5 Things That Break With Rising Rates

Dear Bankless Nation,

When COVID-19 hit, the Fed courageously dove into the thick of the US Treasury market and committed to buying over $1 trillion in Treasury bonds.

The plan was simple: keep rates low, print money, and stimulate the economy.

A global pandemic and a recession mashed together into one mutant blackswan event would have just been too much for the markets to bear.

Thankfully, the stimulus went as planned.

- Treasury interest rates hit record lows at near zero

- Global markets quickly rallied as fears of recession evaporated overnight

- Crypto markets mooned

- The Payroll Protection Program (PPP) reduced a spiking unemployment rate

- We developed cures and vaccines to Covid

We did it!!!

Right?

Well… not exactly.

Expansionary monetary policy allowed inflation to hit a 40-year-high of 8%. In response, the Fed is now scrambling to combat inflation by aggressively reversing course and raising interest rates.

But, policy doesn’t always work as intended, and things may break.

Here are the 5 things that could break if the Fed continues on its course:

- Inflation (in a kinda positive way)

- Housing Markets

- Financial Institution Solvency

- Sovereign Debt and Forex Markets

- Private Credit Markets

1. Inflation

Why is the Fed raising interest rates in the first place?

To fight inflation.

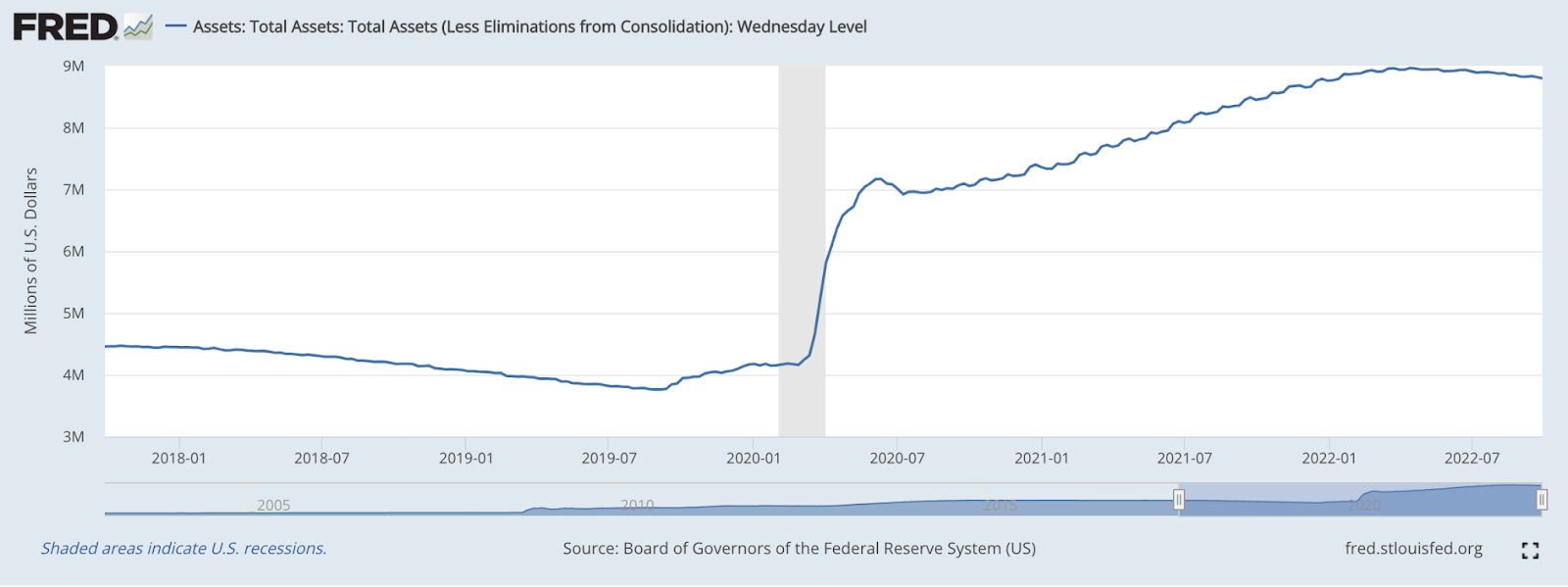

The Fed’s unlimited bid on the US Treasury market during COVID-19 – and to a lesser extent, US Mortgage Backed Securities (MBS) markets – increased the size of its balance sheet from $4.24 trillion to $8.96 trillion.

