5 Reasons This Could Be The Crypto Bottom

Audio of our 50-minute conversation with Chris Burniske is available exclusively to Bankless Premium subscribers. Upgrade to listen.

Dear Bankless Nation,

2022 has been a brutal year, with the collapses of former titans like Terra, 3AC, and FTX wreaking havoc on the industry.

Sentiment is in the gutter, and prices are down very, very bad. The total crypto market cap is down over 71% from its peak, wiping out more than $2.2 trillion in value in just over a year.

But could the worst be over?

Chris Burniske believes so. A partner at venture firm Placeholder, Chris is a true crypto OG, having survived numerous cycles. He wrote one of the earliest books on crypto investing, and was the first buy-side analyst to cover crypto.

He’s also nailed this bear market, calling the top in November 2021, and urging caution during the July-August rally.

Now when many are questioning crypto’s future… Chris has flipped bullish and believes there’s a strong chance we’ve bottomed.

Our very own David Hoffman talked with Chris earlier this week for 50 minutes, where Chris articulated the thesis informing his bottom-call. The audio of this call is available exclusively for Premium subscribers.

In today’s newsletter, we dig into the central reasons why Burniske thinks we’ve bottomed.

-- Bankless team

Why Chris Burniske Thinks The Bottom Is In

1. No Forced Sellers

One key reason as to why Chris Burniske thinks we’ve bottomed is that there are no more large forced sellers.

Many believe that the collapse of FTX will kick-start a second contagion event on the scale of the credit crisis in May-July of this year following the collapse of Terra.

However, Chris believes that rather than create a new wave of forced selling, the implosion of FTX is the “grand finale,” the last shoe to drop in the massive unwind and deleverage that we’ve seen since the destruction of UST.

Who might the next large forced seller be? It’s hard to tell now. It was easier in the summer, when it was much easier to identify possible players who could go under.

The industry as a whole is also better positioned to weather the FTX storm relative to the collapse of Terra and 3AC, as credit across crypto (and for that matter, TradFi) was much tighter now than it was when those events occurred.

While we may see some bankruptcies, this will not add near-term sell-pressure to the market, as assets held by bankrupt companies will be auctioned off at a much later date.

Chris does acknowledge that there is a risk of end-of month selling from fund redemptions, but believes the impact of this on the market may be reduced, as most funds who are getting redeemed have likely been rekt.

2. BTC Is in Deep Value Territory

Another reason why Chris believes we’ve bottomed is due to a variety of on-chain, technical, and quantitative indicators that suggest Bitcoin is in deep-value territory.

