6 Levels of Wealth with Nick Maggiulli | Author of The Wealth Ladder

Nick:

[0:00] If you want to go past 10 million, aka level five, you have to completely change your strategy. Unlike everything so far in the wealth ladder, like going from level three to level four is usually just like having a higher paying job and just being able to save more and invest well. And, you know, you just give it time. And that's a lot of it too. Like time's a piece of it. The difference between, you know, level four and level five is not just time.

Ryan:

[0:24] Welcome to Bankless. This is Ryan Sean Adams. Just me today. You guys know crypto is a technology for both generating and for storing wealth. The question is, what is wealth? Every once in a while, I like to do an episode on wealth just to set the foundation. Because just like crypto, wealth can be a freedom technology. And if it's used well, that's exactly what it is. It can also be a trap. Sahil Bloom reinforced this idea for me in his book, The Five Types of Wealth. We did an episode on that. It's a great conversation. We'll include a link in the show notes for you. Now this episode with Nick Majuli, our guest, swings the focus back towards one type of wealth, net worth. So picture a ladder. You start with nothing. Then as you climb each rung of the ladder, your strategy needs to change in order to get to the next level. You hit 10K and then you hit 100K in net worth, then a million and then 10 million and beyond. How do you climb each rung of this wealth ladder? What strategies do you need to achieve deca-millionaire status? Also, everyone assumes they want $10 million in net worth, but is it worth it? These are all topics we discuss in today's episode. Again, to round out this conversation, I do encourage you to listen to the episode we did with Sahil on the five types of wealth, because I don't want you guys getting stuck on a wealth treadmill to nowhere. But if you do want to climb, I think this episode will help. We'll get right to the episode. But before we do, I want to thank the sponsors that made this possible.

ADs:

[1:53] In the wild west of DeFi, stability and innovation are everything, which is why you should check out Frax Finance, the protocol revolutionizing stablecoins, DeFi, and Rolex. The core of Frax Finance is Frax USD, which is backed by BlackRock's institutional biddle fund.

ADs:

[2:06] Frax designed Frax USD for best-in-class yields across DeFi, T-bills, and carry trade returns all in one. Just head to Frax.com, then stake it to earn some of the best yields in DeFi. Want even more? Bridge your FraxUSD over to the Fraxtile Layer 2 for the same yield plus Fraxtile points and explore Fraxtile's diverse Layer 2 ecosystem with protocols like Curve, Convex, and more, all rewarding early adopters. Frax isn't just a protocol, it's a digital nation powered by the FXS token and governed by its global community. Acquire FXS through Frax.com or your go-to DEX, stake it, and help shape Frax Nation's future. Ready to join the forefront of DeFi? Visit frax.com now to start earning with frax usd and staked frax usd and for bankless listeners you can use frax.com slash r slash bankless when bridging to fraxel for exclusive fraxel perks and boosted rewards imagine a world where traditional finance meets the power of blockchain seamlessly that's what mantle is pioneering with blockchain for banking a revolutionary new category at the intersection of tradfi and web3 at the heart is you are the world's first money app built fully on chain it gives you a swiss iban account blending fiat currencies like the euro the Swiss franc, the United States dollar, or the renminbi with crypto all in one place. Enjoy real-world usability and blockchain's trust and programmability. Transactions post directly to the blockchain, compatible with TradFi Rails, and packed with integrated DeFi futures. UR transforms Mantle Network into the ultimate platform for on-chain financial services, unifying payments, trading, and assets like the MI4, the METH protocol, and Functions FBTC.

ADs:

[3:35] Backed by developer grants, ecosystem incentives, and top distribution through the UR app, reward stations, and Bybit launch pool. For MNT holders, every economic activity in UR drives value back to you, embodying the entire stack and future growth of this super app ecosystem. Follow Mantle on X at mantle underscore official for the latest updates on blockchain for banking. That's x.com slash mantle underscore official.

Ryan:

[3:57] Bankless Nation, very excited to introduce you to Nick Majuli. He is the author of Just Keep Buying, and he is part of a wealth management company as well. And he's got a soon-to-be-released book called The Wealth Ladder coming out. We're going to learn from him about The Wealth Ladder today. Nick, how are you doing?

Nick:

[4:13] Good. Thanks for having me on, Ryan.

Ryan:

[4:15] This is actually from a blog post that I was telling you off-air that I read in 2019, and it led to an impression on me. This is really an opportunity to dive into the mental model of The Wealth Ladder, which I think is really important for bankless listeners to get inside of their heads. It's incredibly useful as they're going through this path of kind of building wealth in their own life. Let me just start with a question though. How did you learn personal finance and like wealth management in general?

Nick:

[4:40] I just spend a lot of time reading books, reading blog posts, and just, I was very curious about it. And so I would just read a lot on it, crunched a lot of data on it, and started writing about it. I think actually writing about it helped me more than anything, because that's when I really discovered like, oh, here's my opinion on this. Is that correct? And like, you know, you have to go through that process a lot and find research and do all that. And it's a lot easier now with AI to help with like finding data sets and things like that. But still, it's it's been a journey.

Ryan:

[5:08] Do you think that's how people should learn it? Basically, I'll learn by doing mentality because it strikes me that there's only so much you can get out of, you know, maybe a class you take on wealth management, like investing wealth management really feels like it's something that has to be practiced. And also, you have to learn through your mistakes over the years.

Nick:

[5:27] Yeah, exactly. You have to, I mean, with investing in particular, I mean, The good thing is we've had kind of some of these markets, you know, we had 2020, we had 2022, these markets that were kind of down years. And so seeing how you reacted during those periods is going to be very helpful for how you might react in the future, etc.

Ryan:

[5:43] This is why I actually think that, you know, we have a crypto audience here, too. So I actually think that, you know, crypto offers a rare opportunity for these lessons to come at you at about like three to five X speed versus the normal market, because there's such insane volatility.

Ryan:

[5:57] And you can make mistakes very quickly within the crypto asset class, that's for sure. Let's talk about the Wealth Ladder concept. I wanna maybe split this conversation into two pieces. So this is a really simple mental model for understanding personal finance. We've actually got it on the screen. And I want you to help describe, to unlock this mental model for the bankless audience. And then we can talk a little bit more about what we can actually do with this mental model once we have it unlocked. but maybe you could take us from the top. What is the wealth ladder? What are we looking at right now?

Nick:

