Dear Bankless Nation,

Investing is an exercise in both finance and psychology.

Doing your fundamental research is a must, but an investor's ability to control their emotional behavior and mindset is also crucial to achieving success.

Even the world’s best investors succumb to their own emotional vices.

What they don’t tell you is that they’re also exceptionally good at minimizing them.

The hard skills of finance can be taught in any business school.

Mastering the psychology of investing and taming one’s emotions on the other hand is an incredibly difficult skill set that is far harder to teach, and can only be perfected on the investment battlefield itself.

Thankfully, Bankless had some excellent help in learning how to do so from Morgan Housel, partner at the Collaborative Fund, a financial writer, and the New York Times Best Selling author of “The Psychology of Money”.

Morgan appeared on the Bankless Podcast this week, where he shared ten lessons on how we can view money and wealth in order to improve our own investment thinking and avoid behavior-driven errors.

Ben breaks these lessons down today for us.

- Bankless team

#1 - Nothing is Free

There is no such thing as a free lunch. Everything worth pursuing has a cost attached to it.

In crypto, the cost of pursuing outsized returns is being forced to endure tremendous volatility.

Crypto is perhaps the only asset class where investors can earn life-changing venture scale returns in the public markets within a matter of months.

Despite this tantalizing upside, investing in crypto is far easier said than done due to the immense price swings in most tokens. To capitalize on these higher highs, investors will also likely endure lower lows, and must have the stomach to withstand the volatility and manage the pain, anxiety, sadness, frustration, and disappointment that comes with watching their portfolios evaporate in the blink of an eye.

In the long-run, crypto investors that ride out the volatility tend to be rewarded over time.

For example, ETH has had eight drawdowns of more than 50% in its seven year history (an average of more than 1 per year). Weak investors looking for quick profits would’ve been weeded out a long time ago.

Those who have seriously studied the fundamentals and with grit are still scoring gains today.

#2 - No One Is Crazy

Our personal experiences shape how we perceive the world. This is true when it comes to both one’s personal life, and approach to money and investing.

Our unique, individual experiences with money influences the ways in which we spend, manage, and invest it.

Because of this, there is no definitive “right” or “wrong” way to invest. Each individual should manage their portfolio in a way that fits their own unique risk tolerance, time horizon, and financial goals.

An example discussed on the podcast are meme coins. OG’s may scoff at the idea of newcomers choosing to buy assets with seemingly no fundamental value. But someone new or casually interested in crypto may view these assets as speculative instruments that can help them achieve their financial goals.

These differing investor preferences and groups of market participants (another example being short-term traders vs long -term investors) can lead to much of the discourse resulting in people talking past one another.

Because of this, we should be less judgmental when we think about others' decisions, as everyone in the markets is really playing their own, personalized game.