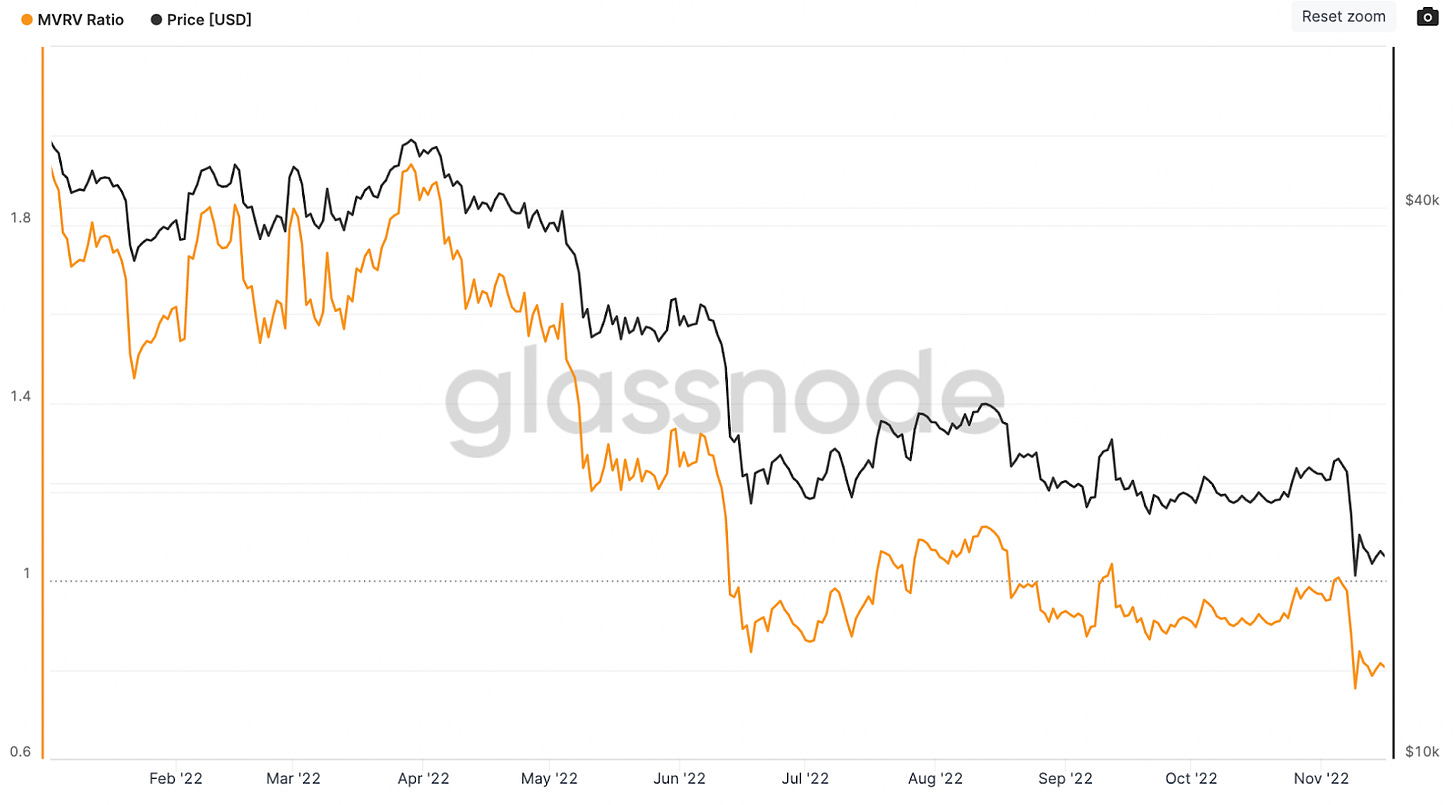

One metric Chris points to is Market Value to Realized Value (MVRV) ratio, which per WooMetrics, “approximates the value paid for all coins in existence by summing the market value of coins at the time they last moved on the blockchain.”

Chris believes that BTC is in value territory when MVRV dips below $1, as it suggests that most investors are underwater and therefore less likely to exit their positions.

