Where Ethereum is Still Too Centralized

Dear Bankless Nation,

We spend a lot of time at Bankless preaching the gospel of decentralization and showcasing technologies that can bring it to the mainstream.

One of these technologies is Ethereum, but despite all of its strengths, there are some key areas where the ecosystem's trustlessness and decentralization need improvement. Today, we dig into a few problems and take a look at the potential solutions.

- Bankless team

3 Centralization Vectors in Ethereum

Bankless Writer: Jack Inabinet

The Ethereum ecosystem is more centralized than it needs to be.

We often praise the accessibility of staking, but are slow to acknowledge Lido’s outsized batch of staked Ether. We champion decentralized monies, but remain heavily dependent on trusted stablecoin issuers. We chastise alt-L1s for compromising on the principles of decentralization, despite similar shortcuts for our own scaling solutions.

All hope is not lost, however, for where there is centralization, devs often have a solution. Today, we’re exploring the centralization vectors of Ethereum in staking, stablecoins and rollups -- and what is being done to address them.

🥩 Staking

Problem: Ethereum’s security is concentrated in the hands of few.

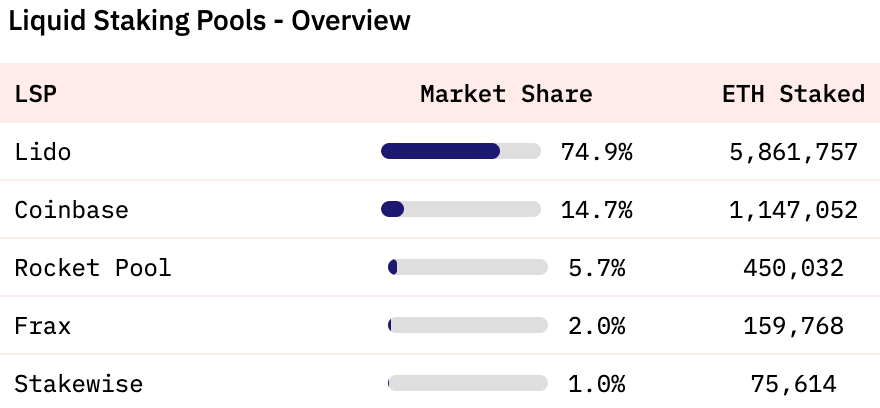

Lido's liquid staking derivative (LSD) "stETH" dominates DeFi; the token has the highest liquidity of any staking derivative, it stands out among its peers as the bluechip liquid staking collateral with Lido controlling 17.6% of Ethereum TVL. One of every three Ethereum validators (30.6%) belongs to the protocol and its staking derivative holds a commanding 74.9% share of the LSD space.

While many decentralized protocols, such as Rocket Pool, allow anyone to serve as a node operator, Lido’s current V1 implementation only allows whitelisted operators to run validators for the protocol. This creates a centralization vector in their massive ETH stake among a select list of pre-approved partners.

As of Q4 2022, Lido had 29 active Ethereum node operators.

💡 Solution: PoS and withdrawals.

Lido is a convenient target, yet it should be noted that Ethereum’s transition to a proof of stake consensus (the Merge) has already contributed towards the network’s decentralization.