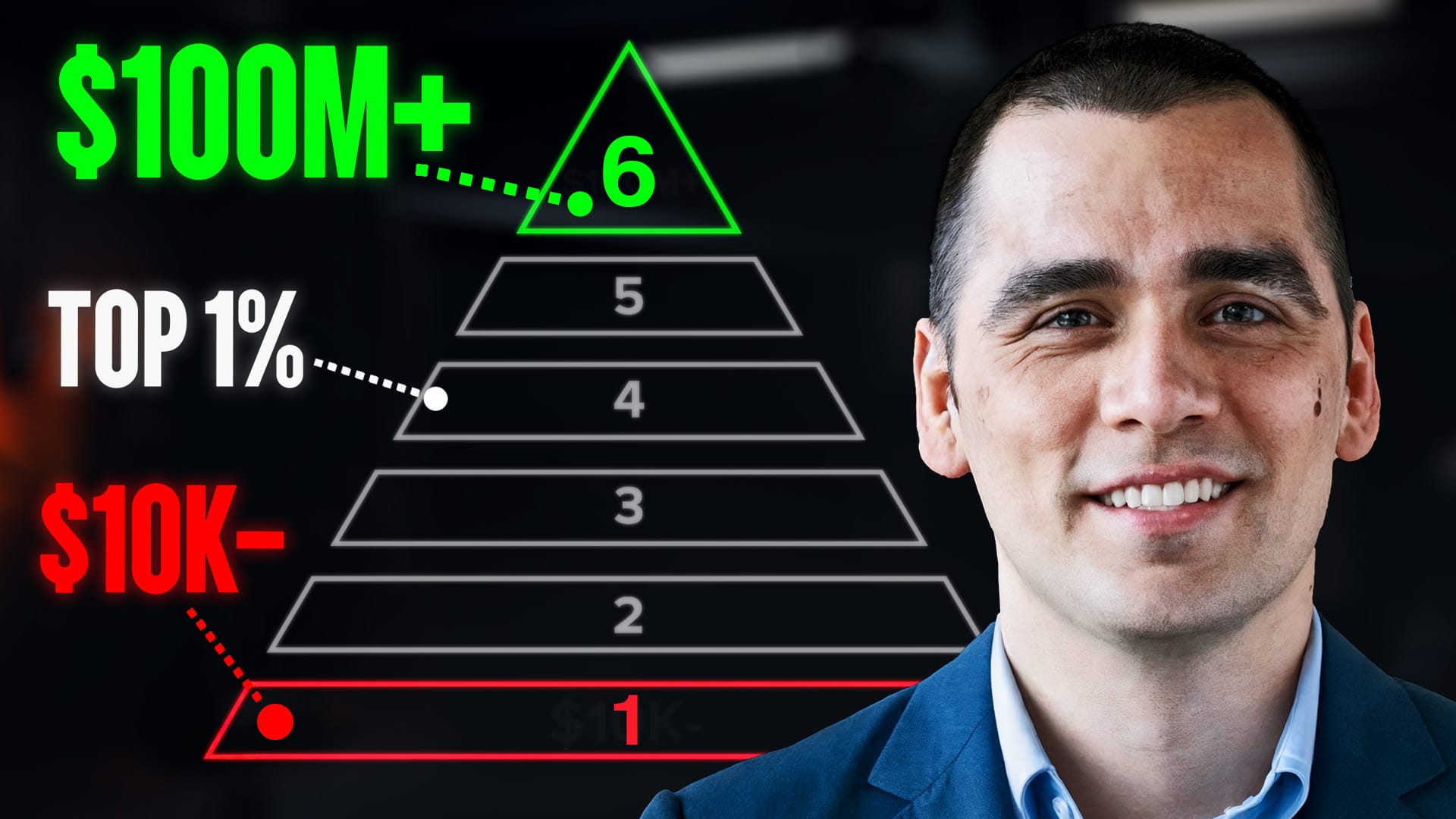

[6:31] So the wealth ladder is this idea that your financial strategy should change over time. That's the overarching message. But within that, there's six distinct wealth levels, which are based on your net worth. So that's all your assets minus all your liabilities. You can think of everything you own, cash, crypto, cars, stock, money in your bank account, minus any mortgage debt, credit card debt, student loans, et cetera. And so you net those out and hopefully you have a large positive number, right? That's the net worth. And once you have your net worth, you're in one of the six wealth levels. And level one is less than $10,000 in wealth. Level two is $10,000 to $100,000. Level three is $100,000 to a million dollars. Level four is $1 million to $10 million.

Nick:

[7:17] Level five is $10 million to $100 million. And level six is over $100 million. The nice thing about this wealth level framework is that you just have to memorize one of the levels and you can just back out the rest by either dividing by 10 or multiplying by 10. So I say, I always say memorize level three, which is a hundred thousand to a million dollars, because that's the middle class in the United States, about 40% of us households are in that wealth level across the entire us. And so if you just remember, Hey, that's level three, then you can say, okay, two should level two divide by 10. So it's 10,000 to a hundred thousand. And then level four is 1 million to 10 million. So from that, you kind of have an idea of, Hey, these are different wealth levels. These represent generally pretty large lifestyle changes. And they also represent kind of different economic classes in America. 20% of households are in level one, 20% roughly are in level two. As I just said, there's 40% in level three. You have about 18% of households in level four. That's been a big change over recent years. So there's more millionaires than ever. And then the top 2% are in level five and six. And most of that's going to be in level five. There's only like 11,000 households in level six in the United States, which is over $100 million, an extreme amount of wealth.

Ryan:

[8:25] Okay. So we have, you know, 10K, maybe that's just starting up as just starting out. Then we have a hundred thousand, which is a threshold that's stage two. And then we have becoming a millionaire essentially, which is kind of a, it feels like a big milestone for a lot of people when it comes to wealth. And then we have becoming a deca millionaire. So that's 10 million above. And then we have centimillionaire. Okay. And it seems to kind of, obviously it thins out as you get to those higher rungs of the ladder. But these are the six rungs of the ladder here. Why are we doing 10X scales here? Why are we going from... 10k to 100k 100k to a million why is this logarithmic

Nick:

[9:03] I think because a lot of the data suggests that these are the the amount of wealth changes you need to see a lifestyle change to see an increase in happiness like there's a lot of data that shows this it's it's not just like happiness increases linearly with wealth but it's like log wealth so for example if someone had zero dollars and you gave them 10 000 they would probably be pretty happy like oh my gosh like i can breathe easy. I don't have stress. If I give $10,000 to someone with a million bucks, I promise you they are not going to have the same elation, right? Even though $10,000 is $10,000, right? But it's just not going to move the needle for much. I bet the person with a million bucks would still be happy and very thankful, but they won't feel the same elation and joy. And oh my gosh, my life feels changed as someone that goes from zero to 10,000. Everyone knows this intrinsically. As you get more money, it becomes less useful and less impactful on your life, right? Going from 4 million to $6 million is less impactful than going from $0 to $1 million. Even though $4 to $6 is a $2 million gain, you're not going to feel that different compared to going from $0 to $1 million.

Nick:

[10:03] And so I think once you start realizing that, you can come up with a framework like this. And that's where the framework kind of was derived from. And in particular, what you're showing here in this visual, I came up with like a spin, because this is like the wealth ladder overall. And then based on the wealth ladder, you can make different spending decisions, income decisions, investment decisions, et cetera. And that's what I cover in the book. But what you're showing here is the spending piece a little bit, which is like, hey, as you move up the wealth ladder, certain spending categories don't matter as much. So by the time you're in level two, you don't have to kind of look at like, what's the price of my eggs at a grocery store? You're like, oh, if I want to get the cage-free eggs, I just get the cage-free eggs, right? By the time you get to like 100,000, you start to go toward a million deeper into level three, you don't really have to look at prices at a restaurant anymore. You're like, oh, I want the salmon for $35 instead of a burger for $25. And by the way, I'm just, I'm quoting like New York prices for the record. That might seem crazy, but that's very normal pricing in New York, 25 bucks for a burger. And then, you know, once you're in level four, which is one to 10 million,

Nick:

[11:03] that's where you can start saying, hey, I'm going to buy a slightly nicer seat on the airplane. Maybe I'm going to get more leg room or emergency exit row or, you know, and then eventually as you get deeper into level four, you can start going, you know, first class and you can stay in nicer hotels, et cetera. And so that's the idea here with this visual is like, as you move through the levels, There's different levels of spending freedom, as I call them. And, I have a mathematical formula that describes this a little bit more. This is just kind of a simplification of that here. And it's going to be in the book in a different way.

Ryan:

[11:32] I like that. And it's very useful to think. So let's just maybe go over this. So if you're at kind of, I guess, stage one is nothing, right? So we're really starting at kind of rung two? Yeah, yeah. Okay. So paycheck to paycheck is really rung one. Rung two is $10,000. And that's when grocery prices start to matter a little bit less. Like you're not feeling as much of that squeeze every time you buy something, price of eggs, as you mentioned, at the grocery store.

Ryan:

[12:00] The next run, $100,000, that's when restaurant prices start to matter less. So you could just say, yeah, go up to a restaurant once a week, a couple times a week, whatever. You're not feeling the impact of that. It's not like a major decision for you. And then you start to get to millionaire status and then vacation prices start to matter a lot less. So if you're $100,000 maybe in terms of net worth, then you have to think very carefully before you travel somewhere outside of the country or what your expenses look like on that side. But millionaires don't worry about that so much. And they get to 10 million and home prices even matter, start to matter less. And they get to sent a millionaire status. And it's like, what are prices? Like nothing, nothing really matters. That's how it scales up and it scales up in a log type way. I'm interested too that you draw this as kind of a step function. Is it really a step function or is there some smoothness to the line here? For example, if I have like, you know, net worth of $90,000, is it really that much different from $100,000?

