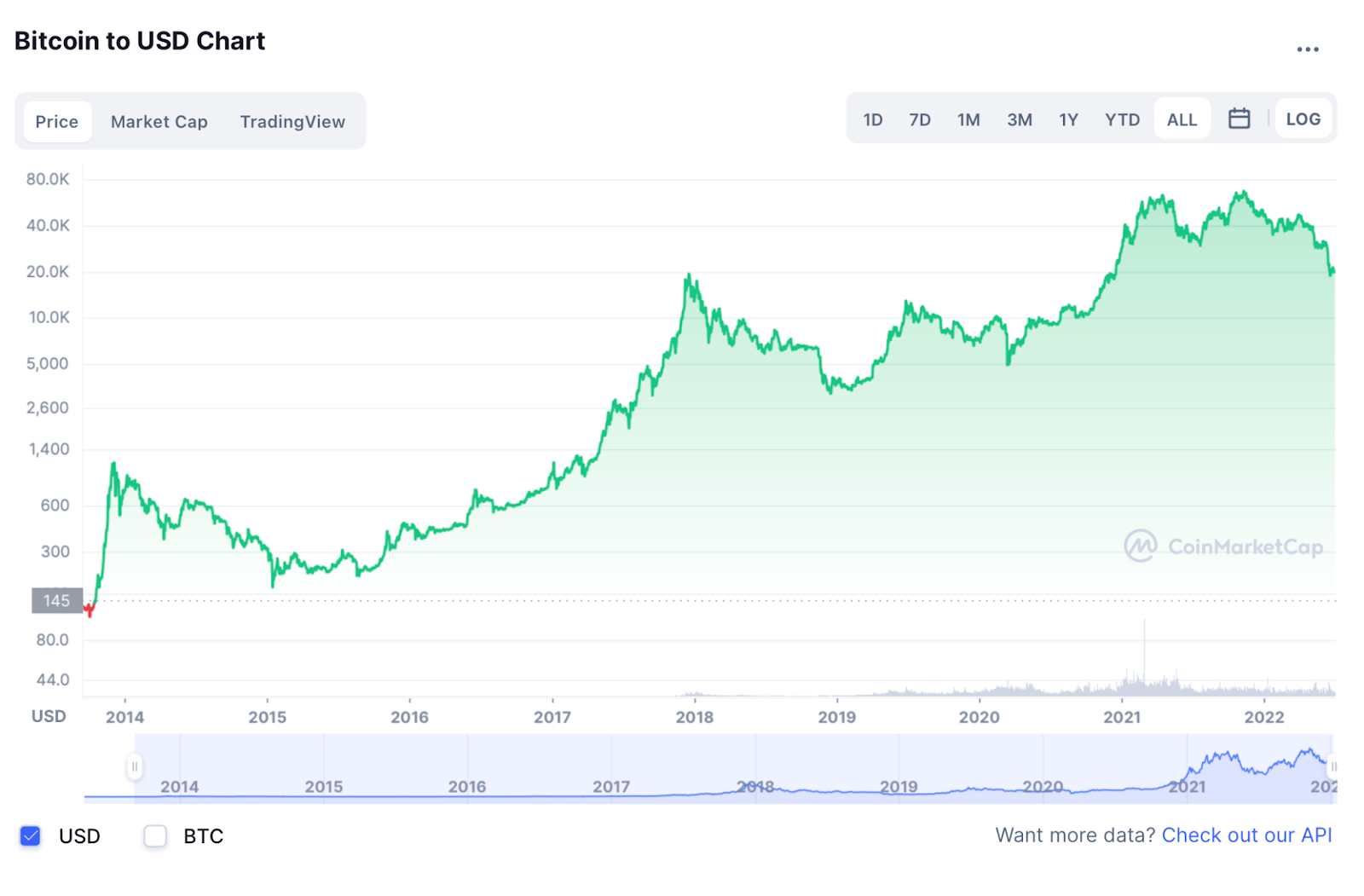

Look at this.

Now look at this.

Now let’s play a game. Pick a starting point on any of these charts. Any point: peak, trough, whatever. Note the number.

Move forward three years. Is the number up? Yes it is.

It is up a LOT? Yes it is.

Yay! You win.

It’s not matter of “if,” but “when.”

#3: Be Loss Aversion Averse.

So there’s this thing, a proven psychological concept called loss aversion, derived from the study of subjective probability.

“The response to losses is stronger than the response to corresponding gains”

It basically says that humans tend to exhibit an irrational economic behavior of seeing losses as worse than corresponding gains.

In fact, a study in the Journal of Risk and Uncertainty (yes, that is a real thing) found that loss aversion means that losing money can be twice as effective on your psyche than gaining an equivalent amount.