That is an increase of $4.72 trillion, or 111%.

Where did all of that money come from?

Essentially, from thin air.

The Fed repurchased Treasuries and MBS through Open Market Operations, which is a fancy monetary policy term for buying and selling Treasuries and MBS.

When conducting such an operation, the Fed credits or debits a bank’s reserve accounts at the Federal Reserve. There is no need for the Treasury Department to create or destroy any money. A simple ledger adjustment at the Fed can simply create trillions of brand new dollars.

Stimulating the economy to drag ourselves from the depths of Covid required Quantitative Easing (QE), meaning the Fed purchased Treasuries and MBS – hence the balance sheet expansion.

And wouldn’t you know it, creating new dollars caused inflation!

Can you recall how else we created new dollars during Covid?

That’s right! Those sweet, sweet stimmies and those fatty PPP loans, which evolved into PPP grants and never had to be repaid.

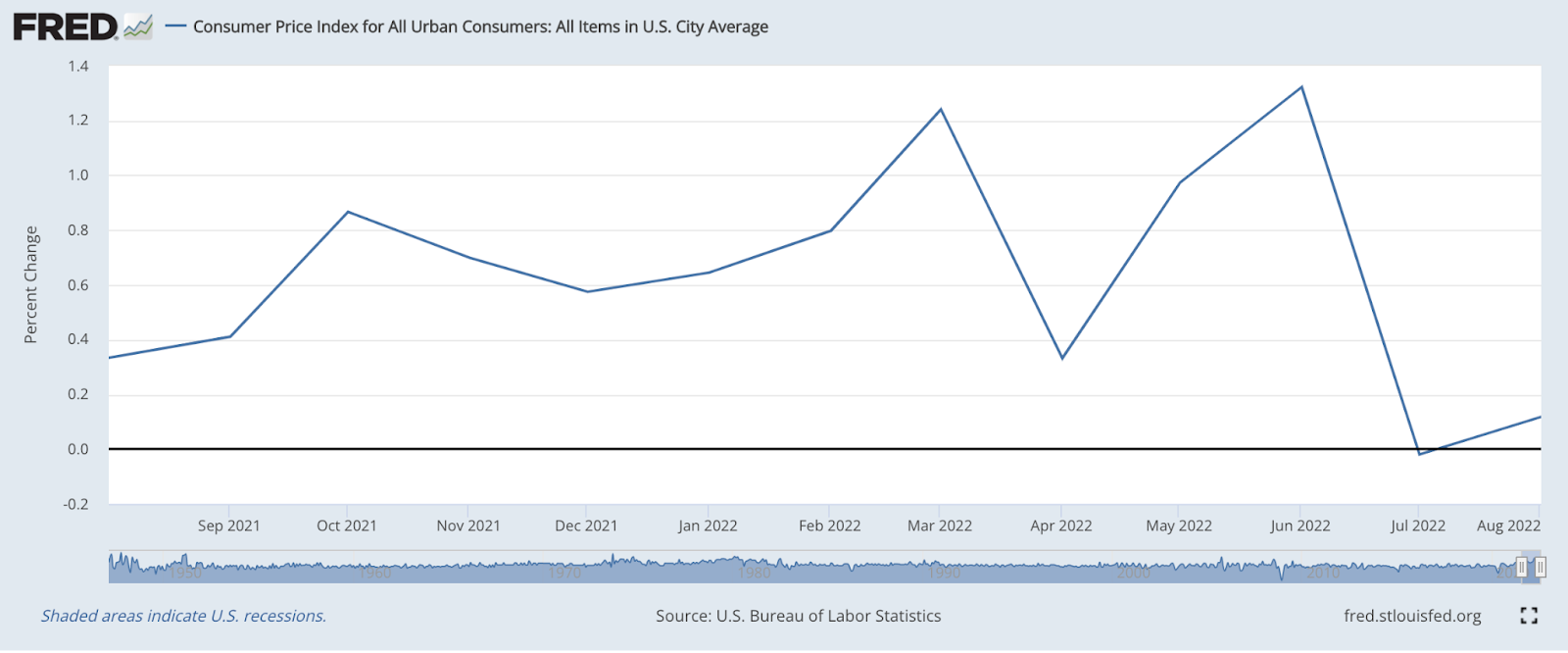

Central banks claimed that inflation was only transitory. But in December 2021, people finally came to terms with the fact that the mighty United States of America is not immune to basic economic principles after the CPI reported its biggest annual increase in 40 years.