Nick:

[13:07] No, it's not. So, I mean, of course, this is a step function to create the ladder effect and kind of create the wealth ladder as a visual. But it's not like the moment you go over, you know, $100,000, your life is transformed. Of course, that's not true. I think everyone knows that logically. I think it's just a way of thinking about it in more of a step function. So there's more of a idea of, hey, there is a big change that happens, right, in a certain spot. And I think by doing it by, you know, orders of 10, it's easier to memorize, right? By doing this, you know, log-based. I don't even say the word logarithm in the entire book because I don't, you know, I mean, a lot of this is marketing. Like I, even like when people say, oh, the rungs of the wealth ladder, I say no levels, but there's no levels on the ladder. I'm like, I agree, but the word rung just doesn't sound as good. And people don't realize that, right? And my first book was called Dollar Cost Averaging. It wouldn't have sold as well as when it's called Just Keep Buying, right? It's like people don't realize that. And I'm not trying to hate on anyone who says rung. That's fine. if you want to call it that. But I say levels only because people say, yeah, I'm in level three, I'm in level four. It sounds weird when you just say rung one and rung two or whatever.

Nick:

[14:08] Going back to the point here on the pricing, like the whole idea behind this, and there is like a logic, it's, you know, what is the amount of money you could spend that's trivial? Like what's a trivial amount of money? And so where I actually got this from, Jay-Z had this lyric, I'm not going to repeat the exact lyric, I'm just going to kind of paraphrase, but he says like, what's 50 grand to someone like me? Can you please remind me? You probably all heard the song before, right? And so basically at the time, his net worth was around 450 million. So let's just say 500 million, you know, to be safe. 50 grand to him was 0.01% of his net worth. It was one 10,000th of his net worth. So I came up with this rule called the 0.01% rule. So if you take your net worth, you divide by 10,000, and that's how much money you can spend like trivially. It's like it's a small amount of money for you. And if you actually, and there's actually an assumption I've used to go beyond this, which is like, let's just assume very conservatively that your wealth is generating 0.01% per day. If.

Ryan:

[15:07] You do that

Nick:

[15:07] 365 days a year, that's about 3.7% per year. That is a conservative return. I don't think anyone's going to... Yeah, everyone's like treasuries. That's basically what it is. It's like, let's just assume no matter what, your wealth's going to produce that, right?

Nick:

[15:20] So if we assume that's true, then on average, you can spend 0.01% of your wealth every single day and your wealth would stay stagnant, right? All else equal, right? Assuming you have no other spending or anything else. So I like using that 0.01% as like your marginal spend. Obviously, you have income coming in, you have spending and all that, but it's that marginal decision that matters. It's not every, no one is, no one is like in level two and is like, should I get a Maserati? No, it's like you're in level two and you're like, do I get a Toyota Camry or a Toyota Corolla, right? You're making these marginal decisions, right? You're at the grocery store and you're like, do I get the cage free eggs or the standard eggs, you know, et cetera. And so we're all making marginal decisions based on kind of our income and our wealth and all these things. And so I'm saying, let's use wealth, because I think it's a better proxy. And it also allows for lifestyle creep. I think that's the big problem that no one's been able to solve in personal finance is like, people want to have some lifestyle creep, but they don't want to go overboard. So what's a good way of balancing that? And I think this is a good balance. It's like, hey, once I'm in level two, now I can kind of have some lifestyle creep at the grocery store. Once I'm in level three, I can start to creep at restaurants, etc. And that's kind of the thinking behind all of this is to allow for this kind of a little bit of spending freedom, but only after you built the wealth. So it's like, hey, you've shown financial discipline. Now you get to have that freedom to spend more. I think it's better to do that than just be like, oh, well, you got a raise of 50 grand. So now you can spend 50 grand more. I don't think that's the way to do it or even saying, oh, you can't spend anything.

Nick:

[16:46] And so I'm trying to find this balance. I think wealth is the way to do that, not income.

Ryan:

[16:50] So that is the 0.01% spend rule that you talk about in your book, what you just defined. Can we apply that math in a few places just to see if it mentally checks out?

Nick:

[17:00] Yeah, of course.

Ryan:

[17:01] So, if I'm at level two, 0.1% at level two, which is $10,000. What are you saying here?

Nick:

[17:11] That's $1. So you just divide by 10,000. So if level two is $10,000 to $100,000, that means your marginal spend per day is $1 to $10, depending on where you're in there. If you're a 50,000, it's five bucks a day. Okay.

Ryan:

[17:25] So every $1 feels kind of like a lot to me, right? So I'm like looking at coupons, I'm looking at discounts, that kind of thing at that second rung. Is that right? Yeah.

Nick:

[17:35] Well, so I would say $1 is not a lot to you anymore. If you're below $10,000, I would say it is. But once you get to $10,000, $1 is not a lot. By the time you get to $100,000, $10 isn't a lot, basically. I'm saying that is the amount that I'm considered trivial. If it's above that amount, I mean, of course, we're now cutting hairs here. Is $1 or $1? You know what I'm saying? I'm not trying to get there, but I'm just saying in general. Yeah, there's a rule of thumb. So it's like in general. So for example, if you hit a million dollars in your portfolio, I would say $100 is trivial to you. That's what I would say because you take a million divide by 10,000, that's 100, right? So that's my argument is what take your net worth divide by 10,000. That's the number of daily spend that is trivial to you, right? If you drop to 20. I see. Yeah, daily. And so I'm saying daily on just like this like marginal daily additional spend because obviously like you have rent, you have, you know, food, you have to buy and all that stuff. But it's like, you're making spending decisions on the margin. No one is going out and just redoing their spending every day. It's like you have kind of general spending decisions you've already made based on your income. It's that marginal decision. Oh, can I buy this thing? Can I buy my latte? Well, my argument is, why don't we use this rule and figure that out? That's kind of a better way of doing it.

Ryan:

[18:47] Okay. So going up the ladder gives you essentially some spending freedom for larger and larger purchases, but they're also reined in, right? You don't have to go crazy. You can observe of the 0.01% rule and basically, you know, like, I guess, quantify how big of a spending purchase it is to you individually

Nick:

[19:04] Based on this.

Ryan:

[19:06] Why are we doing wealth instead of income here?

Nick:

[19:09] Because income's fickle. Like, people get raises all the time and then they get laid off. And it's like going to zero is, imagine if you're going out and signing up for things, signing up for subscriptions, all these other things, and then it's like, oh, my income goes to zero. That income's far more variable than wealth is, unfortunately. And yeah, wealth can fluctuate. Obviously, well, it depends how your wealth's invested. If you're invested 100% in crypto, I bet your wealth's a little bit more variable, a little bit more volatile than your income is. I think that's fair. But for most people in the United States, based on their general allocations, wealth is far more stable than income is, right? Because a lot of people own primary residence. They have bonds, they have stocks, they have all these other things that usually, and as volatile as stocks are, over long periods of time, they're not as bad. And so they can go through periods of high volatility, but in general, there's some staying power there. So I think the idea here is income is fickle. You shouldn't spend based on your income. And anyone who spends based on their income, they usually are not in a great position in the long term. Think about an athlete. I'm making $5 million a year. Why can't I spend... After tax, let's say they take on 2.5, why can't I spend $2 million?

Nick:

[20:18] You could. I'm agreeing. You could. You're still saving $500K a year, but, Let's say you get injured in year two. Now you saved a million bucks. That's great. That's better than most Americans are going to do it. But if you can't get another job after that, you're in a tough spot now, right? And well, it's actually gonna be worse because you were spending 2 million a year. So to cut your spending dramatically, you only have half a year of spending saved, you know, by the time you lose your income. So I think income is not the way to do this. I think you have to, you know, the marginal decision is spend on wealth. Of course, income matters. Everyone spends based on income. That's true. But when you're thinking about like, can I splurge? Can I kind of do a little bit more? Do that based on wealth.

Ryan:

[20:55] So this principle kind of in viewing it like this keeps kind of that lifestyle inflation in check, particularly when you're looking at in terms of wealth rather than income. There's another element to this chart that's actually not in here, right? So we've got the different levels of wealth based on these kind of numbers, like net worth numbers. But what about like age, how old someone is? Or what about time as a variable here? Because you have the concept of like sort of when you're in your 20s, you're sort of a time billionaire, a concept because you have billions of seconds left to live. I mean, if it takes until you're, let's say, I don't know, in your late 70s to get to millionaire status, that seems to be kind of a factor in terms of thinking about your wealth ladder and planning your wealth. How does time come in as a variable to this mental model?