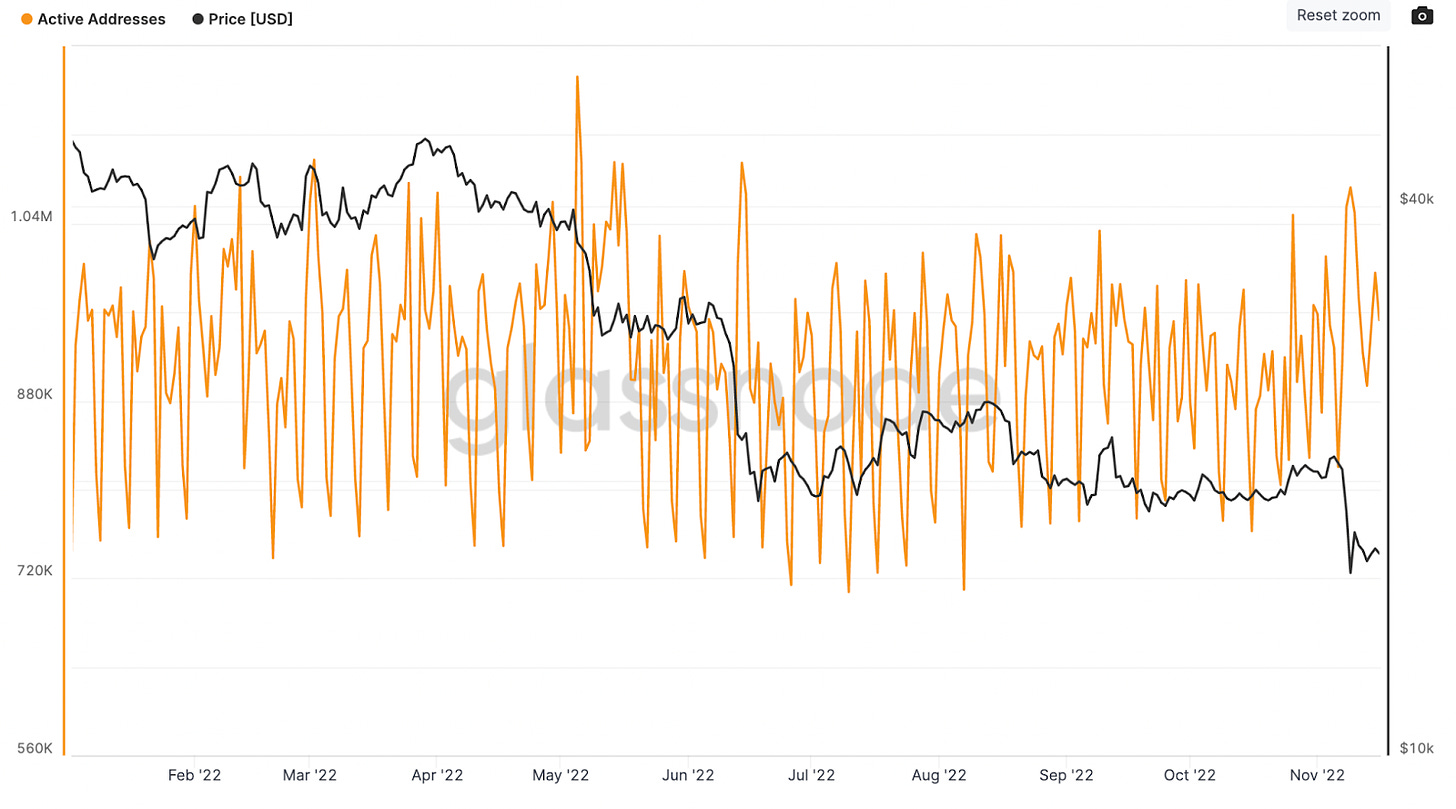

Another on-chain metric is daily active addresses, which spiked to 1.07M on November 9, the day of the *current* local bottom. This represents the high single day total since this summer’s crash. Chris believes that the bump in addresses indicates that new buyers are coming into the market.

How else can we gauge whether Bitcoin has bottomed? One indicator is the 200-week Simple Moving Average (SMA), which has historically represented the bottom for BTC, and is a level that it’s currently trading below.

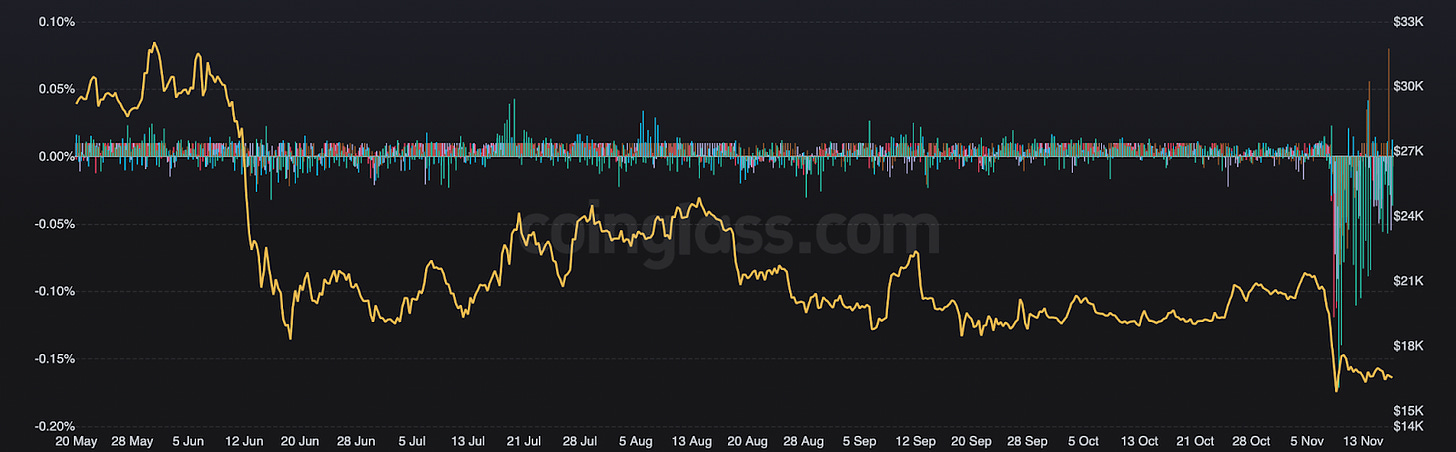

Finally, Chris looks at funding rates on perpetual futures to assess trader positioning. In particular, he states out that he’s looking for a sustained period of negative funding, or when short positions are paying longs. Although it can vary dramatically by exchange, annualized BTC funding is -9.8% on Binance.

One potential outstanding risk is Bitcoin miner capitulation, though he believes that may not be as impactful as previous cycles due to the institutionalization of the sector.

3. ETH’s Fundamentals Are Strong

Ethereum’s strong fundamentals also suggest that the bottom may be in.

