5 Must-Have Crypto Analytics Tools

Dear Bankless Nation,

The most technologically-savvy analytical tools in traditional industries has its limits.

Why? For the simple reason that data is proprietary.

Whether it’s a dataset from a Wall Street quarterly report, or data you extracted from Facebook — it’s data the company wants to reveal.

That puts a ceiling on how in-depth the analysis can get.

But in web3, virtually all of the data is publicly viewable.

On-chain sleuthing is an actual thing anyone can do.

Evidence?

Every time there’s industry drama, dozens of anonymous analysts on Crypto Twitter leaping ahead of each other to offer their post-mortem.

And you can too.

Today, William shows us 5 must-have web3 analytical tools you can use to upgrade your game today.

- Bankless team

Ethereum and other top smart contract blockchains are teeming with data.

If you can parse that data well in real-time, there’s plenty of alpha — and even job opportunities — to unlock.

Accordingly, this Bankless tactic will walk you through the best resources you can use to level up your crypto analytics skills.

- Goal: Learn about top crypto analytics tools

- Skill: Beginner

- Effort: 1 hour to get started

- ROI: Knowing the best ways to “read” blockchains

The best tools for bird’s-eye views in crypto!

Why crypto analytics?

I first discovered crypto in the spring of 2017.

I studied as much about the space as I could that summer, and then that fall I landed my first gig in the field.

It was a crypto news writing job at a small-time outlet, CryptoAnalyst.

The catch? I still didn’t know much about crypto, and the blockchain analytics sector was very primitive and sparse at the time.

I’ve stuck around the ecosystem ever since, and over the past few years one thing has particularly stuck out to me, which is how crypto analytics plays have surged, both in quantity and quality, in recent times.

That’s good news for all of us, because knowledge is power.

Or rather in crypto, knowledge is power and money.

That maxim was as true in 2017 during the ICO ERC20 token boom as it is today in 2022 amid the Cambrian explosion of DeFi and NFTs.

But again, one of the biggest differences between then and now has been the surge in quality contemporary crypto analytics tools that have made it exponentially easier to come by actionable web3 knowledge.

Interested in making the most of these advancements and leveling up your crypto research game like never before? Then it’s time to double down on the best analytics tools around.

Let’s explore 5 platforms you can use to step up your crypto research today. ⬇️⬇️⬇️⬇️⬇️