Nick:

[21:48] So time definitely impacts wealth accumulation. There's no debate there. If you just look at like the median age in each level, it just goes up over time because it generally takes time to earn money, save money, build a business, et cetera, to build wealth. I think, The the time element is actually very interesting. So I don't think it's as

Nick:

[22:06] strong on the spending side as you might think. For example, let's say I got to level four at age 80. Right now, let's assume I have 10 years left. Of course, that's, you know, who knows how long, you know, what's the actual average. But as an as 80 year old male, you probably don't even have 10 years left according to the actual tables.

Nick:

[22:25] Five a million bucks. I probably have even more spending freedom than someone who's 60 with a million, because I have less time left, so I could spend more in theory. So as much as the person who's 20 years old with a million dollars, if they never work again, they don't have that much vacation freedom. On the flip side, person who's 80 with a million dollars actually has even more vacation freedom because they don't have as much time or they have to support themselves. So it's really about your goals and your liabilities, like who do I have to support? How much money do I want to leave behind? There's a lot more to this, but I think the time element isn't as important in terms of the spending piece, right? If you're younger and you have more, that's great. I think in general, that shouldn't matter as much though. I think that the thing that matters more though is how is your net worth comprised? So on this chart, it says liquid net worth. That is something I bring up. So in general, on the wealth ladder, everything I do is based on overall net worth. But I think when it comes to spending, you have to kind of use liquid net worth because you could be like, I have a home that's worth $300,000 and I have, you know, five grand in my bank account, does that mean I have like really deep restaurant freedom? I would say no. I mean, you know, that you have the net worth to be in level three, but you can't access that equity without a HELOC or something and like, you know, home equity line of credit or something like that. So I would say the conservative thing to do is spend based on your liquid net worth. So take out any sort of home equity and then take out, you can even, if you want to, you can take out retirement accounts. Some people do, some don't. There's debates to be had about that. Because retirement accounts are basically like future wealth.

Ryan:

[23:53] The numbers you implied earlier, it can give us some of the stats again at these different stages. So what percentage of the U.S. population is say 100,000 versus a million versus 10 million versus 100 million again?

Nick:

[24:05] Yeah. So 20% is in level one. That's less than 10,000. These are U.S. Households, by the way. Right. And these are approximated. The exact numbers are in the book. I just want to make it easy to memorize. So 20% are in level two. That's 10,000 to 100,000. Yeah. 40% are in level three. That's 100,000 to a million. That's basically like your middle class in the United States. 18% are in level four. That's 1 million to 10 million. That's what I would call the upper middle class. Obviously, it depends where you live. I think if you have 8 million bucks and you're in a low cost of living area, you're definitely upper class. But in a place like New York, I would say that's upper middle class still. And then 10 million to 100 million, that's going to be like, let's just say 1.9%. And then over 100 million is 0.1%. It's actually much lower than that. But I'd say the top 2% is level five and six.

Ryan:

[24:54] And this is going to skew older as well, right? So like larger quantity of 60 year olds that might be in those upper levels rather than like versus like 20 and 30 year olds, I would imagine.

Nick:

[25:04] Yeah, I can actually have age data in here. So the...

Ryan:

[25:07] Well, I'm trying to think this podcast probably skews towards 20s, late 20s, 30s, some 40s. Apologies to all of our older listeners, but I think that is the bulk of this podcast, let's say so because i think people as they're listing this nick what they're obviously doing is they're thinking through okay what level am i you know and so let's give them a sense for that for their for age

Nick:

[25:31] Adjusted yes yes so this is on page 150 of the book and it has a table which has like on the rows it has your household age right so it says 20 to 29 30 to 39 etc and then it has the levels and it breaks out the percentage in each one so for example let's just go through 20 to 29-year-olds, these are the percentages in each wealth level. Okay. So 20 to 29, level one is about 40%. So it's two times what the actual overall is.

Ryan:

[25:55] Paycheck to paycheck again.

Nick:

[25:56] Yeah, paycheck to paycheck is, that's about 40% of people in their 20s are in level one, right? Okay. About 36% are in level two. Okay. 24% are in level three. That's 100,000 to a million. So that's why we call the middle class in the United States. One percent, only one percent are in level four, which is one million to 10 million. So only one percent of people in their 20s are millionaires.

Ryan:

[26:21] A lot of 20 year olds just breathe a sigh of relief and they're saying, oh, thank God I'm not behind Nick. Yeah.

Nick:

[26:26] And then obviously level five and six, it's less than a percent. I don't even know what it is. And once again, the data there is not as good at figuring this type of stuff out, especially if you're once you slice it to be incredibly young and that there's going to be just not that many people like Mark Zuckerberg was one of those people. Like there's just not a lot in that category. Okay, now we can do the 30s. And for those in their 30s, level one is about 22%. Level two is about 28%. Level three, this is the vast majority at 45%. So that's, you know, 100,000 to a million, middle class once again. And a level four, 1 million to 10 million, that's about 5%. So only about 5% of people, even in their 30s, make it into level four. So I know we like to, you know, the media proclaims, oh, look at all these young, rich millionaires and stuff. those people are very rare, even in their 30s, only one in 20 people in their 30s are in the United States are going to be in level four, right? And then obviously we can go up from there, but the data is broken out, you know? And then even by the time you get to your 60s, you know, in level four, one in four, you know, people in their 60s are in level four. But that's, you had time to save money, build wealth, you know, all that stuff.

Ryan:

[27:32] Is what you just quoted, is all that liquid net worth?

Nick:

[27:35] No, this is overall net worth. This is not liquid. I'm sorry, this is overall net worth.

Ryan:

[27:38] So that includes the house as well.

Nick:

[27:40] Yeah, the house, retirement account, everything, your whole net worth.

Ryan:

[27:43] This implies, of course, that each level gets harder as you go. I mean, there's definitely a thinning out type of effect. I feel like we know the reasons why it gets harder. But there are also some reasons why it could kind of get easier, which is like the eighth wonder of the world, compound returns, of course, where if you have a lot of wealth, it's easier to compound those gains and trade a lot of wealth. But just generally, is that the case that people should expect that each of these levels will get exponentially harder, maybe a 10x harder, maybe not quite that much, but more difficult? It depends.

Nick:

[28:19] I mean, it really depends on where you start, your trajectory, everything. Most people, even let's say you graduate from college, had a degree or something. I would say you're probably not in level one unless you really grew up very poor. Most of you, probably through family and network and stuff, you're kind of in level two, even though your net worth isn't above 10K, but you have intangibles that I would value it around that amount. So I would say like I would say I was never in level one, even though like I didn't grow up with much money. My parents declared bankruptcy twice before I was 18. But because of other family and other people had assets and stuff like I don't think I was ever like ever close to being on the streets or something like that. So it's really remember, it's a gray area. But I think thinking of it in this way is very helpful.

Nick:

[29:00] So in terms of like, well, what's the hardest level to jump in or out of? I don't know the exact answer. I'm pretty confident though that it's, you know, level four going to level five is basically, and I don't want to say impossible, but the tactics to get out of level four and into level five are very different than the tactics you use to get into level four. Right. And so if I had to pick like which one's the hardest to break out of, I would say that one, I don't have a ton of data on this. I just have like the switching matrix of like, okay, and this once again, this is in chapter 10 in the book, it's like, hey, let's say you started in level one, what's the percentage you're going to be in level? What percentage of households were in level one after 10 years or after level two after 10 years or level three? Right. And so you can kind of see the switching matrix. And then I do it again after 20 years. So I'm trying to show over long periods of time, what's the probability of households changing wealth levels over time. And this is based on some data from the University of Michigan called the Panel Study of Income Dynamics, and they follow the same households over time. So a lot of the wealth data is just snapshots over time of the entire American household population. This was the same household. So we could actually see when people built wealth, kind of what differences they had, et cetera. And then I put a lot of that into the book.