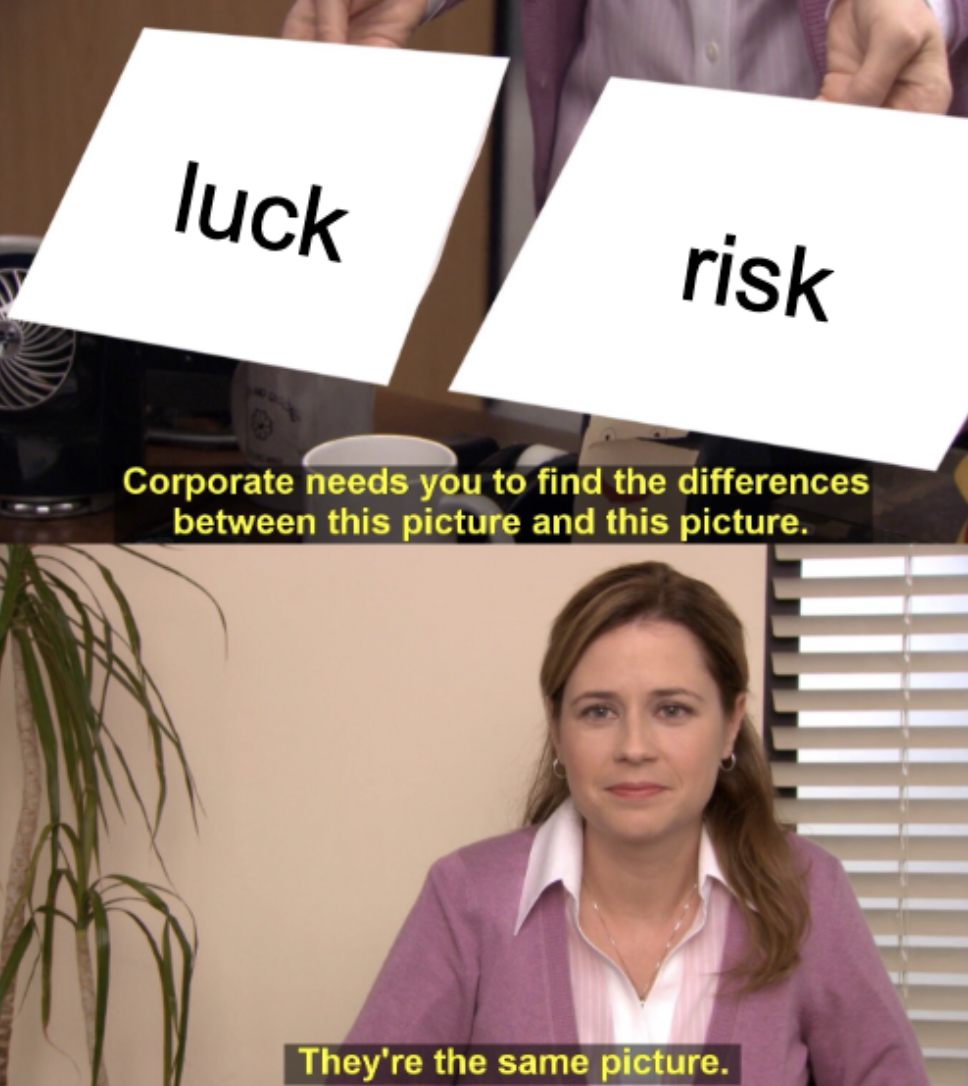

#3 - Luck vs. Risk

Luck and risk are two sides of the same coin.

Both luck and risk factor into long-tail events, or unforeseeable events with outsized impact on returns that an individual investor is unable to control.

Smart investors are very focused on mitigating risk, and will diversify and/or hedge their portfolio in order to do so.

However, luck can have an equally large impact on returns. The most successful people in the world were very lucky, in the right place at the right time. For example, Bill Gates believes he would not have founded Microsoft had he not learnt about computers at his high school.

These random strokes of luck can often warp investor perceptions by making them more prone to survivorship bias, leading them to try and replicate success that is really unreplicable.

To mitigate this, Morgan advises an investor to try and look up to people or qualities which they can realistically emulate themselves.

#4 - Have Enough

Greed is one hell of a drug.

The desire for more isn’t necessarily bad when kept in moderation as it drives people to work harder and improve the quality of their life. But greed is the ugly underbelly of unrealistic expectations that leads to reckless risk-taking, and that is incredibly dangerous.

This is especially magnified in crypto, where markets are 24/7, FOMO runs rampant and social media is used as a scoreboard.

For instance, during a bull market, many market participants will beat themselves up for not earning as much as they believe their peers have. In 2021, it was commonplace to hear a crypto investor bellyache about things like “only” earning a 5x on their position, an outstanding return by any metric, instead of a 10x or 20x.

The fallacy of not having enough can spiral and lead to rash and destructive risk taking. As Morgan points out, Su Zhu and Kyle Davies, the co-founders of hedge fund 3AC, likely could have lived like kings with the profits they earned during the 2020-2021 bull market.

Instead, their desire for more ultimately led to their firm's destruction, causing them to take on more leverage for increasingly risky bets.

The key here is to compare your gains not to the lucky guy bragging over his overnight wealth on the golf course, but to the standards and goals you’ve set for yourself.

Morgan suggests that to be sure you have enough, your expectations should not exceed your current income.

#5 - Money Is a Tool For Freedom

As David likes to say, crypto is not here to make you rich - It’s here to set you free.

While this refers to the sovereignty that comes from self-custody and becoming truly Bankless, the phrase also extends to capital gains that can be earned from investing in the markets.

Accumulating assets and wealth is what philosophers call positive freedom. It expands the scope of freedom one has over their life by providing them with more control over their time. In essence, we come closer to an end-state where we can wake up in the morning free to spend each day entirely as they please.