1. CoinGecko & GeckoTerminal 🦎

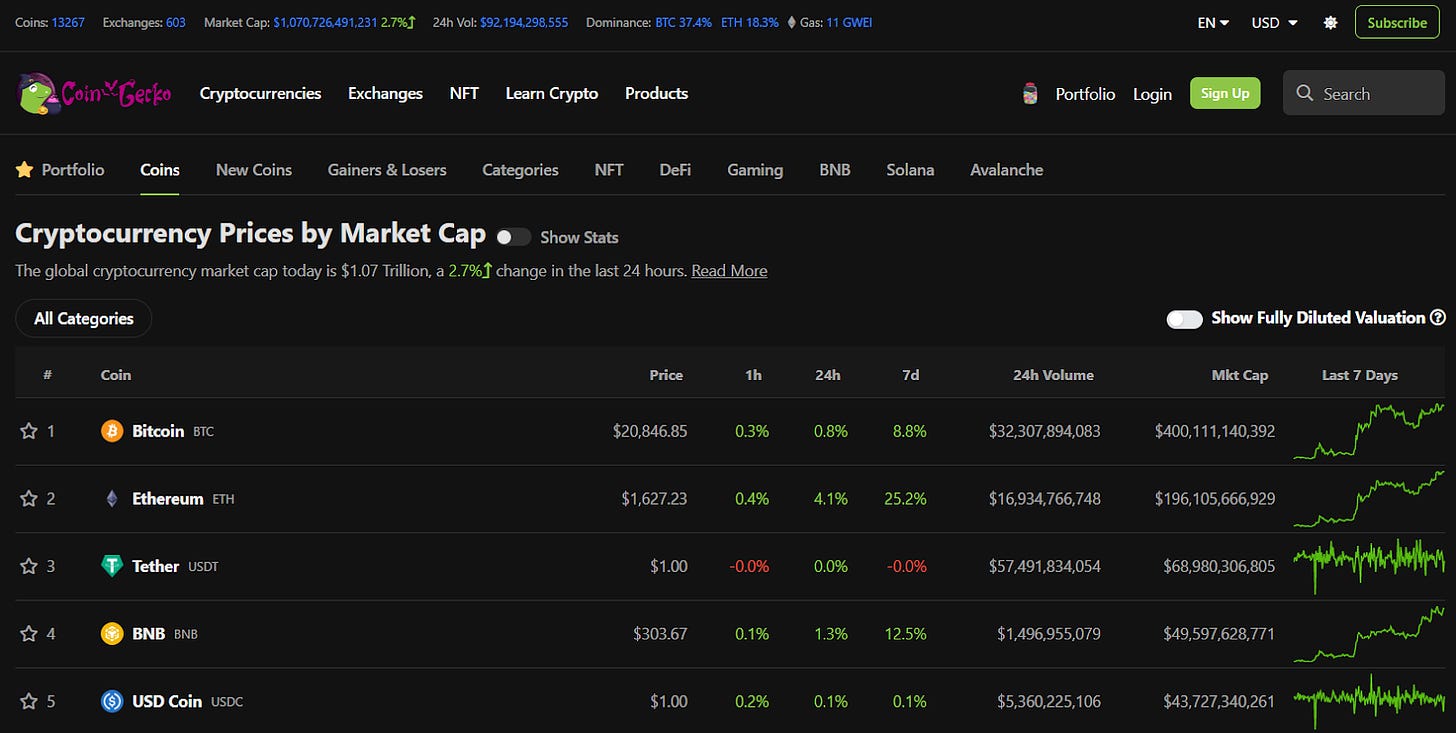

A few years back, it seemed like everyone used CoinMarketCap to check crypto prices, market caps, volume, etc.

Then Binance acquired CoinMarketCap in April 2022, which many felt the platform had been “captured.”

The community started looking for alternatives. The platform that saw the most success in recent years has been CoinGecko, who quietly out-built its competitor during the bear market, and is now currently the world’s largest independent crypto data aggregator.

What I like most about CoinGecko besides its independence is that it feels like the platform is always ahead of the curve.

Whenever I want to check the price action or trade volume of some new obscure coin, CoinGecko seems to always have the basic data on that token ahead of everyone else.

Part of the reason for this impressive responsiveness?

CoinGecko’s reach is downright massive — the platform currently tracks key stats for over 13,000 different crypto assets across over 600 crypto exchanges!

So if you’re looking to track crypto trends in real-time for the biggest projects and for categories like New Coins and Big Gainers & Losers, CoinGecko is as solid as solid gets.