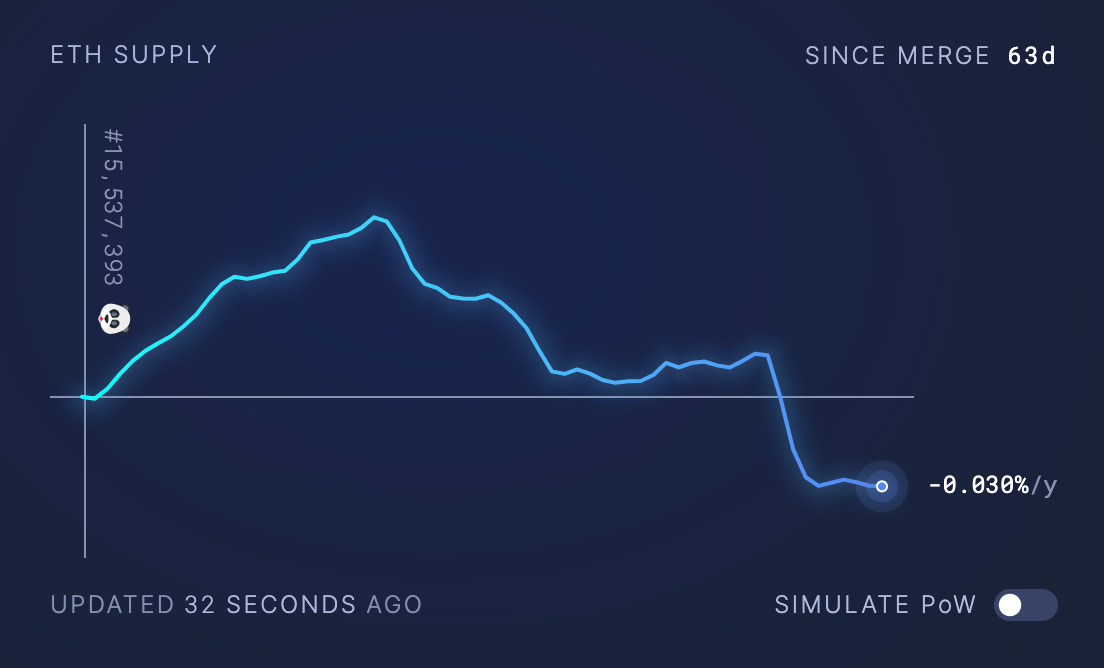

Chris believes the effects of the Merge on ETH market structure and flows are beginning to take hold.

To back up this claim, he points out that ETH’s bottom during the depths of the FTX sell-off on November 9 was higher than its bottom during the Celsius and 3AC blow-up. Chris attributes this to the merge, which as we know, has removed miner sell-pressure and pushed ETH across the ultra-sound barrier, as it has a net deflationary issuance.

Chris also looks to the application layer to evaluate Ethereum’s fundamentals. In particular, he points out how throughout this crisis, DeFi on Ethereum has not skipped a beat.

Major DeFi protocols have operated flawlessly, with major lending markets remaining fully solvent and executing liquidations, while DEXs have facilitated billions in trading volumes. Chris believes that capital allocators who are paying close attention to the space are aware of and understand this.

ETH’s technicals suggest that it’s in value-territory, as it’s trading below its 200-week moving average. In order to sustain a rally however, ETH needs to reclaim this level.

4. Improving Macro

A final reason as to why the bottom may be in is due to improving macro conditions.

Although he is concerned about economic growth, Chris feels that a changing macro backdrop may be conducive to a bottom.

Risk-assets have been hammered in 2022 as the Fed has hiked interest rates. This dramatic increase in the risk-free rate has contributed to multiple compression in the equity market, as investors are no longer willing to stomach nose-bleed valuations now that there is a true cost of capital.

As a result, high-growth tech companies, particularly those in the Nasdaq (which crypto has demonstrated a strong correlation to), have experienced a brutal drawdown of a similar magnitude to the unwinding of the dot-com bubble of the late 1990s.

However, one critical difference between now and then is that the fundamentals of many of these companies are strong, with businesses such as Meta continuing to be free-cash flow machines with a strong grip over the market in their verticals.

Inflation, the straw that stirred the tightening drink, is also showing signs of rolling over, with recent CPI and PPI prints coming in soft. While some may scratch their heads at the market rallying with headline inflation at a 7-handle, it’s important to remember that markets are forward looking.

As Chris puts it, the market cares about the “the rate of change at the margin” or the notion of “bad things slowing down,” as it suggests that conditions will improve in the future.

5. These Factors Are Aligning

With the post-LUNA deleveraging coming to an end, bullish on-chain, technical, and quantitative indicators for BTC and ETH as well as an improving macro backdrop, the stars are aligning for crypto to have put in a bottom.

Don’t get it twisted… Chris expects significant volatility in 2023 in a similar vein to the last bear market. We may get face-ripping, head fake rallies followed by nasty drawdowns.

However, the aforementioned confluence of factors is enough for him to believe that there is a strong probability that the worst (at least in terms of price) is behind us.

Will he be proven right? Let us know your thoughts.