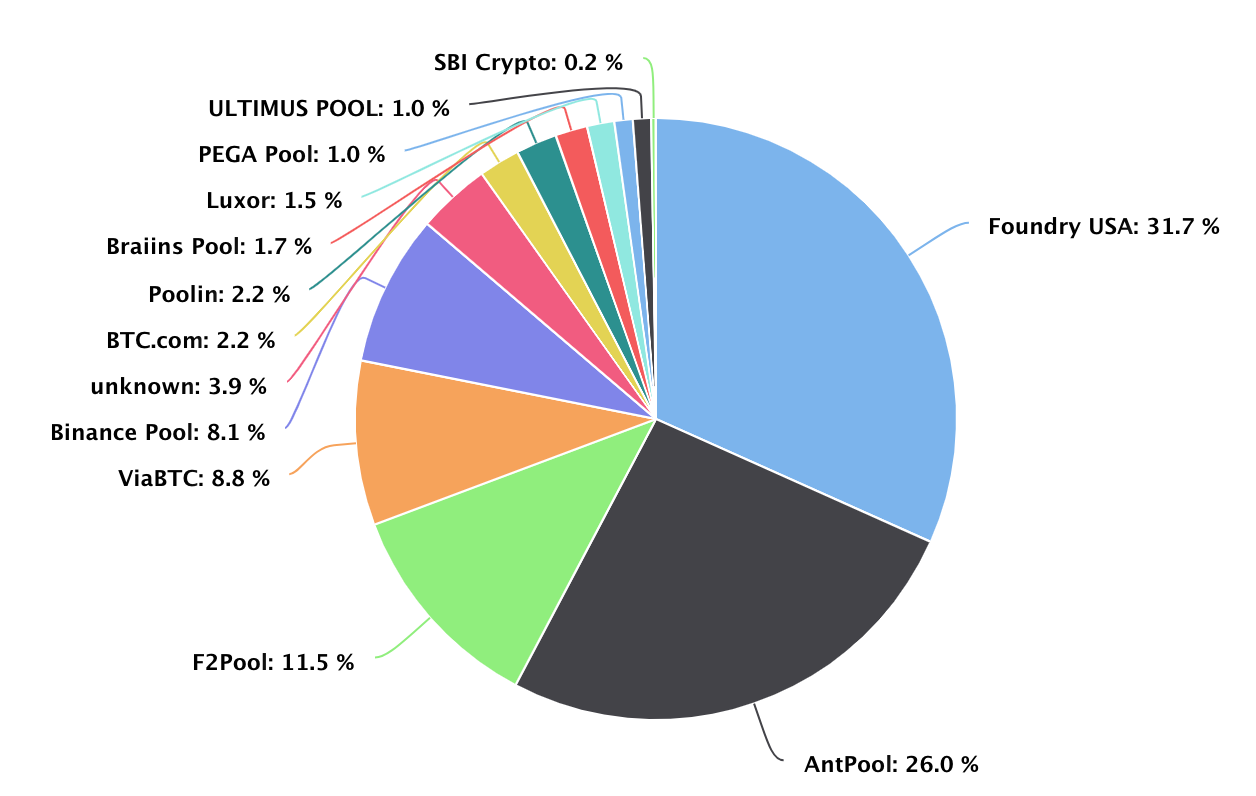

Lido may control 30.6% of the validator set, however, Bitcoin’s largest mining pool operator controls 31.7% of hashrate. The top twelve BTC mining outfits control a combined 96.1% of the network’s hash power, compared to 70.3% of staked Ether distributed among the network's twelve largest stakers.

PoS better serves the long-tail of actors, like solo validators, than a PoW system, allowing a broader set of participants to earn rewards securing the network. Like the Merge hard fork that preceded it, Ethereum’s latest network upgrade, Shapella, was a crucial step towards decentralizing network security.

Shapella enabled withdrawals, providing solo stakers and staking pool users with liquidity on staked ETH for the first time since the inception of the Beacon Chain in December 2020. Withdrawals provide optionality for stakers seeking liquidity: solo-staking and staking pool solutions are now valid competitors to LSDs for stakers seeking to retain liquidity.

Simultaneously, the next generation of staking protocols are attempting to provide Lido users more reasons to withdraw than ever before. Novel approaches to staking (Stakewise V3 and ether.fi) establish competitive marketplaces where node operators compete for capital by offering superior staking yields and LSD-Fi protocols like unshETH are attempting to decentralize stake via token incentives.

🔐 Learn more and build on core.safe.global

🏦 Stablecoins

Problem: Centralized stablecoin reliance plagues crypto.

After Circle announced it had $3.3B trapped inside of the failing Silicon Valley Bank, its stablecoin faced indiscriminate sell pressure.

USDC wicked down to all-time lows of $0.82 on centralized exchanges and liquidity was vaporized from on-chain stableswap pools. Maker’s DAI and Frax’s FRAX, both heavily collateralized by USDC, were inevitable casualties and traded at significant discounts to peg during the event.

Thankfully, the market took note of the dangers and chose to diversify from USDC, with the stablecoin's market cap falling 30.1% since the March Banking Crisis!

Unfortunately, the lesson learned left much to be desired: instead of swearing off centralized stablecoins, we simply repudiated USDC and turned to Tether’s opaquely backed stablecoin USDT in its stead. USDT’s market cap has been up-only from the event, increasing 13.6%, and is approaching all-time-highs set prior to the collapse of Terra-Luna.

💡 Solution: Building the next generation of stablecoins.

Rather than seeking out a stop-gap solution with extremely limited reserve transparency, crypto should be turning to truly decentralized stablecoin alternatives. Access to seizure-resistant, transparently reserved, on-chain stablecoin alternatives is imperative.

While Reflexer’s RAI has been long lauded for providing these qualities, its dependence on ETH as the sole collateral has limited scale and a continually negative redemption rate has hampered adoption. No one wants to hold a “stablecoin” that decreases in USD value!

HAI, a RAI fork deploying to Optimism in the near future, aims to remedy the flaws of its predecessor by accepting yield-generating stETH as collateral, a move hoped to turn the redemption rate positive.

Meanwhile, Berachain's HONEY stablecoin will be collateralized by the various assets staked to the chain's unique proof of liquidity consensus layer, a move that could help HONEY achieve UST-type scalability without the risks of endogenous collateralization.

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

🧻 Rollups

Problem: Rollups are centralized and lack needed security features.

Sequencers order transactions and build the local chain for L2s, playing a role similar to validators on Ethereum, but require much heavier trust assumptions.

While the single sequencer model employed by most rollups is efficient and offers low gas fees alongside quick transaction times, they are controlled by a single entity, representing a threat to network liveliness and a nexus for centralization.

Alt-L1 chains have long been chastised for sacrificing uptime and decentralization in the pursuit of low fees and high TPS. At present, Ethereum’s scaling experimentations have yielded similar results and undermine the benefits of transacting on a trustless network.

Making a thread logging every single #Ethereum L2 outage @arbitrum @optimismFND @0xPolygonLabs

— DavidHoffman.bedrock 🏴🦇🔊🔴_🔴 (@TrustlessState) March 27, 2023

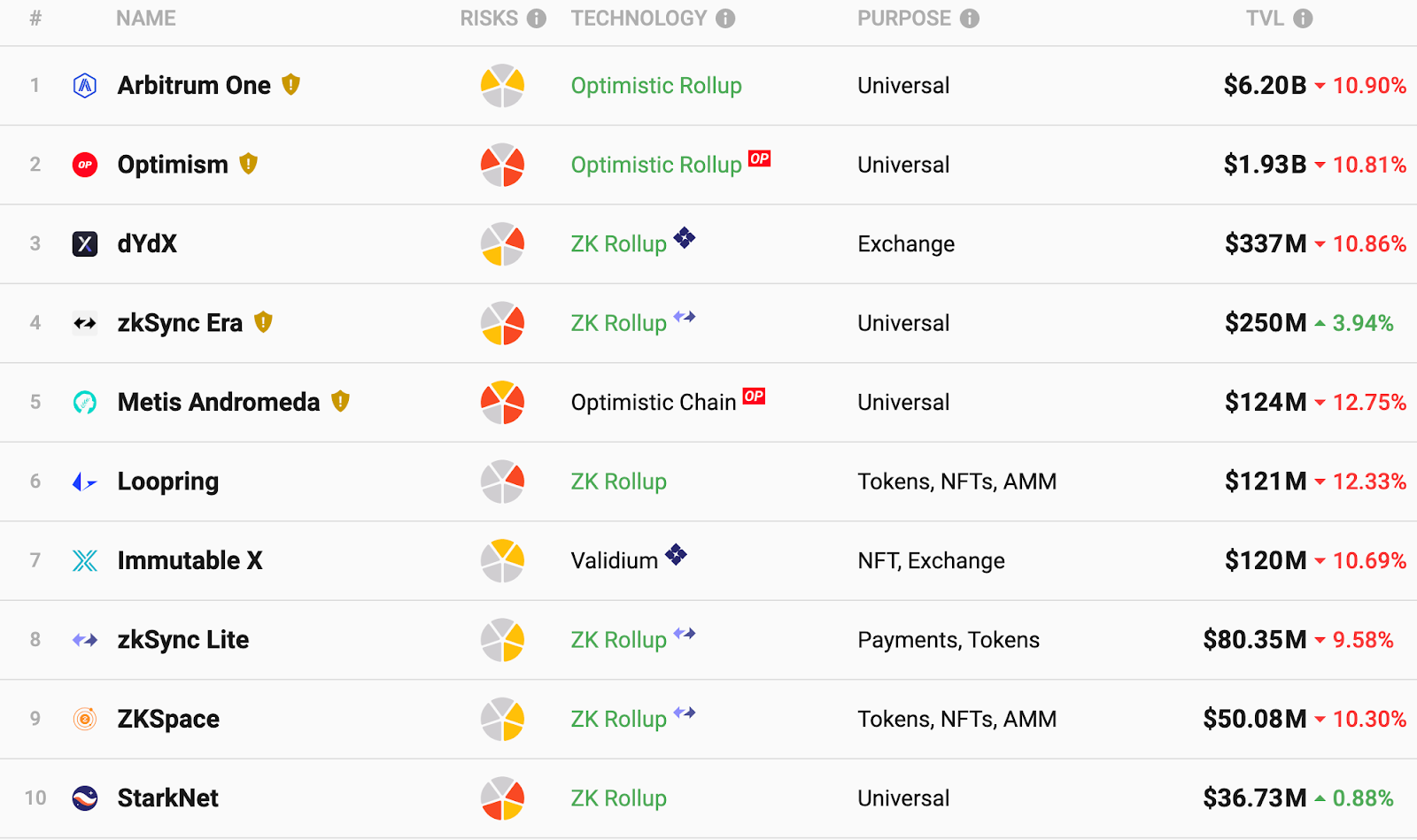

A brief glance at the “risk” classifications of the top ten Ethereum scaling solutions on L2BEAT displays the glaring gap between where L2s are today and where we’d like them to be.

Optimism and forks like Metis Andromeda lack fault proofs, while the leading rollup solution, Arbitrum, only allows whitelisted actors to challenge the state of the rollup. Without permissionless state validation, a malicious sequencer may include false transactions.

Further, many rollup contracts are upgradeable, a feature which allows the owner to alter code (presumably to fix bugs). Unfortunately, updates to battle-tested code reset the Lindy clock and can lead to errors, compromising rollup integrity. The August 2022 $200M Nomad bridge hack is a testament to the pitfalls of upgradable contracts.

💡 Solution: Implement decentralized sequencers and continue building.

Visible on every rollup’s roadmap is a nebulous promise to work towards the decentralization of the sequencer set. The hard part is getting there! Optimism, for example, lists “decentralizing the sequencer” as an objective, however, notes “the precise mechanism for sequencer rotation is not yet finalized.”

While possible L2 teams are toiling on in-house solutions for sequencer decentralization in private, a variety of exciting external solutions are emerging to solve the problem for them.

One potential solution gaining traction is “based” sequencing, highlighted by Ethereum researcher Justin Drake in a March 10 forum post. In this model, the L1 block proposer, in collaboration with searchers and builders, permissionlessly includes the next rollup block as a part of the L1 block.

A based rollup inherits the liveliness and security guarantees of Ethereum, but its throughput is limited by the transaction ordering and data availability of the L1. Moreover, transaction confirmations are constrained by the chain’s twelve-second block confirmation time, eliminating the fast pre-commits enjoyed by traders on L2s like Arbitrum.

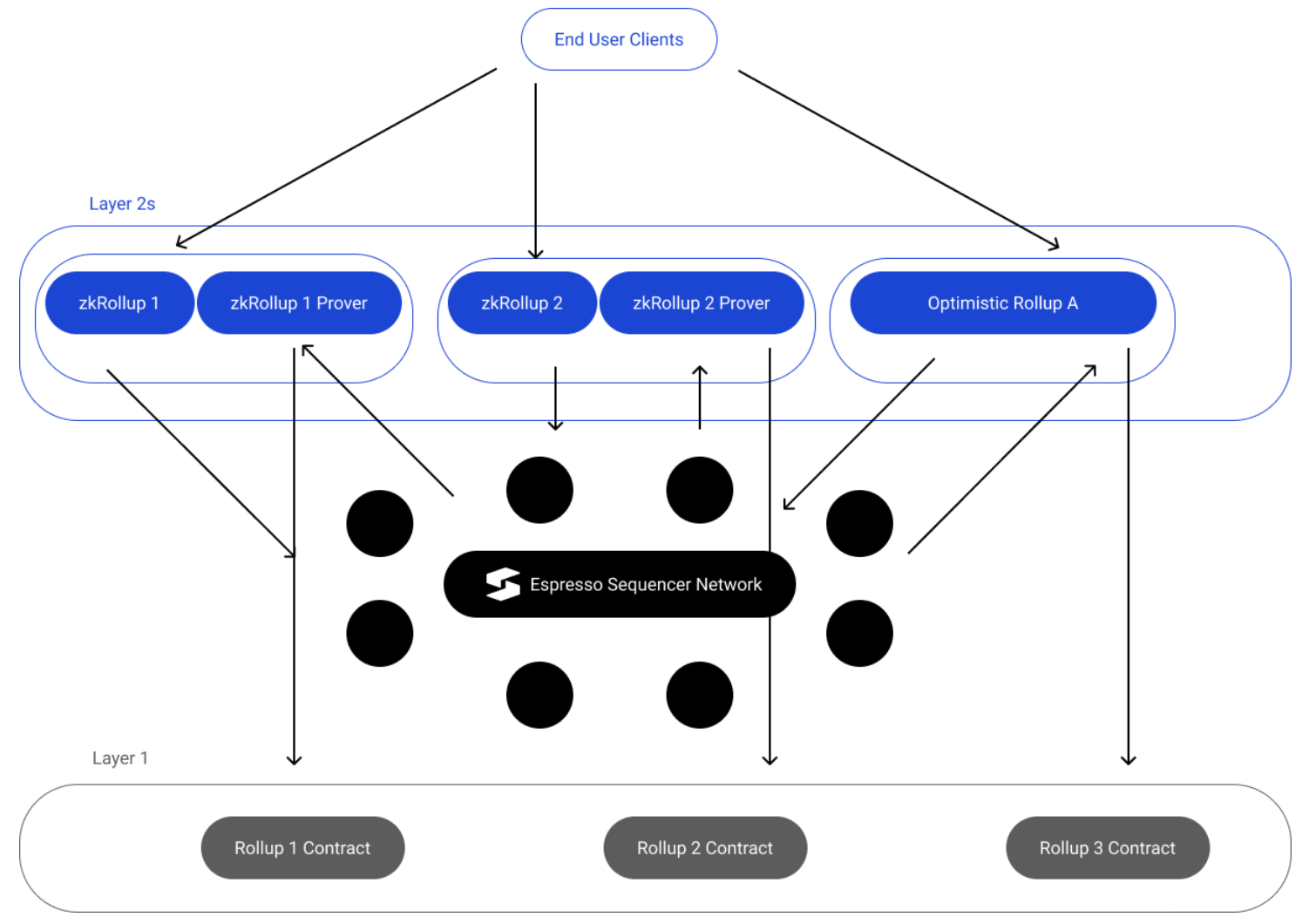

Espresso, Astria, and Radius are some of the innovative protocols aiming to provide middleware sequencer solutions that enable rollups to access a decentralized network of sequencers, while circumventing L1 finality bottlenecks present with based sequencing.

Beyond decentralizing the sequencer set, shared sequencer layers promise native cross-rollup atomicity and bridging for rollups opting into the network, much like Optimism's OP Stack “Superchain” vision. These shared sequencers, however, are accessible to any optimistic or zero-knowledge rollup, regardless of its construction. Additionally, these solutions can soon take advantage of EigenLayer restaking to increase capital efficiency and boost sequencer yields.

Unfortunately, in terms of the institution of permissionless proofs and elimination of upgradable rollup contracts, more time and further development are the only remedies to improving rollup risk profiles. A lack of working fraud proofs and upgradable contracts reflect the reality that obtaining scale on Ethereum requires compromise today.

Vitalik proposed a three-stage taxonomy for classifying rollups by the amount of “training wheels” required. Stage one rollups, the second classification, have working proof systems and stage two “no training wheels” rollups eliminate smart contract upgradeability.

The majority of rollups remain at stage zero. Clear progress is being made, however, with Arbitrum recently becoming the first stage one EVM-compatible rollup and Vitalik predicting that all rollups progress to this second step within the year.

Reaching the "basic rollup scaling" milestone in my roadmap diagram.

— vitalik.eth (@VitalikButerin) December 31, 2022

That means:

* EIP-4844 rolled out

* Rollups partially taking off training wheels, at least to "stage 1" as described here https://t.co/qNQonDQkzG pic.twitter.com/7HePctWw1l

In closing

If you weren’t here so early, Ethereum likely wouldn’t still be struggling with these centralization issues. Crypto is the bleeding edge of permissionless financial innovation and we’re still working out all of the kinks.

Don’t let the odd trust assumption or two deter you. When they exist, allow them to serve as glaring reminders of innovation yet to come. Eliminating them not only increases security guarantees, but presents new (and potentially lucrative) opportunities for users.

The future is bright and the crypto frontier is ever-shifting! Props to you for sticking around for the journey in spite of the shortcomings 👏

Action steps

- 📰 Read about other centralization vectors on Ethereum in A Beginner's Guide to Ethereum Censorship