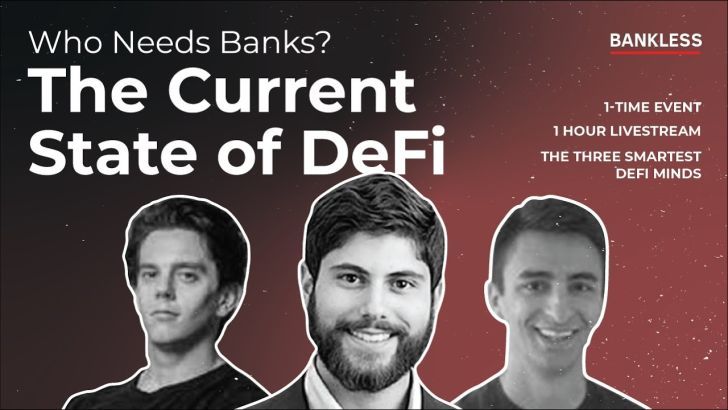

📺 PANEL: The Current State of DeFi | Vance Spencer, Santiago Santos, Spencer Noon

You can earn some serious DOUGH when you LP w/ PieDAO! Learn how with this guide🥧

In this special episode of Bankless, we bring on some of the best minds in the space to discuss where DeFi is and where we're headed.

And as always, make sure to LIKE and SUBSCRIBE to the Youtube Channel 😎

📺 DEFI PANEL

🎙️Listen to Podcast Episode | 📺 Watch the Episode

Bankless Sponsor Tools:

💰 GEMINI | FIAT & CRYPTO EXCHANGE

https://bankless.cc/go-gemini

🦊 METAMASK | DEFI PASSPORT

https://bankless.cc/metamask

🦄 UNISWAP | DECENTRALIZED EXCHANGE

http://bankless.cc/uniswap

🔀 KWENTA | SYNTHETIC ASSET EXCHANGE

https://bankless.cc/kwenta

PANEL: The Current State of DeFi

Guests: Vance Spencer, Santiago Santos, and Spencer Noon

June 10, 2021

It feels like we're living out a crucial moment in the story of Decentralized Finance. A variety of perspectives will collectively yield that we are at a tipping point – from macro to micro, from collective to individual, and from economic to social. As we witness the emergence of a new technological ecosystem, the stakes and implications are ever increasing. Thus it only makes sense to bring on a panel of some of DeFi's smartest minds to hold a summit on where we are and where we're heading.

This panel comprised of Santiago Santos of Parafi Capital, Vance Spencer of Framework Ventures, and Spencer Noon of the Variant Fund. In broad terms, DeFi refers to open, blockchain-based finance. The root of this stack consists of primitive financial services – the money verbs like borrowing, lending, trading, escrow, etc. It involves programming smart contracts to execute logic that transfers value on the blockchain. Within these parameters, there is infinite expressivity and room to explore.

The internet of value has set itself up to be a game of optimizing capital efficiency through logic. The winners of this game will be the protocols, apps, individuals, and institutions that minimize counterparty risk while maximizing anti-fragility and resilience. The key here is finding ways to balance the values of consumer agency and protection with the power of capital efficiency. Maximalism and absolutes will be pushed to the margin as the realities of tradeoffs become increasingly apparent.

DeFi, despite its youth, has shown itself to be resilient and deeply anti-fragile. Good logic doesn't break. As it matures, the growth and depth of DeFi infrastructure will demonstrably contribute to its Lindy effect. The total addressable market (TAM) of this ecosystem difficult to quantify, as it is a non-zero game that currently encapsulates the entire global economy at present. Conversations like these should leave an informed viewer feeling optimistic, inspired, and determined to face the obstacles ahead with resolve and conviction.

Resources:

🏴 JOIN THE NATION 🏴

Subscribe: Newsletter | iTunes | Spotify | YouTube | RSS Feed

Follow: Twitter | Instagram | Reddit | TikTok | Facebook

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.