Ryan:

[30:14] So this is part of the benefit. Maybe we're starting to get to some of the application of the wealth ladder as a mental model. I think we have the basis of the mental model, but the application of it is you can chart yourself on the wealth ladder somewhere, in each of these levels. And then there's a different strategy for each level to get to the next level, right? At level one, you're not going to use the same strategies as going from level three to four. So can you talk about maybe some of these levels individually? Because people by now in the conversation, I think they've placed themselves. They're probably like, okay, I see it. I'm level two right now. I'm working to get to level three Maybe we could talk about some of those levels individually and what you advise as to the strategies of how people kind of climb from one level to another. Maybe we should start with, let's just start with level one. If you're doing paycheck to paycheck, I don't know what portion of the bankless listeners are there, but what should you do?

Nick:

[31:12] I think the most important thing in level one is establishing some form of safety. And that can be financial emergency fund. People have probably heard that before. It can also be non-financial. It's like, what relationships do you have that you can rely on if you got into a tough spot financially? And the reason I bring this up, every level of the wealth ladder, something is being amplified. And you don't know what it is, but in level one, it's bad luck. And what do I mean by that? Interesting. Let's say you have a car, your tire blows out. If you're in level three or four, that's an annoyance. Oh, crap, my tire went out. I have to call AAA or I have to do this thing.

Nick:

[31:48] I got to go take it to the shop. Whatever it is, you got to just do this annoying thing. You have the money, you're going to get it fixed, obviously. It's not going to really impact your life. It's just going to impact you that day. Someone in level one, if that happens and they don't have money, they don't have credit, they don't have any way of fixing that, they may not get to work. If they don't get to work, they could get fired. If they get fired, they can go in a credit card debt, right? You can just see how a simple annoyance for someone in, let's say, level three or four can be a massive headache.

Ryan:

[32:15] Wrecks their life for months.

Nick:

[32:16] Yeah, it could be if they could get into a financial tailspin. And if you look at the data on like people that get into like, you know, financial distress events, delinquencies, bankruptcy, etc. You know, 50% of those events are experienced by just 10% of the population. So it's a very small percentage of people that get caught in these traps, and they just never get out. Now, of course, some of that's behavioral, they're just they just make bad decisions, they never make good decisions. That's some people, but I believe there's a good portion of the population in that, sector that just they had they got unlucky once and then they just fell into a pit and it was it was really really difficult to get out so the goal is to not fall into that pit in the first place and how do we do that we try and build some sort of redundancy safety in our personal lives with relationships with financial whatever just to get to level two because by the time you're in level two you can breathe a little bit easier having just a you hear about what happened with during coven when people got these covid checks and you know i saw so much stuff on twitter and interviewing people in articles of like, oh my gosh, I've never like had to worry about where my next meal's coming from and you know, anymore. I don't have to do that anymore because I got this check and right. And that little feeling of relief, it's by the time you get to five, 10 grand, you're going to be having even more of that and you can kind of chill out of it. And so I think that's incredibly important in level one.

Ryan:

[33:30] That's got to feel like a great jump going from level one to level two for the

Nick:

[33:34] First time for a lot of folks. It's the most important jump. It's the most important jump without a doubt, because that's where you can say, hey, I don't need my basic safety. You know, you think about Maslow's hierarchy of needs, your basic safety is kind of taken care of. That doesn't mean you're a step for life. That doesn't. There's a whole list of other financial woes you can have. But, you know, where am I going to sleep and where am I going to eat? Those can be covered with with 10 grand.

Ryan:

[33:57] All right, let's get to level two. So someone who's in level two somewhere, somewhere between 10K and 100K, what's your best advice for them?

Nick:

[34:06] So I think there's two types of people in level two. There's people who are on their way to like level three and four and they just need time. They're just, they got the education. They're maybe very, these are usually just young people. Maybe they graduated from university. They got a good job and they're like, they just started saving. And their only issue is they just need time.

Ryan:

[34:24] Right? And they're doing what you advise,

Nick:

[34:26] Which is just keep buying. They've already done everything. Yeah. They're buying, they're investing in assets. Great. They're just, they just need time, right? If you're like 22, like I'm only 22. I don't have $100,000. It's like, just give it time. If you're doing the things, if you have a good income, you're saving money, you're investing, just give it time, right? Then there's another group who I would say their income isn't as high. Maybe they're a little bit older. They've been saving a little bit here and there. Maybe they have a 401k, you know, maybe they own a home and they're just, you know, and they've been paying into it. It's not a super expensive home. And their issue is probably their income's not high enough. And my guess is that's because they're in a job that doesn't pay as well. And that might be because they don't have an education to get a higher paying job or they don't have the skills to do other types of jobs that pay more. So everything I focus on in level two is like education, but ultimately to get to income, right? So it's like whatever skills you can build and whether that's, you know, you can go to a trade school, you can do coding. There's all these different skills that can have benefits, especially if you're in level two and you don't have that background.

Ryan:

[35:25] That I think can pay off in the future.

Nick:

[35:27] And I think that's what I focus on level two is like education, get skills, like because once you can change that trajectory, that's how, you know, you got to put a wedge between your income and your spending. And I don't think you should keep putting downward pressure on your spending because you can only cut so much. So the real solution is just raise your income. Of course, that's not easy. That takes years of time, practice, dedication, et cetera, to build the skills to get there.

Ryan:

[35:49] So level two to three is really about investing yourself.

Nick:

[35:53] Yeah, education. I would say education for those people that just don't need the time. I think there's people like, for example, I got into level two. I would say when I graduated college, I was in level two. I did not have over 10,000. I had under $10,000, but given my education and everything, on my balance sheet, I would say I had over $10,000 in wealth, and I just needed time to get into level three, et cetera. And so I think that was my thinking at the time, and I think that's still accurate. So I think a lot of people in level two, that's their situation. For those that are like, I didn't get an education. I don't necessarily have amazing skills. You got to make that gap so that you can get on the right path so you're going to end up being in level three, level four.

Ryan:

[36:31] And make sure you're doing the good investment practices, which is like being patient, dollar cost averaging into high quality assets. Like that just goes without saying, does it not?

Nick:

[36:40] Yeah, I mean, it's true in level two, but it's even more true in level three. I guess this is a good segue to get into that. I'll just look at that.

Ryan:

[36:47] Yeah. Three to four.

Nick:

[36:48] Yeah, so the big and every, every chapter every level has a strategy right and so in in, In level three, that is just keep buying, which actually was, you know, the name of my first book. But I fundamentally believe that is the strategy for people like, hey, I'm in that kind of 100K to a million range. What do I do to get to a one to 10 million? Well, you got to, you know, the continual purchase of a diverse set of income producing assets. That is the mantra from just keep buying. And it's also included in the wealth ladder. And I believe that is the way to do it. And there's three pieces of that. The continual purchase means you're, you know, just keep buying or buying over time of a diverse set. I really believe in diversification. I'm sorry, diversification deeply.

Nick:

[37:29] And I mean that across like so many things like I own crypto. I'm not a big crypto investor. I've never been in the space deeply, but I've owned crypto. I'm going to continue to hold it. And it's a small percentage of my allocation. It's only been about 2% of my net worth, but it's been about 2% of my net worth since 2018. And so luckily, I haven't actually had to buy too much more because my wealth's increasing, but the crypto prices keep increasing as much. So I've only had to, I've had to sell once because it went too high. And so I had to sell it a little to kind of rebalance, but it's staying about 2%. So even as, you know, Bitcoin's cranking, you know, my wealth is increasing. So it's staying in my kind of right range. And if it goes too low, I will buy more of it. If it goes too high, I sell it. And I'm very disciplined. I follow those rules. Yes, would it have been better if I put every dollar I owned into Bitcoin, of course, but I don't think I would have been able to hold through all the madness that happened. And I think that's more important in terms of wealth building than just like trying to maximize a number. So that's the next thing, right?

Nick:

[38:24] Diversification. And then of income producing assets. So as I said, for the most part, I own income producing assets. That's stocks, bonds, real estate, farmland, all those different types of things. Or small business, I've done some small private investments. And so in general, that's kind of where I focus my time and energy in my investment portfolio. So the non-income producing is about 5%. But it can be more. I mean, I don't know what the right range is. I say non-income producing like gold, wine, art, crypto, et cetera, can be up to 15%, but it's really up to you. Some people have a lot more in crypto and that's fine, but the volatility for me is a bit much.

