5 Sectors to Keep An Eye On

Dear Bankless Nation,

What’s next?

The markets are in turmoil. The regulatory noose is tightening. Blockspace demand is the lowest it has been since 2019. Crypto Twitter is a ghost town. And now the biggest event of the year—the merge—is in the rearview mirror.

Is it just me, or does crypto feel rudderless right now?

We know this feeling won’t last forever. Between the ability for anyone to build and innovate on blockchains and the potency of the intellectual capital in this space means it is inevitable that some application or technology will get people excited again, bringing back demand for blockspace and propelling the next wave of user adoption.

The question is… What will that be? What’s next for crypto?

Let’s touch on a few exciting areas in both infrastructure and applications to see what that may be?

1. Layer 2s

Layer 2s are poised to continue to grow over the coming months.

While at present there is scant demand for blockspace, the increased transaction capacity provided by these networks has already begun to unlock new use cases and will pay long-term dividends during the next bull market by allowing more users to be onboarded into the on-chain economy.

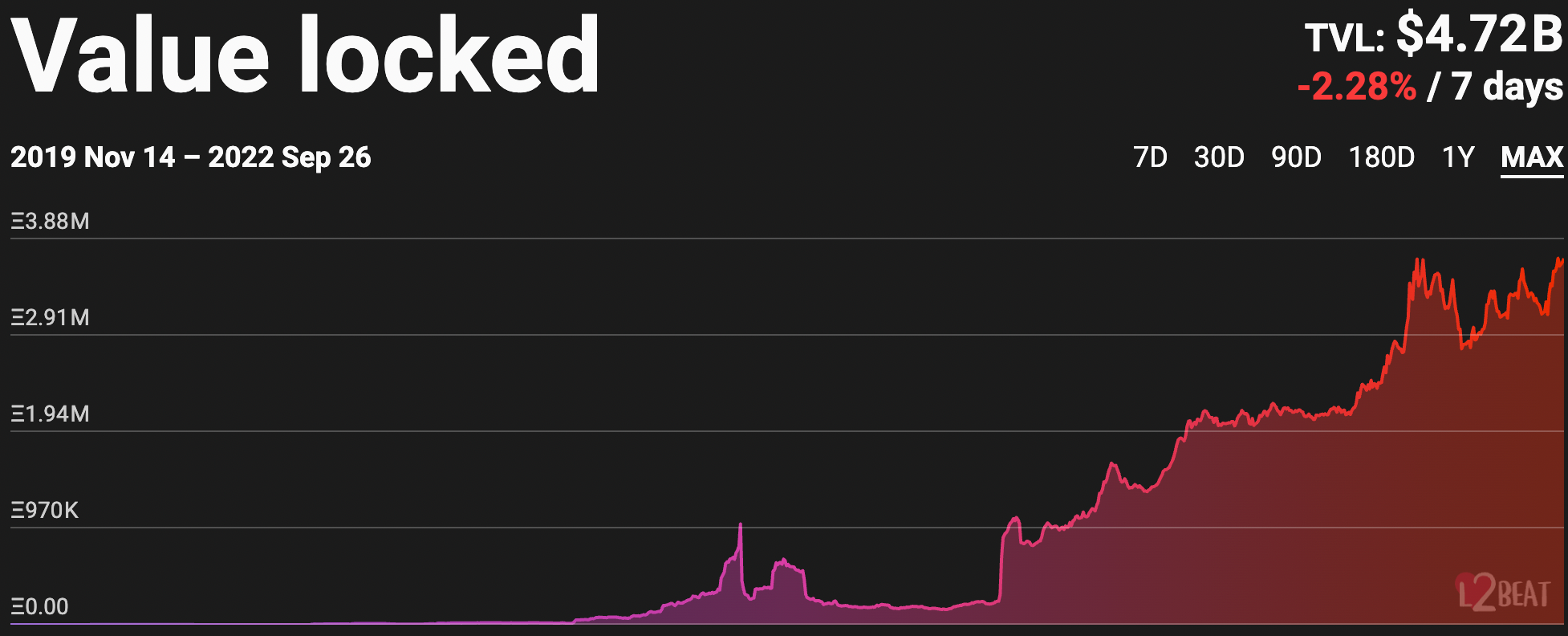

In fact, despite the bear market, value locked on Layer 2s in ETH terms sits at ATHs.