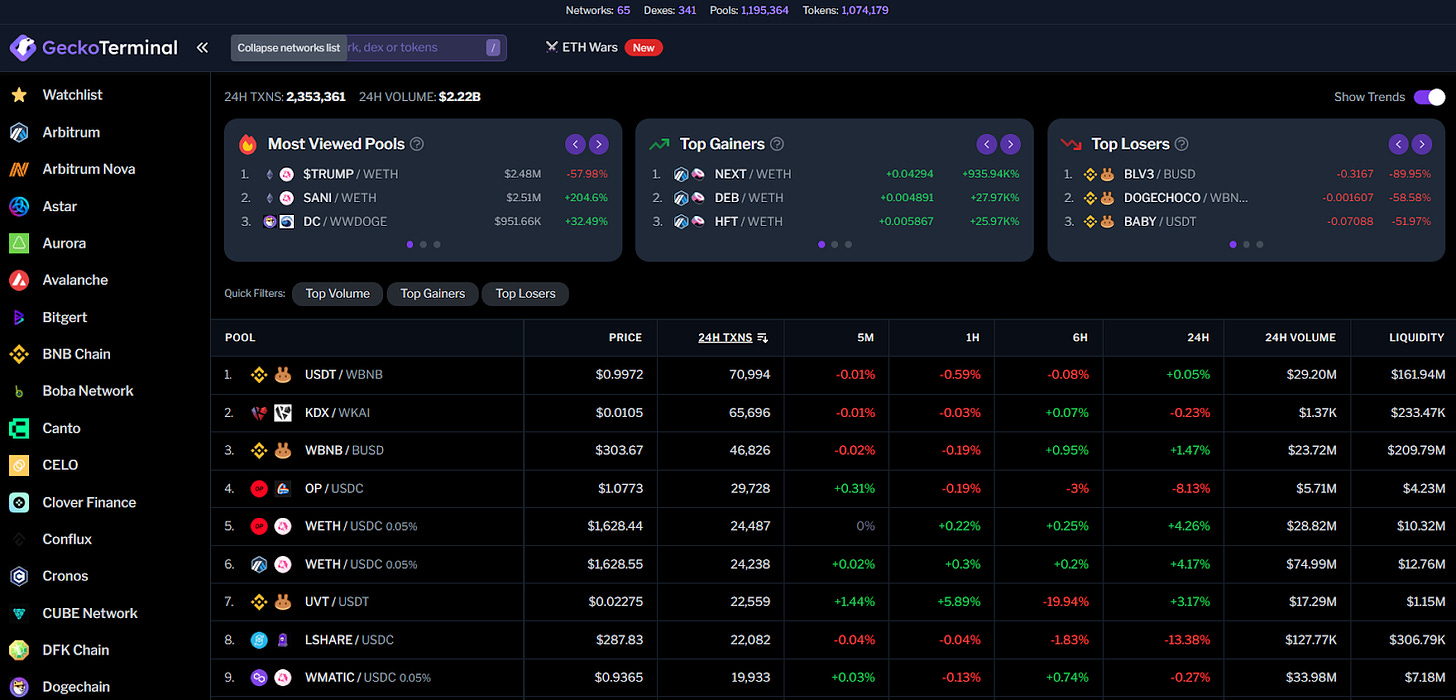

But that’s not all — the project’s also recently launched GeckoTerminal.

GeckoTerminal is a DEX aggregator.

Remember how I said CoinGecko’s reach is massive?

The same is true for GeckoTerminal — if there’s a token you want to trade, whether it’s on an Ethereum Virtual Machine (EVM) chain or a non-EVM chain, GeckoTerminal likely has the charts and the pools you’re looking to directly analyze!

2. DeFi Llama 🦙

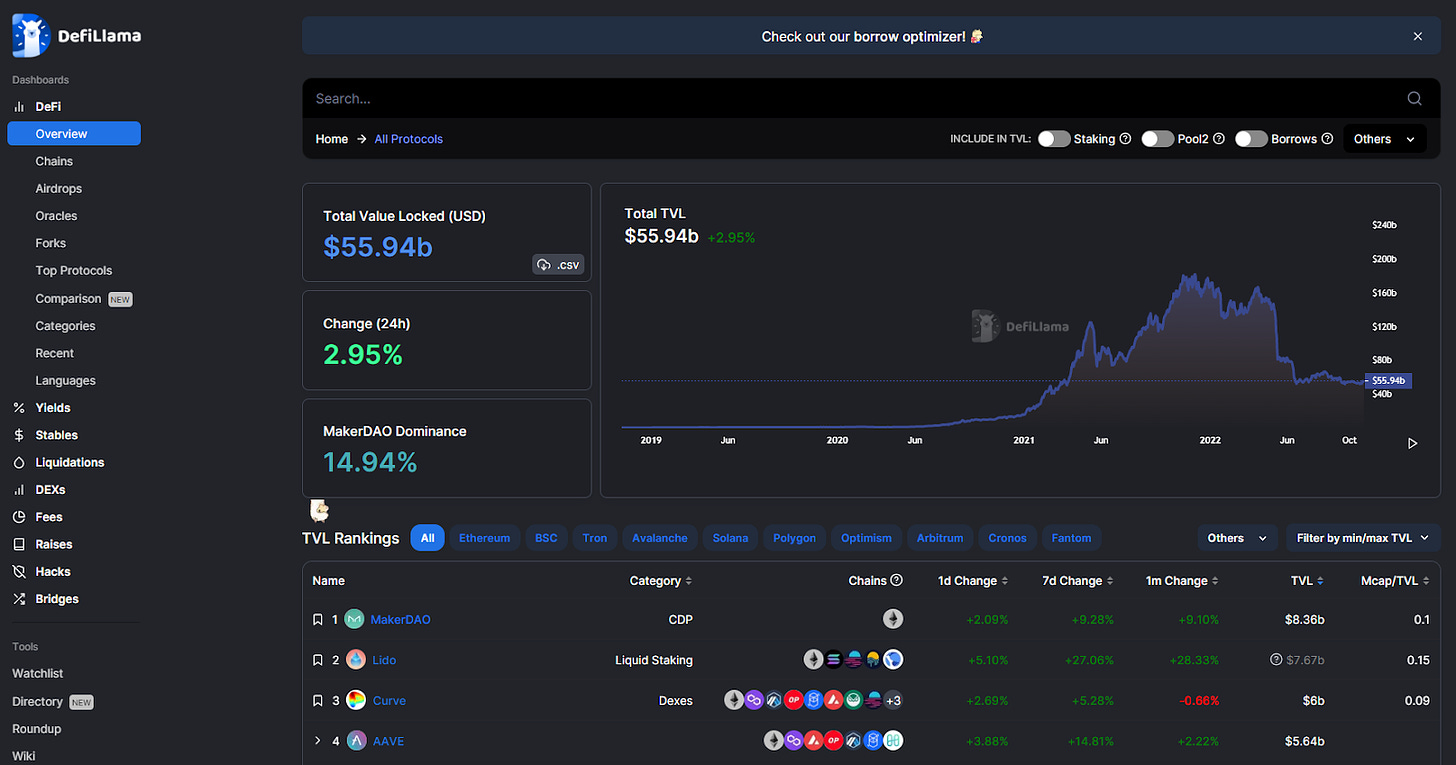

As a DeFi power user, DeFiLlama is a treat to use.

Why?

Because DeFiLlama accurately and quickly tracks total value locked (TVL) data and volume data across +150 chains and tons of different protocols, meaning the platform is a fantastic way to “see the cryptoeconomy from above” at any given time, so to speak.

However, DeFiLlama is so much more than a plain DeFi stats hub.

The project also provides real-time yield metrics, stablecoin charts, liquidation activities, airdrop opportunities, hack info, and beyond.

In other words once you go ‘Llama, you never go back’. 🦙

3. Dune Analytics 🏜️

Almost a total of 2.8 million users are currently holding @Reddit's Collectible Avatars on @0xPolygon 👀

— Peter (📖, ✍️, 🔑) (@p_petertherock) October 19, 2022

And out of these wallets, almost 2.7 million users are holding just one Collectible Avatar.

Will social platforms 🗣 be one of the main drivers of NFT adoption? pic.twitter.com/NmHvsSfIaR

Over the past couple of weeks, Reddit NFTs have popped off.

Yet a few weeks ago I didn’t know anything about them at all!

When I saw activity around these digital collectibles starting to surge, I knew I needed to write a Metaversal post to explain the basics of what was going on, so I did.

Where’d did I go to catch myself up before teaching others?

The answer is Dune Analytics.

Dune Analytics is a platform that lets anyone create crypto analytics dashboards anyone else can review using SQL.

For example, I researched my Reddit NFTs post mentioned above using an analytics dashboard created by Dune user petertherock, and it covered everything I needed, like number of NFT holders, sales volume, and more.

The cool thing about Dune is that it covers these sorts of stats for DeFi and NFT projects alike across a variety of chains, like Ethereum, Arbitrum, Optimism, Polygon, and beyond.

I recommend Dune as an important part of any on-chain analysts info diet accordingly.

4. Nansen 🧭

1/ GM Explorers 🧭

— Nansen 🧭 (@nansen_ai) October 27, 2022

NFT Sniper (powered by Price Estimates) is now available to all Nansen Standard & above users 🔥

Select All, NSN-NFT500, or NSN-BLUECHIP10 collections to discover NFTs listed below their estimated value 💰

And there's more ⤵️ pic.twitter.com/PTQooDiGyF

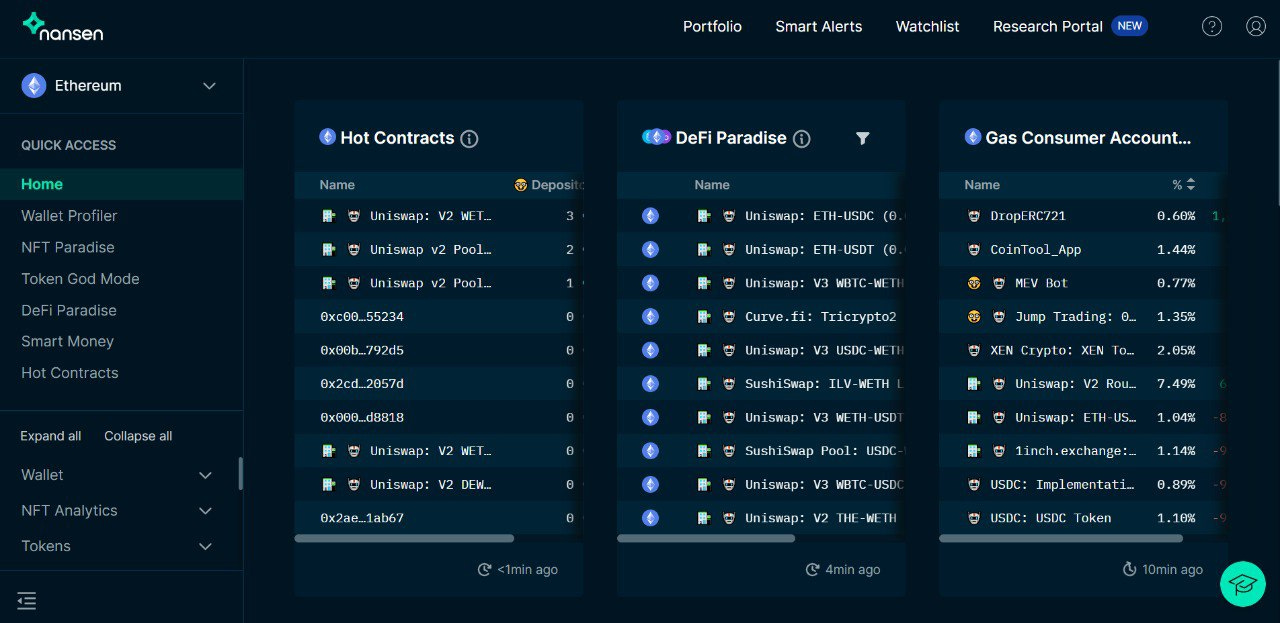

If someone gave me a challenge to make $1 million in the cryptoeconomy in one year’s time with the stipulation that I only use one tool, that tool would be Nansen.

That $1M mark is an arbitrary number in a hypothetical example, but the results Nansen can help you achieve are very real.

I noted as much in one of my June 2022 Metaversal posts, Free-to-Mint NFTs, where I detailed a personal anecdote of how I used Nansen’s Mint Master tracker to mint WAGDIE NFTs before their floor prices initially exploded.

At the time, I said:

“I found WAGDIE via Mint Master by noticing on Friday that nearly 40 ‘Smart Minters’ had participated in the project’s mint. I was then able to accumulate a few before the project exploded, and now the floor price at the time of this post’s writing is 1.5 ETH each, so my subscription’s been covered multiple times over at this point.

Of course, it’s not that every mint will be a win, but Nansen makes it simpler to surface signals in real time.”

That’s still true today.

It won’t lead you to constant wins, but it will help you surface notable “1 in 100” or “1 in 1,000” plays in real-time in ways that other projects can’t.

For instance, Nansen provides the following awesome services:

- Wallet Profiler — metrics on any wallet address

- Hot Contracts — a dashboard for tracking trending smart contracts

- DeFi Paradise — a complete overview of the DeFi economy

- NFT Paradise — a complete marketview of the NFT economy, including trending collections and new mints

- Smart Money — a dashboard for tracking the activities of prolific crypto and NFT traders

- Token God Mode — a one-stop search engine for all the main info around a token, e.g. volume, transactions activity, etc.

5. Token Terminal 👩💻

Token Terminal is one of my favorite crypto analytics platforms because it arguably has the best fee and revenue stats around for both blockchains and protocols.

Want to know just how profitable a given crypto project is at any given time?

Token Terminal has you covered, whether you’re researching projects across a certain vertical — e.g. lending markets — or across entire chains.

Becoming A Better Crypto Analyst

If you learn how to navigate the 5 crypto analytics projects listed above, you will become a better crypto analyst than most everyone else right now.

The good news is that these platforms make navigating key blockchain data simple, so it doesn’t take a particularly specialized knowledge base to get adept at them.

Explore and use the projects, and who knows?

You might just start pulling out on-chain victories that you didn’t know were previously possible!

Action steps

🔭 Check out the best crypto analytics tools:

CoinGecko + GeckoTerminal

DeFiLlama

Dune Analytics

Nansen

Token Terminal

- 🔐 Also check out our previous tactic 5 tips to maintain your crypto privacy