Ryan:

[38:59] Where do people screw up from three to four? Like what are the common pitfalls when they're going from 100,000 to a million?

Nick:

[39:06] I think the thing that there's two things that can prevent them from getting to a million. And I think one of those is they don't have a high enough income. If they get into level three a little bit later, like late in their career, and if their income just isn't high enough. It's just there's not enough momentum there, even with investing to get out of level three. So I think income is one piece of it. But the other thing I see is generally in the data, when you look at the households that start in level three and get to level four and compare them to the households that start in level three and stay in level three after a decade, right? So we're comparing three to four versus three to three after 10 years. There's two differences. Those that got to four had a higher starting income. So that's one of them. That's important. But the other thing is those that stayed in level three spent almost as much money as the people that made it to level four. So it's like, they aren't making as much as the people that eventually make it to four at the beginning of the period, but they're spending almost as much. So it.

Ryan:

[40:04] Really is that

Nick:

[40:05] Lifestyle inflation. Keeping up with the Joneses. And I think it's mostly, if I'm being honest, it's mostly showing up in real estate because that's the biggest line item for most people. It's like you're paying to be in a certain area or you really have a high mortgage or something and that's causing it. And if you actually look at how those in level three, what's their asset breakdown? The vast majority of their wealth is going to be home equity. It's going to be in their home. And so this is covered in chapter three of the book. So yeah, so among those that are actually homeowners in level three, over 60% of their assets is in their home. So you took their entire balance sheet, 60%. And in level two, it's like 70%. So the first three levels, those people that actually own homes, it's the vast majority of their assets. After that, once you go into level four and beyond, it drops quite a bit because those people tend to have a lot of other income producing assets that actually

Nick:

[40:51] produce money for them versus a home, which doesn't necessarily kick off income.

Ryan:

[40:56] I want to talk about four to five next, which is 1 million to deca millionaire status. But before, maybe it's worth kind of pausing because the bulk of the audience listening will probably find themselves in the first three levels that we mentioned, you know, quite obviously... I think maybe I have a question for you about how this looks now versus how it looked, you know, say 30, 40 years ago. So there's generally somebody growing up in their 20s or 30s. I'm not sure. How old are you,

Nick:

[41:25] Nick? 35.

Ryan:

[41:26] So you're 35. Okay. So you're a millennial, right? So things have felt like they've gotten harder for younger generations. And maybe some of the millennials have kind of like, I would say on the other side of this, they've made it. Maybe they had a house and they've enjoyed asset price inflation over the last 10 years or so. They've done what you've advised and they've invested in capital assets and they're doing quite well on them. They've got crypto, then they've done quite well on that. But there are a lot of people who feel like they're growing up in a world where just asset prices have gotten away from them. I think where we see this most is home prices. How expensive is it for you just to get a home if you're in your 20s and you're just starting up? I guess the meta question here is, has this wealth ladder gotten harder for newer generations? At some level, this is kind of a ladder of the American dream, isn't it? And the American dream for a lot of people does feel like it's out of sight. Do you see that as you're looking at the data and you're advising folks on personal finance?

Nick:

[42:30] So it's definitely gotten harder on the housing piece. There's no debate there. I think when we talk about the American dream, I think the American dream has also changed over time. I think it's not the same American dream. For example, houses are so much larger than they used to be. If you look at price per square foot, that has gone up since COVID. But before COVID, that was basically flat for over 20 years. Price per square foot had not changed. It was only since COVID that it's actually started to go up. And so-

Nick:

[42:57] What that means to like, oh, is the American dream still around? It's like, we're just building bigger and bigger houses and people have to pay the same price per square foot to get the, you know, inflation adjusted price per square foot to get a bigger and bigger house. Where that came from, I don't know, when did the American dream become a much bigger home? I don't know how that happened, but that started to happen. So we're not really comparing apples and apples. The other thing too, is like so many people travel more. Like when I talked to my parents, like, oh, what did you guys do when you were growing up? Did you guys like fly to Europe and go to airplanes? It's like not even about money. It's like so many people didn't travel. And now there's so many more people traveling and people that I would say are not necessarily super wealthy because they prioritize those things more. So I know the housing market is messed up, but we have a different we're buying a different basket of goods today than we used to buy. Right. I think health care is even worse than the housing market, but that's a whole separate discussion. So when I'm thinking about this and like you're saying, oh, is it harder or easier? It's definitely harder and it's harder for a few reasons. It's just there's more competition out there today. You know, let's go back to 1950. Let's let's make it super easy back then. And of course, there's a lot of discrimination and things related to this in the United States. But if you were a man and it was 1950, you only had to compete with other American men and generally white men. I mean, of course, there were, you know, there was a labor market for black men as well, but it wasn't, you know, as as equal as is today or more equal. Right.

Nick:

[44:15] And we didn't have the Civil Rights Act, all that type of stuff. So think about your competition then. And then women enter the workforce. So now you don't just got to compete against, you know, half the population and have maybe a slight advantage over over one group of people. Now you have to compete with all these other people. And that was just the US. And so that was it got tougher then. And then guess what? Now we have globalization. So now you're not just competing against people in the US and just men and just white men or whatever. Now you're competing against people all over the world to do your job. And so people are wondering like, well, why are asset prices going up? Why is all this happening? Like there's money coming in from all over the place. There's so many apartments in New York City that are bought out by people in Asia and that just buy the apartment. They don't even live there and they have it as like another, a safe haven for their wealth, right? They don't want to just have it all like in China or they don't want to all have it in Japan or wherever. And so when you start thinking about this in that way, you're like, oh, wow, it does make sense why the competition is getting harder because there are more competitors than we used to have. And that is an unfortunate truth, but it is the truth, right? There is money coming in from other places that is bidding up asset prices across the board. And that is causing some of this. It's not the whole explanation, but if you think about it logically, it's like, yeah, wouldn't I rather just compete with fewer people? Yes, I would love to live like that, but that's not the world we live in. So you are saying.

Ryan:

[45:29] Nick, it is harder. You acknowledge that, but you also seem pretty optimistic that it's possible. And I guess you believe it's possible. And this is part of the reason why you've written this book. And I want you to talk to maybe a certain segment of the audience who just looks at this and is just like, yeah, sorry, the game is rigged. I'm not even going to bother playing this whole game. It's just not worth it. Do you feel like people have a fighting shot at getting to these different levels if they basically do what you're prescribing?

Nick:

[45:57] It depends which level. I think five and six is really tough. I mean, what is a fighting shot? It's very difficult to get to five and six. So I mean, depending on how you define fighting shot, no. But I do believe that most people, if they work at it, they can get to level three. And some, if you get it early enough, you could get to level four, right? I fundamentally believe that. But I don't think everyone's going to get into level four. I think that's tougher. It also depends. Once again, it depends where you start, how much. Like if you start like deeply in debt, you kind of don't have a lot of skills and something you're like in your late 30s, early 40s. I think it's tough to get out of that hole and then get to level four. I think it's doable, but it's really tough. It really depends on your starting conditions. That matters a lot too. I don't want to downplay that as well. But yeah, and it also depends how much you can work. Do you have like, what are your liabilities? If you have like, oh, I already have two kids I have to take care of, like, and I don't have time to do other things, side hustles, whatever, then that's going to make it tough. That's going to make it difficult. Right. And there's no way around that. I can't I can't say, oh, yes, everyone can be a millionaire and perfect and great. Like, no, there's going to be certain restraints on your life, possibly. And you have to figure out what are you willing to sacrifice? What do you care about? Why do you even want to be a millionaire? I don't even I get why people think why they want to be a millionaire. But why do you want to be a millionaire? So I would think through a lot of those things.