Control over time is exceedingly rare. As Morgan points out when describing a dinner he had with a wealthy fund manager, there is such a thing as being “cash rich and time broke,” or being well off financially.

#6 - The Power of Compounding

A common saying in the investment world is that “compound interest is the 8th wonder of the world”.

While it is easy to be distracted by short-term fluctuations in the market, investors often forget that truly outstanding returns with low risk come from compounding over time.

Look to Warren Buffet for a prime example. Buffet is known for thinking of his investments in a long time-horizon. The Oracle of Omaha has accumulated a $97.5B fortune, with ~96% of that wealth accruing after his 59th birthday.

Of course, Buffet is also an investment genius that has a knack for making really good bets. But we can see that much of Buffett's wealth can be attributed to simply spending enough time in the market to massively compound returns.

This same principle can be applied to crypto as the space continues to grow over the coming decades.

#7 - Getting and Staying Wealthy

Getting and staying wealthy require opposite mindsets.

In Morgan’s view, in order to get rich one must be optimistic. This is because optimists are more willing to take on personal and/or financial risk, go against the curve, and see the potential in an idea, business or project which has the potential to deliver massively outsized returns.

However, in order to stay rich one must be conservative. That doesn’t mean keeping your money under a mattress. But it is sensible to employ a balanced, more risk-averse mindset and investment strategy when the priority is to protect, rather than grow, one’s capital.

Morgan puts it aptly — You should save your money like a pessimist and invest like an optimist.

#8 - Being Reasonable vs. Being Rational

While we often strive to make a rational decision, sometimes it is best to make a reasonable one.

Put differently, we should try to make the best decisions for ourselves that we can at any given moment in time, even if in theory, that decision may not seem to make sense or lead to maximizing short-term profit as an investor.

An example of this is choosing between lump sum investing and dollar-cost-averaging (DCA). It seems rational to select the former but how likely are you to time the bottom?

It may be more reasonable for some investors to go with the latter in order to reduce the chances of them feeling regretful if prices drop immediately after they make their investment.

Although this could lead to lower short-run returns, making the reasonable, rather than rational, decision to DCA and minimize regret can avoid clouding their judgment and making consequential mistakes over the long-run.

Reasonable ⚖️ > Rational 🧠

#9 - People Change

Just as prices change over time, so do people and their preferences in life.

Morgan believes that people underestimate how much they will change over the course of their lives, and in turn how much this will affect one’s financial goals.

For instance, a recent college graduate and crypto permabull may feel it makes sense to keep their entire portfolio in the asset-class given their belief in crypto’s long-term upside and the potential to recoup losses over time with their future income.

However, let’s say this permabull gets married and has kids. When you were in your 20s, living in a nice mansion with a big pool and the latest cars was all you ever wanted. Now that you’re in your late 30s with kids, you realize that you’re much closer to life fulfillment than you once wanted.

As a result of their changing circumstances, they may begin to prioritize financial stability over maximizing potential returns. They may choose to diversify beyond crypto and into less volatile assets, such as real estate.

The best way to roll with the punches of change are to avoid extremes when planning one’s finances - An investor seeking to minimize the impact of change should aim to find a balance between risk taking and conservatism.

#10 - Pessimism

People are often attracted to pessimism because it sounds intelligent, grounded, and realistic. As Morgan puts it, a pessimist will sound like they are trying to help you by pointing out flaws and warning of potential risks.

This gravitation towards pessimism is fueled in part by the nature of good and bad news. It’s much easier to notice when bad things are happening, as they typically occur in the blink of an eye, while it takes time for the benefits of good news to play out.

An example of this is Terra, which imploded and wiped out tens of billions in the span of just a few days. A crypto pessimist may point to this as a reason for why crypto as a whole is a failure.

However in doing so, a pessimist will ignore the fact that over the past 14 years, crypto has still managed to create a sovereign, robust, and resilient trillion-dollar ecosystem that is capable of withstanding extreme events such as the collapse of an eleven figure stablecoin without the need for any government intervention.

Furthermore, an optimist would point out that Terra is another in a long list of seemingly existential crises crypto has managed to overcome in its short history.

An optimist would highlight that despite the chaos, we’re still standing.

We’re still here, and we’re still building.

So yes, pessimism may sell. But it usually pays to be optimistic in the long-run.

So there you have it, ten expert tips on the psychology of investing with Morgan Housel.