This is some deep monkey brain, instinctive behavior that seems to be hard coded into a lot of us. It’s not efficient in this modern world. The truth is that when it’s good, it’s better than you think it is, and when it’s bad, its never as bad as you think it is.

Some of you svengalis will be able to identify loss aversion and switch it off, others of us will have a tougher time disbelieving our own instincts.

A good way to start is: Don’t base your entire happiness and self-worth over a number on a screen.

Or here’s another workaround: just value your portfolio in ETH.

If you hold, that number can only ever go up.

#4: Divorce your bags

There are a few different reasons we invest in crypto.

Sometimes it’s because we believe deeply in an emerging tech.

Sometimes it’s because we saw some degen tweet some hype, got sucked into a pump, and forgot to sell before it was too late.

Here’s a list of hype tokens from 2017 that you’ve probably forgotten about: OMG, ICON, MIOTA, TENX, NEM, NXT, DRGN, DASH, WNGS, REQ, AION, XCP, POE, BCC.

This list goes on.

And on.

A lot of these tokens dropped 95% and were never heard from again. Some of them ended up being straight up scams.

You might be married to your bags, but your bags are not married to you. Whittle your holdings down to the tokens you believe in to be durable long-term, and chill on the hail marys for a few months.

#5: Actively fight burnout.

Burnout is really about the lack of two elements: balance and reward.

I know we talk about bear markets as build markets, but unless you’re a developer or deep in crypto, chances are you’re not seeing a lot of that building happening. If your primary metric or KPI for crypto is price, then your reward synapses will not be reinforced for a long time, and your brain will go sad bad.

There are plenty of other ways to find reward in crypto: learn new things, join a DAO, engage with new Web3 products, be early on a new tech, make human connections, catch an airdrop, contribute in your own way, get a job in crypto, meet Web3 people in the meatverse.

Let's talk about balance. Holding during a bear market is 65% boredom, 25% sheer panic, and 10% futile, wide eyed optimism. Rinsed and repeated over the course of a couple years, that is a deeply imbalanced existence — particularly if crypto has taken over your life.

If crypto has become the main thing in your life, it’s probably wise to find a little balance from elsewhere: family, friends, hobbies, or, uh, y’know: experiencing life and not a digital facsimile of it.

Literally anything will do so long as it’s mostly legal.

It’s summertime. Go outside. Stroke a hedgehog. They’re adorable! 🦔.

#6: Address your own macro.

Just as the crypto market is beholden to the larger macro-economy, your own mental health in regards to crypto is beholden to your own macro psychology.

Let’s say you’re maybe kind of a mess. Imagine for a second that ETH hit $20k and you sold it all. You’d still probably be a mess, albeit a wealthier one.

For example: If you have an addictive personality, chances are you look at the opportunity of trading in a bear market like a dog staring at a Slim Jim. Just one quick flip of a hot small cap, right?

Bad degen! That’s a mega-fast way to bankrupt yourself, bear or bull market.

Ultimately, crypto isn’t really the problem here. It’s the underlying psychology. You can extrapolate this notion to accommodate any number of psychological quirks: depression, anxiety, OCD, anger, etc.

If your relationship with crypto is a vessel for a deeper issue, you ultimately have to address that issue to get anywhere. So address your macro, and then re-address your relationship to the crypto market with a clear(er) head.

#7: Don’t check out, lean in.

If you got into the crypto game for quick riches, I have some bad news for you…You did it wrong. So let’s talk ‘get rich slow’ schemes instead.

There will be many moments where you’re tempted to give up on crypto and Web3, promising yourself that you’ll check back in when things are hot.

The problem is, by the time people figure out things are hot, they’ve missed all the opportunities for generational wealth. The standout projects of the next bull run will launch in the deepest depths of this bear.

So instead of checking out, commit to leveling up your knowledge and involvement. Find a way to bring your own skills to the table. Reassert your goals. Audit your information sources: Are you sure Bitboy is a good use of your time? Is your version of Crypto Twitter more about moonshots and drama than substantive discourse? Mix it up!

Most importantly: Make sure you’re tuned in when the opportunities appear. It won’t require rocket science, just a clear head and a keen eye. With your mental health accommodated, you have a better chance at operating with both in play.

Conclusion

In prior bear cycles, there was the looming, existential threat that blockchain technology was vaporware and may actually recede to nothing with absolutely no notice and we would all be broke forever.

This time, there is literally 0% chance that this technology is going to fizzle away. Everyone knows that it works. it’s just about scaling and developing, all of which is happening at a rapid pace.

Anon, we live in uncertain times.

Actually, they’re all uncertain times.

But if everything was static, there would be no opportunity.

Action steps

- 🐻 Read how How to Survive a Crypto Bear Market

- 📼 Watch Vance Spencer’s ‘The Bear Market Gift’ episode of the pod