ADs:

[47:17] Ethereum's Layer 2 universe is exploding with choices. But if you're looking for the best place to park and move your tokens, make your next stop, Unichain. First, liquidity. Unichain hosts the most liquid Uniswap V4 deployment on any Layer 2, giving you deeper pools for flagship pairs like ETH USDC. More liquidity means better prices, less slippage, and smoother swaps, exactly what traders crave. The numbers back it up. Unichain leads all Layer 2s in total value locked for Uniswap V4. And it's not just deep, it's fast and fully transparent, purpose-built to be the home base for DeFi and cross-chain liquidity. When it comes to costs, Unichain is a no-brainer. Transaction fees come in about 95% cheaper than Ethereum mainnet, slashing the price of creating or accessing liquidity. Want to stay in the loop on Unichain? Visit unichain.org or follow at Unichain on X for all the updates. Binance is the world's number one crypto exchange. Over 275 million users already trust their world-class security. Binance makes starting crypto as simple as it should be, whether it's learning about crypto on Binance Academy or browsing hundreds of assets and viewing your newly created portfolio in a clear, easy-to-track dashboard, Binance helps you go at your own pace. For hardcore traders, Binance Pro opens up industry-leading services for trading professionals with fully bespoke trading products, along with a suite of white-gloved services for VIP and institutional clients. Need support? 24-7 customer service is on hand whenever you need it. And with some of the lowest fees and deepest liquidity in the market, it's no surprise why over 275 million users trust Binance for everything crypto.

ADs:

[48:42] Download Binance today and get started in minutes. Binance is not available in certain countries, including the United States. Check its terms for more information.

ADs:

[48:49] Ever wonder how industry-leading companies like Coinbase, Metamask, and Phantom Wallet build products that always stay ahead of market shifts and new token listings? It's because they all use the CoinGecko API, the most reliable and comprehensive crypto data API, backed by a rock-solid 99.9% uptime SLA. Builders, analysts, and businesses rely on CoinGecko for real-time data on 9 million cryptocurrencies across 1,500 exchanges and 200 different networks. It goes beyond crypto prices to access liquidity, OHLCV, DEX data, metadata, NFT floor prices, and more, enabling your team to build and scale powerful products like wallets, oracles, exchanges, AI agents, and DeFi applications without limitations. Onboarding is easy with clear documentation and enterprise-grade support that answers you faster than finality, 24-7 around the clock. Supercharge your product and build with CoinGecko API today. Head to GCKO.io slash Bankless10 and enter code Bankless10 for 10% off any plan. CoinGecko API, crypto's most trusted and reliable data source.

Ryan:

[49:53] Well, let's talk about that maybe. Another quick side quest is just like, part of what you're saying is it gets somewhat exponentially harder from, you know, like the upper rungs versus the lower rungs. There's a question people really have to ask themselves, which is like, do I even want to do this? like is building the wealth in the way I'm building it worth missing out on other areas of wealth? So we've talked about this entire episode, of course, The Wealth Ladder is based on net worth from a financial perspective. We recently had Sahil Bloom on the podcast. He wrote a book called The Five Types of Wealth. And it was a fantastic book, really influenced how I think about wealth.

Ryan:

[50:30] And net worth, The Wealth Ladder here, is just one element of wealth. He also talks about relationship and social wealth. He talks about time wealth. He talks about your health. All of these things are a more encompassing definition of wealth. And so I think there's an element sometimes when people see this chart and they're just like, ah, if only I can get from like level two to level three, then I'll be happy and I'll have the life I want or three to four. And that every, I guess, step up of the ladder feels like it's not maybe fulfilling them in in the way that they want to be fulfilled. Maybe you could talk a little bit about that, right? Because once you start to get to level three, level four, Sahil Bloom calls this like, maybe you have your enough life. And your enough life is basically sort of a number, some kind of wealth where you can sort of live the life that you want and you're using your money, but your money is a tool. It doesn't own you. And so maybe reflect on that for a minute, Because I think people seriously need to consider where we get into the upper levels here, whether they want to proceed or not.

Nick:

[51:39] Yeah, I think it's a great question. And it's funny because Sahil and I, he asked for me to collaborate with him on his book. And so there's like a chapter in there that's like based on some of my work. And then I used his framework in my books. We did like a jersey swap with chapters basically. But yeah, I think his approach is correct. You have to think about these other types of wealth and like how much they matter and thinking through those. And does it matter to keep climbing? And that is the big question. Like what are you willing to do and sacrifice to move on and give up for what? And what are you doing it for? I think in certain cases, it does make sense. I think if you're lower on the wealth ladder and you want more freedom, you want more of the ability to choose what you work on, all those types of things, I think it does make sense to climb the wealth ladder. The question is where, where do you stop? And you're right. Is it level three? Is it level four? It depends where you live, your cost of living. What do you care about? What do you value? All these questions, I can't answer for you. You have to kind of look inside yourself and say, here's the things I really care about? And then how do I go to get those? I think understanding yourself is far more important than any of these frameworks or any of this stuff, because if you know what you really want, then you can solve, right? It's like always solve backwards, figure out the end game and then solve backwards from there. That's how I like to live life thinking about, okay, what, well, ideally, what would I like to, what would I like my forties to be like fifties, et cetera? Think through that and then back out how you might be able to get there.

Ryan:

[53:02] Yeah. I think that's great advice maybe another way to ask this in the meta question is this is a ladder to where like where are we arriving on the other side is that different for everybody or like for you what what is this ladder about what's what's on the other side of this of

Nick:

[53:17] Course it's different for everybody it's like what do you what do you actually value and for mine it's like i think about time freedom probably the most and so i still have a full-time nine-to-five job i write on the weekends and And obviously, I wrote a book Tuesday. I was like doing that all basically last year. And so I don't have as much time freedom as I would like and figuring out how do I build that time freedom eventually and what that's going to look like. And it may not even happen for the next years. I mean, you know, I just got married. And so my wife and I probably start having kids relatively soon. So I know once that happens, I'm going to have to move something around in my life. Does that mean I blog less often? Does that mean I, you know, I take a different role at my firm? I have no idea, but at some point in the future, I'm going to get to a point where I'm like, hey, I need to move things around to have more time for my family and things like that. And so I know that's coming and I'm anticipating that, which is why I'm kind of getting ahead of it now. But I think you have to think through what are the things you care about and how do you want to optimize those things?

Ryan:

[54:14] So with those caveats aside, we left folks at, I think, level four here. So let's talk to those mountain climbers who want to go scale Mount Everest and keep going to the top here. So from level four to five, this is the difference from a million to 10 million. What does that look like? What's your advice for those folks?

Nick:

[54:33] If you want to go past 10 million, a.k.a. level five.

Ryan:

[54:37] You have to completely change your strategy.

Nick:

[54:39] Unlike everything so far in the wealth ladder, going from level three to level four is usually just like having a higher paying job and just being able to save more and invest well. And you just give it time. And that's a lot of it too, like time's a piece of it. The difference between level four and level five is not just time. And I can just give you an example. Let's say you have a million dollar portfolio. I'm just trying to make it very easy. You just got to level four. It's earning 5% a year, inflation adjusted. So let's say a relatively conservative annual return, and you're saving $100,000 a year, do you know how long it would take you to get to level five to 10 million? The answer is 28 years. Wow. And that's after you got to a million dollars, right? So like, you already made it there, you got this money, all this stuff, and still it takes you another three decades of grinding and saving $100,000 a year, right? So once you start to do the math on this, you realize like, oh my gosh, like, there's just like no way I'm going to get there by doing this standard, you know, have a good job, save money, invest, you know, in income producing assets. It's just not going to happen, right? On an inflation adjusted basis.

Nick:

[55:45] So how do people do it? Besides like celebrities, athletes, entertainers that, you know, end up getting paid, you know, tons of money in these huge contracts. Besides those people that get paid a lot for their labor, it's basically all entrepreneurship. And so they found a business and they sell it for tens of millions of dollars, or they started a startup and that thing sells for hundreds of millions or even billions of dollars. And so once you net it all out, they end up with over $10 million basically. And so that's basically the only path up. So the question for someone in level four is, do you want to go and start a business and go down this road of doing all this crazy stuff just to get to over 10 million? Or do you want to say, hey, maybe I can take my foot off the gas and I don't need to really do any of that. And that's where this whole idea of Coast Fire, which is like, you know, financial independence, retire early. That's the fire movement. But coast is like, hey, I've saved up enough for my retirement, so I won't have to worry about that. And I just need to coast until I get there. I have enough assets now where I can, if I can just cover my current living, I don't need to save any more money. I just need to cover my current expenses all the way until I retire. And my assets that I currently have are going to grow enough to a point that by the time I hit retirement, they are enough to sustain me through my retirement. So it's a different way of looking at it. And I think there's going to be a lot of people who are in level four who are busting their their butt let's say um to.