Arbiturm and Optimism are far and away the two largest L2s, with the optimistic rollups combining for a 96.6% share over all DeFi TVL on L2s.

Each of these networks have several catalysts on the horizon.

For instance, Arbitrum is poised to grow with the resumption of Arbitrum Odyssey, a program designed to encourage users to try out different protocols by rewarding them with NFTs.

The network is also poised to benefit from the launch of their (still unconfirmed) native token, which is expected to take place after Odyssey is completed. In the meantime, the L2 will continue to benefit from numerous upcoming protocol launches.

Optimism also has several exciting catalysts, including Quests, an active program similar to Odyssey where users can earn NFTs in exchange for interacting with protocols, as well as the Bedrock network upgrade.

Although they are still earlier in their life cycles, zk-rollups are set to make some noise in the near future as well. Several zk-EVMs, such as those being developed by zkSync, Polygon, and Scroll, are set to launch either mainnet or testnets year’s end, while StarkWare’s governance token, STARK, is scheduled to go live by the end of this month.

2. Cosmos

L2s are not the only infrastructure game in town. There are numerous exciting developments happening within the Cosmos ecosystem. Cosmos enables developers to create highly customizable, application-specific blockchains that can leverage interoperability via inter-blockchain communication (IBC), and seems set to grow in terms of both user and developer activity due to key network upgrades and chain launches.

One such upgrade is that of Interchain Security. Set to launch in January 2023, interchain security will enable Cosmos chains to leverage the Cosmos Hub, the network which has the largest value staked, for their security, meaning that they do not need to bootstrap their own validator set, a process which is difficult, expensive and introduces security risks.

There are also several exciting Cosmos chains that seem set to gain traction over the next several months including Canto, an L1 that provides a native DEX, stablecoin, and lending market as public goods as well as Berachain. Berachain is a soon to be launched, DeFi oriented L1, and has a cult following while utilizing a unique, Proof-Of-Liquidity consensus mechanism.

3. DeFi Resurgence

Powered by the aforementioned L2s and app-chains, DeFi is poised to experience a resurgence as we head into Q4 ’22 and Q1 ’23.

One sector that seems to be gaining considerable momentum are options protocols. Benefiting from the increased capacity provided by L2s, protocols like Dopex, Lyra, and Premia seem set to grow in the near future, as options become a more significant part of crypto market structure and as sophisticated DeFi users seem to manage their risk on-chain.

Another sub-sector that looks poised to explode in growth is NFT-Fi, or DeFi for NFTs.

Like it or not, NFTs are not going anywhere, with the JPEG markets set to become more liquid and mature as trading, lending, and derivatives primitives continue to get built out.

There are numerous exciting NFT-Fi projects that are live and set to launch in the coming months. This includes AMMs like SudoSwap, lenders like NFT-Fi, JPEG’d and MetaStreet, appraisal protocols like Abacus and perps DEXs like NFT Perp.

We’ll be covering NFT-Fi in more depth this week on the Bankless Newsletter - Stay tuned for more alpha on that front.

4. Web3 Social

Between DeFi, NFTs, and just pure speculative trading, many of the most popular crypto use-cases to date have been entirely financial in nature.

While nearly all dapps touch money to some degree, there are numerous applications that are largely non-financial that seem set to gain traction in the near future.

One exciting sector of this are decentralized media platforms. These networks differentiate themselves from Web2 incumbents by providing users with strong censorship resistance guarantees and creators with an increased ability to port their audience.

A few apps and protocols to keep an eye on in the coming months are gm.xyz, and Lens, as well as DeSo, an L1 specifically designed to host blockchain-based social applications.

5. GameFi

Another area that could grow is crypto gaming (GameFi).

There have been hundreds of millions poured into this sector over the past year following the success of play-to-earn games like Axie Infinity, STEPN, and Sweatcoin.

Although many gamers seem to hate crypto and NFTs today, GameFi has the potential to serve as a major funnel to bring hundreds of millions, if not billions of users on-chain.

Will we finally see a breakout AAA quality crypto game?

Hear what Vance Spencer thinks.

Hope Is On the Horizon

While crypto feels listless, there are many network upgrades and innovative applications alike that are poised to help drive the next wave adoption and make crypto exciting again.

The macro clouds will clear eventually and the insatiable demand for blockspace will return again.

But in the meantime, the seeds of the next bull market will continue to be planted.

- Ben