The Fed, however, continued to expand its balance sheet until the middle of April, at which point they became net sellers of Treasuries and MBS.

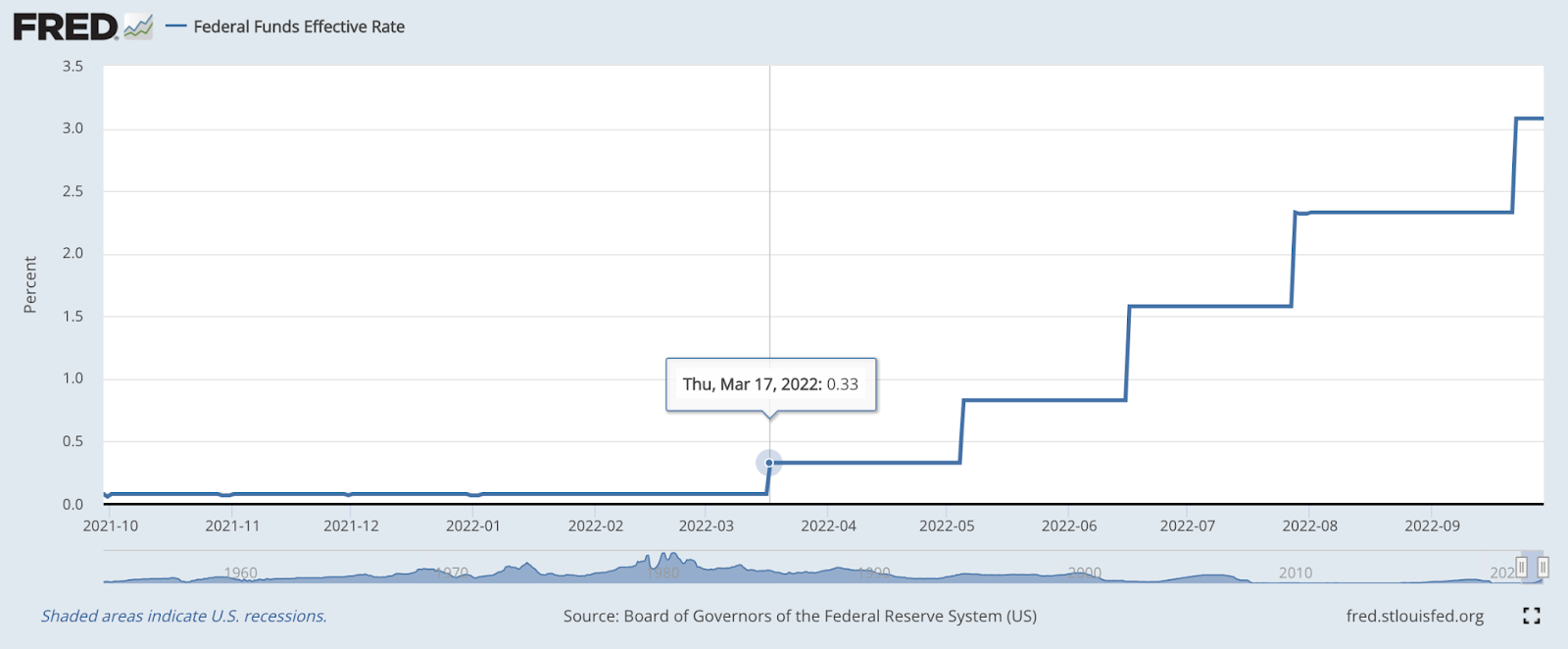

Further, the Fed failed to raise interest rates until the middle of March, despite knowing inflation would be stickier than expected a full three and a half months prior!

Raising interest rates increases the opportunity cost of money.

As cost increases, investors are less willing to pay high prices.

Increasing opportunity cost delays consumption.

As we can see in the chart below, the month-to-month change in inflation has been decreasing as of late, therefore, rate increases = successful!

We broke inflation! Probably… Maybe?

So I guess this is a positive break. However, raising rates to reduce inflation comes at the risk of deflation and while inflation is not desirable, deflation is even less so, as it may create the spiral of a weakening economy.

Put elegantly by Elon:

2. Housing Markets

US home prices have been on an absolute tear since the end of the pandemic.

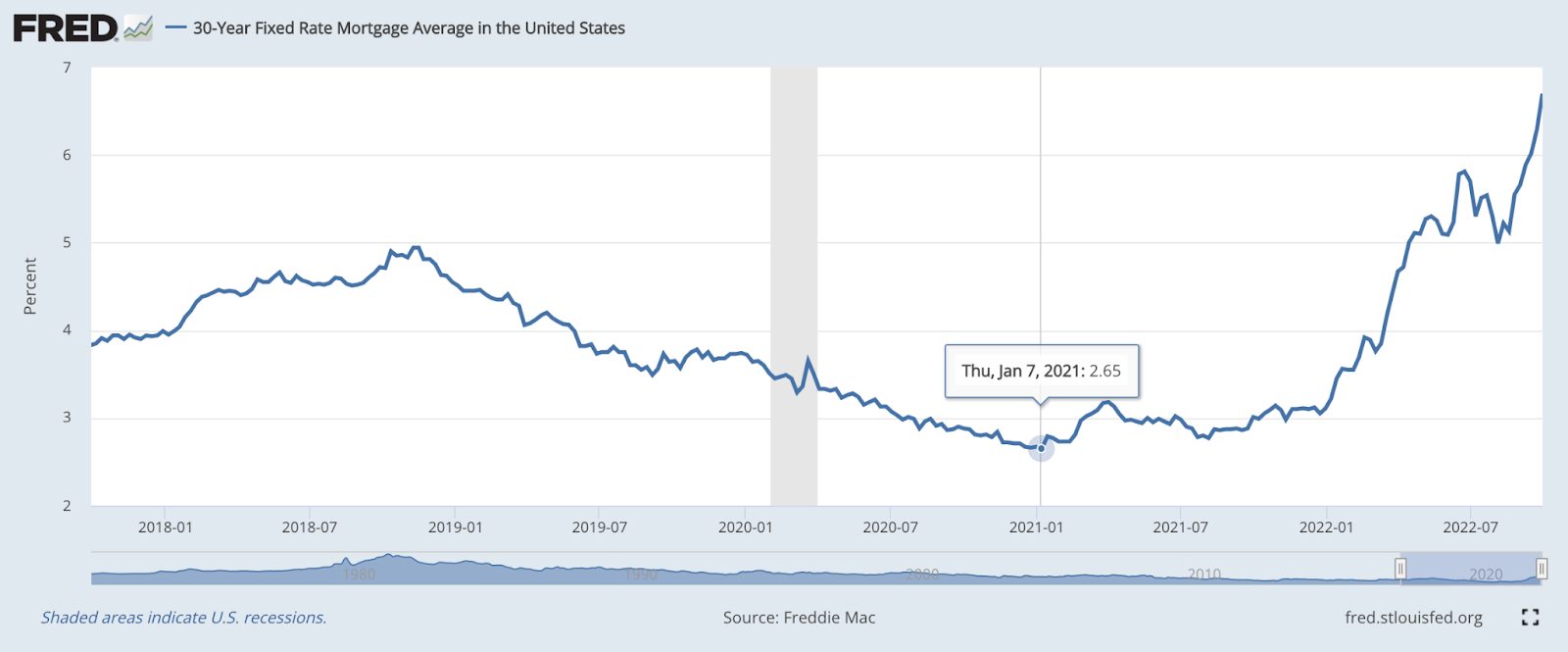

Over the past two years, the median home sales price has risen by 36.5%, fueled by historically low interest rates on mortgages.

In January 2021, you could take out a 30-year mortgage at 2.65%.

Today, it’s 6.70%. 😱

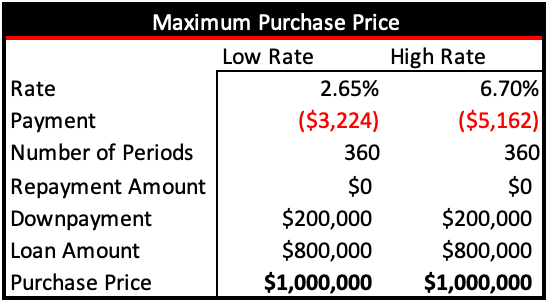

To examine the impact of mortgage rates on the purchasing power of consumers, let's take a hypothetical buyer, looking to put 20% down on a 30-year, fully amortizing mortgage, with a budget of $1M.

The low rate scenario uses our record low interest rate mark of 2.65%, while the high interest rate of 6.70% is the current rate offered on 30-year fixed mortgages.

The monthly payment for this hypothetical buyer in today’s high rate interest environment is $1,939 (or over 60%) greater than had they purchased the home in January, 2021.

It’s 60% more expensive to buy a home today than less than 2 years ago!

Unless you can increase your annual income by 60%, if interest rates continue to rise, buyers will be able to afford less, and home values will have to decrease (which they already have).

Initially, decreasing home prices will only impact those who purchased homes and took out high interest loans in 2022 on overvalued real estate, however, a potential housing bubble could cause cascading foreclosures, much the same as a falling token price can cause cascading liquidations.

3. Pension Funds

When rates rise, discount rates increase and the market value of existing assets decline.

Thanks to their known cash flows, fixed income instruments (bonds) are extremely easy to price, given the bond’s yield and future cash flow timing. Many large financial institutions also love fixed income securities, as it provides a known cash flow, enabling them to match assets with obligations.

For a pension, bonds provide known cash flows to match with fairly certain liabilities payments to retirees. While pensions generate income and returns through a variety of investments of varying risk profiles, a primary income generation tool is sovereign bonds, especially those originating from the country in which the pension operates.

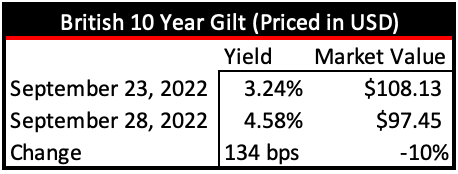

British pensions funds have been absolutely shellacked by rising interest rates, after tax cut plans announced by UK’s new Prime Minister Liz Truss gave rise to investor fear over Britain’s ability to service national debt.

From peak to trough, the tax cut announcement wiped out 10% of the value of British 10-Year Gilt (the UK equivalent of US Treasuries). This rapid drawdown in the market value of assets placed enormous strain on UK pensions’ solvency, and required the BOE to step into the fray, supporting the Gilt via QE (printing money).

If the Fed continues to raise rates, markets will demand higher yields on foreign paper, placing the solvency of holders (i.e. pensions) at risk!

4. Sovereign Debt and Forex Markets

In point #3, we discussed how the BOE was forced to commence QE to defend yields on the Gilt and prevent pension fund insolvency.

How did they do this?

By turning on the money printer, much like the Fed did to support US Treasury yields in the depths of Covid!

But doesn't QE and money printing just increase inflation?

And isn’t inflation what we started raising rates to fight against?

Yes. But hey… the boomers can’t lose their retirement accounts.

It is fairly clear to see the inflationary shocks in the British Pound from the chart below:

While extremely rapid QE measures stabilized Gilts, the result was the value of the Pound temporarily falling off a cliff against the dollar.

Protection of British interest rates came at the cost of a devalued Pound!

Britain is not the only major economy affected by Fed rate increases.

The Bank of Japan (BOJ) has conformed to a policy of yield curve control for decades, the first major central bank to do so since 2016.

Rising rates in the US make Treasuries and Dollars attractive investments, causing upwards pressure on Japanese yields. To combat this pressure, the BOJ has resorted to… you guessed it… QE!

But the BOJ has reached the limits of QE.

Currently the Yen to Dollar exchange rate is 144.68 to 1, with 10-Year bonds yielding 24 bps!

The BOJ may soon have to choose between further devaluing the Yen or losing control of the yield curve. Such a change in monetary policy may be seen by markets as a sign of looming disaster, further hammering the Yen and rocketing Japanese yields.

5. Private Credit Markets

If the US Government is forced to pay more in interest when yields increase, I can assure you that private corporations experience the same effects.

Corporate bonds help to finance a wide range of publicly traded and private companies. MicroStrategy has used its debt issuances to finance purchases of Bitcoin while Boeing uses bonds to finance the development of new manufacturing plants in South Carolina. Real estate developers, such as Greystar, may opt to finance developments of apartments using bank loans, instead of issuing bonds.

You get the idea.

Regardless of how the company structures financing, there will be some form of interest rate attached to the note.

These notes are often interest only, or mature before being fully paid down.

New debt must be taken on to repay maturing notes.

Rising interest rates make new debt more expensive for borrowers. Low interest rates allowed for borrowers to finance projects that would be considered unfeasible in today’s high interest rate environment. When it comes time to rollover outstanding debts on unfeasible projects, corporations will resort to selling, as their cash flows from the purchase asset may no longer cover interest obligations.

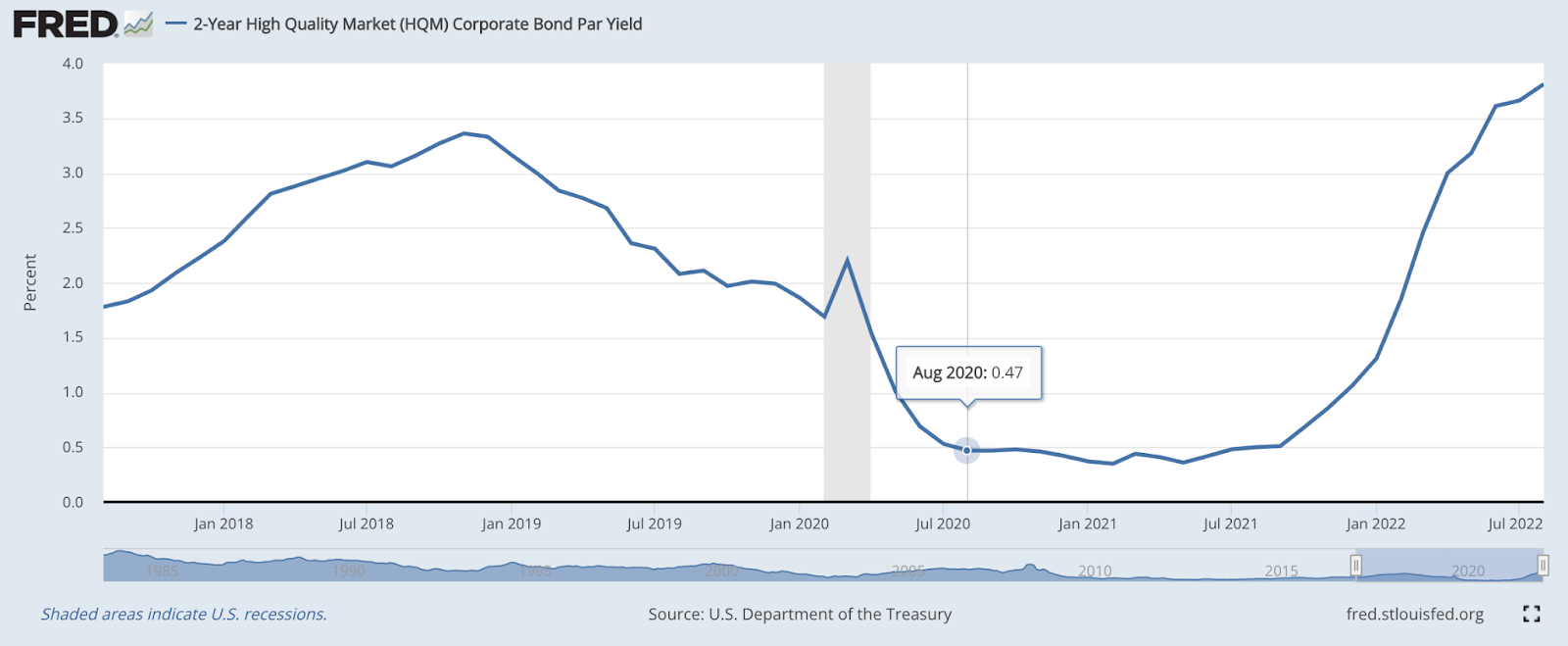

High quality, two year corporate bonds yielded 0.47% in August, 2020.

In August 2022, they yield 3.81%, an increase of 711%. 🚀

Payments on interest-only notes rolled over last month increased by seven times! While proformas often provide some amount of slack for changes in interest rates, an payment increase of that magnitude may force asset sales.

A Difficult Decision

Multiple pressure points exist in the global financial system, and with each Fed rate hike pushing us closer to the edge of the recession cliff, it may only be a matter of time until we see a true crisis, potentially caused by one of the five factors listed above.

The Fed faces a difficult decision: continue to raise interest rates, potentially destabilizing US allies attempting to stimulate and maintain low interest rates, or devalue the Dollar and exacerbate inflationary pressures in the US.

Jerome Powell and the FOMC are walking the knife’s edge.

A singular misstep and…