Nick:

[57:08] Make more money, save, grind all that crap. And they're going to look at it and say, why am I doing this? It doesn't even make an impact anymore. I'm going to just do the math as well. A million dollars, you're saving 100K a year, that's impacting your wealth by 10% a year, right? 100,000 over a million is 10%. By the time you get to $5 million, that 100K is only 2% of your wealth. It doesn't move the needle anymore, right? And so you have to decide like, why am I doing all of this for this amount of money? When my assets alone will probably earn more than I do. So it's like you get into this spot in level four where there's like a no man's land. And if you actually look at the data, the hardest level to break out of over a 20 year period is level four. Most people that get into level four, 20 years later, they're still there. They do not break out of that level because it's just a completely different game to get out of there.

Ryan:

[57:55] And also maybe that's partially by design. Maybe some people just decide not to. Like, I don't need to scale it.

Nick:

[58:00] I think that's good. They shouldn't. I agree. They shouldn't. I think most people rationally should say, hey, why am I doing all this? It doesn't make sense anyway.

Ryan:

[58:08] Well, we're at it like since because once you're at once you're at four and you're looking at five, you're you probably got enough for retirement. You're getting pretty close there. What do you think about retirement? You think that's like an overrated concept or do you like the idea?

Nick:

[58:21] Depends how you define retirement. I think if you define retirement as like, oh, I'm just going to be on a beach all day. Some people, most people I think would not enjoy that. Some people do love that and they just chill out and they don't care. But I think the good, I'd say the vast majority of people need something beyond just consumption and like, you're like, what's your purpose, right? And I've had people write to me about this when I write about fire stuff and they tell me like, you know, I retired early, I did this, but it's like, I just feel like I'm just going place to place waiting to die. I'm just partying up with all these random people I'll never see again, having a good time. But I'm just like, and it's dark, dude, it's dark. Some of the stuff people have told me. And of course, that's not every person on fire. I don't want to say that I want to paint a bad brushstroke over the whole movement. I just think there are people out there where it's like, what's your purpose? If you don't have that thing you're doing, or I know I want to do this thing, it can be really tough. And this has nothing to even do with fire. This is just true of retirement in general. It's a lot of people that their whole life is their job. They leave and then they have an existential crisis. They don't know what to do next. They're sitting there and they're watching CNN or Fox News all day. It's like, that's not an ideal retirement for most people. And so because of that, I think that's something else to think about. So before you know, what I like to say is, before you know what you want to retire from, make sure you know what you want to retire to, right? And that's the big idea.

Ryan:

[59:40] Yeah, I think you said it earlier in the podcast where your big thing is like it's time freedom. I mean the wealth piece is the ability to buy yourself time freedom and then you have the ability to work on whatever you want. You don't have to be at a specific meeting in a specific time or show up at a day job. You get to pick and then it's up to you what you decide to invest in. But for most people, most of the time, I think you're right. It's not about just like going on a beach and I don't know, living in a permanent state of vacation, right? It's like humans, I mean, we desire, like we need purpose. We need something to strive for. We need to like work and have output. So I think a lot of people resonate with that. Let's talk about this last rung here or level, let's say. This is the 10 million to 100 million. I'm not sure what fraction of the bankless audience is game to go try this, but what does it take at the highest levels here?

Nick:

[1:00:36] So, I mean, to build, to build more wealth, you just have to, if you have a business you're going to sell, you got to just sell a bigger business, right? That's it. And the truth, though, is most people that made it past, let's say, 100 million. Yeah. They usually don't make it there on their first business, right? And I give plenty of examples in the book, but you can think of, you know, Elon Musk, his first business was not PayPal, which that made him a lot of money. He had something before that, right? Most people have a business before that they sell, make a little, make some money off, and then they use that and there are resources there to really go in on the next one. Even like Mark Cuban, you know, he sold whatever broadcast.com in like the late 90s during the bubble, and then he used that to propel himself up further, right? And so a lot of this is just, you know, do you want to keep doing that? And a lot of it's protection. How do you protect your wealth? So I think the strategy and the discussion is very different once you're in level five, because it's like, what are you trying to do? What's your actual goals? Why are you grinding to level six? I mean, and one of the quotes I have in the book is, you know, for some people, the most expensive thing they own is their ego. And I fundamentally believe that's true. That's especially true in levels five and six, because at some point you're saying, why are you doing this? And what's the, you know, and, you know, people want to just take money and light it on fire, over concentrate, risk it all for what? It's ego, I believe, at the end of the day.

Ryan:

[1:01:54] Do you think there's an element of like, maybe to quote another 90s rapper, Biggie, more money, more problems here? Is each of these higher levels?

Ryan:

[1:02:01] What problems come at these higher levels? And we were talking about just thinking about how to secure your wealth, maybe worrying about it all the time. And what are the downsides here?

Nick:

[1:02:11] So that's a piece of it is worrying about it. There's tax implications. There's estate planning implications that happen in level five that you don't have to worry about as much in level three or four. There's like, you know, intrapersonal things are different, right? If you just think about like, let's say someone's visiting you for a house party, if they trip and fall, like, okay, if you're not that rich, they're probably not going to sue you. Obviously, if they need medical care, okay, you help them out with that, whatever. But if they know you're rich, I mean, they might take advantage of you or they may purposefully trip, right? All sorts of things that wouldn't be, if people know, if your wealth is publicly known, there's now a target on your back for people to abuse that in a way that doesn't happen for people that are just like, you know, middle class, upper middle class. And so I think that's something else to think about is how does that change, you know, your relationship with other people? Like, let's say if, you know, you happen to be single, you're on the dating market, you'll never, it's going to, in the back of your mind, you're never going to, does this person actually like me for me or is it for my money? And so that changes the dating market. Now, it's very ironic that men are, you know, going out there trying to accomplish all these things and become, you know, rich and famous and successful and all this. And at the end of the day, that kind of distorts the whole point of dating, which is you want to find someone who likes you for you. And you've now made that kind of impossible, right? You've made it very difficult to actually, you have to just test people for a long time to actually get to know that. So it's ironic that a lot of the things we chase end up harming certain parts of our lives in other ways.

Ryan:

[1:03:36] The trade-off is much harder to live a normal life, I guess, is

Nick:

[1:03:40] What you're saying. Yeah, exactly. Once you have extreme wealth, and as long as it's publicly known or it's known like someone could search it or figure it out. Yeah. No one knows. It's a completely different story because then you can be like, oh, this person has no idea that I'm worth, you know, $20 million and they're treating me how they would treat anyone. Right. I think that that changes things.

Ryan:

[1:03:57] There is a subset of people listening to this episode and people that I met within crypto that have actually zoomed up this wealth ladder very quickly and maybe in some cases too quickly. Have you run across that? What are the concerns about going from two to four, two to five in a hurry? Because that has happened in crypto to a number of people, maybe not a great number of people, but certainly generational wealth in this fast-paced asset class can happen very quickly. And sometimes I feel like people have no idea what to do with it.

Nick:

[1:04:32] Yeah. I think the big issue is probably concentration. And so it's like, you know, oh, I bought this random alt coin. It went up 10,000 X. And now I went, you know, level two, level four, let's say, you know, and did you sell, did you diversify your wealth when you're there? Maybe some people did. That's great. But a lot of people don't necessarily. And if it comes crashing down, it's a whole other story, right? I had a friend, a close friend out here in New York. He had five of these monkey NFTs through Solana. He had seven of them. Yacht Club. Yeah. No, not the Bored Ape ones. They were called like the monkey one. I don't even know but they were an alt nft so this is really solana they were under solana i think they're under ethereum so they're on a different chain you knew.

Ryan:

[1:05:12] A true degen

Nick: